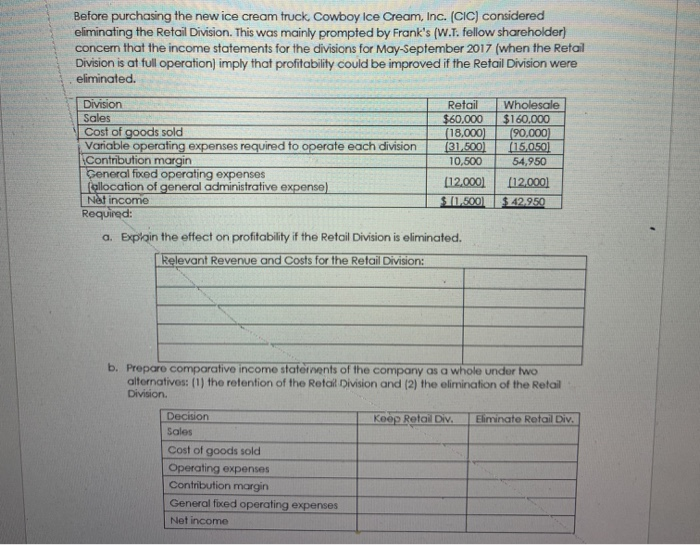

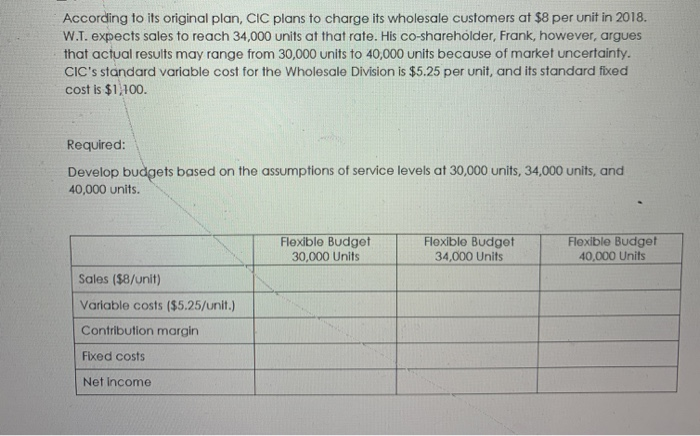

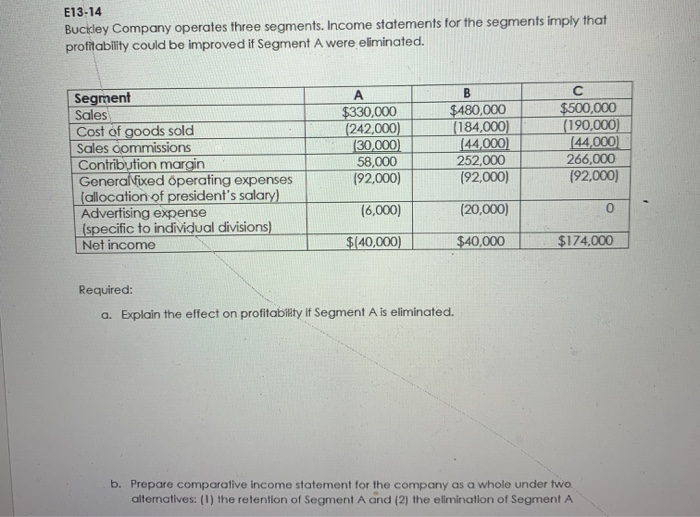

Before purchasing the new ice cream truck, Cowboy Ice Cream, Inc. (CIC) considered eliminating the Retail Division. This was mainly prompted by Frank's (W.T. fellow shareholder) concern that the income statements for the divisions for May-September 2017 (when the Retail Division is at full operation) imply that profitability could be improved if the Retail Division were eliminated. Division Retail Wholesale Sales $60,000 $160.000 Cost of goods sold (18,000) 190.000 Variable operating expenses required to operate each division (31.500 (115.0501 Contribution margin 10,500 54,950 General foced operating expenses Lollocation of general administrative expense) [12.000) (12.0001 Net income $1.500 $.42.950 Required: a. Explain the effect on profitability if the Retail Division is eliminated. Relevant Revenue and Costs for the Retail Division: b. Prepare comparative income staternents of the company as a whole under lwo alternatives (1) the retention of the Retail Division and (2) the elimination of the Retail Division Keep Retail Div. Eliminate Retail Div. Decision Sales Cost of goods sold Operating expenses Contribution margin General foed operating expenses Net income According to its original plan, CIC plans to charge its wholesale customers at $8 per unit in 2018. W.T. expects sales to reach 34,000 units at that rate. His co-shareholder, Frank, however, argues that actual results may range from 30,000 units to 40,000 units because of market uncertainty. CIC's standard variable cost for the Wholesale Division is $5.25 per unit, and its standard fixed cost is $1.100. Required: Develop budgets based on the assumptions of service levels at 30,000 units, 34,000 units, and 40,000 units. Flexible Budget 30,000 Units Flexible Budget 34,000 Units Flexible Budget 40,000 Units Sales ($8/unit) Variable costs ($5.25/unit.) Contribution margin Fixed costs Net Income E13-14 Bucidey Company operates three segments. Income statements for the segments imply that profitability could be improved if Segment A were eliminated. Segment Sales Cost of goods sold Sales commissions Contribution margin General fixed operating expenses (allocation of president's salary) Advertising expense specific to individual divisions) Net income $330,000 (242,000) (30,000) 58,000 192,000) $480,000 (184,000) (44,000) 252,000 (92,000) C $500,000 (190,000) (44,000) 266,000 192,000) (6,000) (20,000) $(40,000) $40,000 $174,000 Required: a. Explain the effect on profitability if Segment A is eliminated. b. Prepare comparative income statement for the company as a whole under two alternatives: (1) the retention of Segment A and (2) the elimination of Segment A