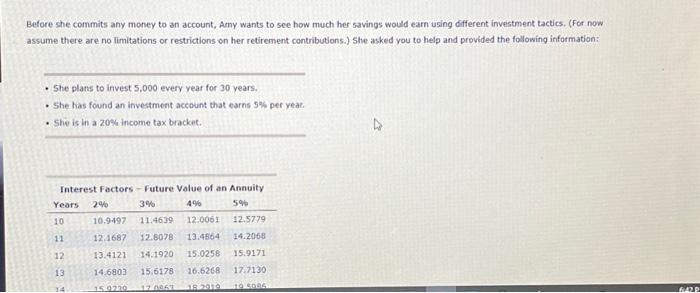

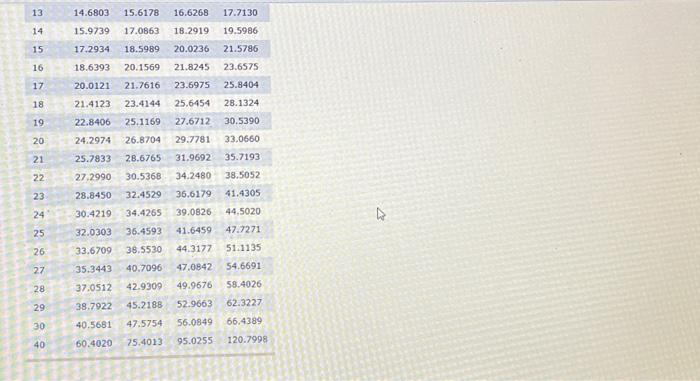

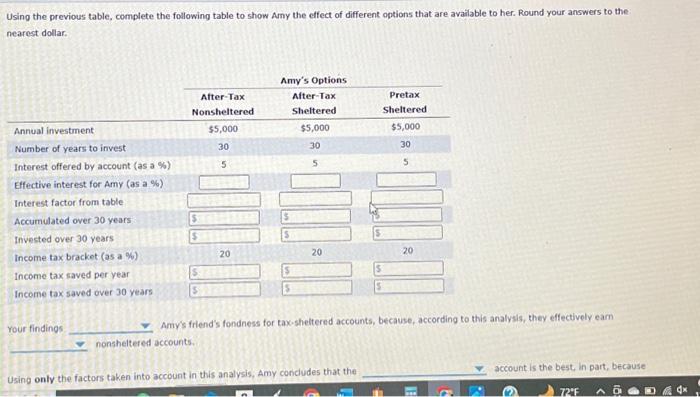

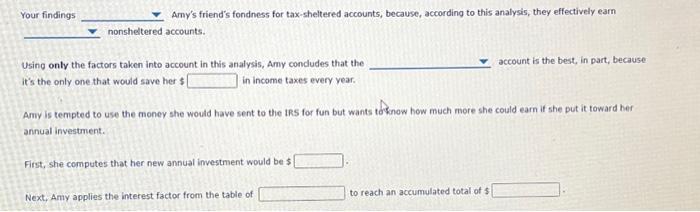

Before she commits any money to an account, Amy wants to see how much her savings would earn using different investment tactics. (For now assume there are no limitations or restrictions on her retirement contributions.) she asked you to help and provided the following information: - She plans to invest 5,000 every vear for 30 vears. - She has found an investment account that earns 5% per year. - She is in a 20% income tax bracket. \begin{tabular}{|l|llll|} \hline 13 & 14.6803 & 15.6178 & 16.6268 & 17.7130 \\ \hline 14 & 15.9739 & 17.0863 & 18.2919 & 19.5986 \\ \hline 15 & 17.2934 & 18.5989 & 20.0236 & 21.5786 \\ \hline 16 & 18.6393 & 20.1569 & 21.8245 & 23.6575 \\ \hline 17 & 20.0121 & 21.7616 & 23.6975 & 25.8404 \\ \hline 18 & 21.4123 & 23.4144 & 25.6454 & 28.1324 \\ \hline 19 & 22.8406 & 25.1169 & 27.6712 & 30.5390 \\ \hline 20 & 24.2974 & 26.8704 & 29.7781 & 33.0660 \\ \hline 21 & 25.7833 & 28.6765 & 31.9692 & 35.7193 \\ \hline 22 & 27.2990 & 30.5368 & 34.2480 & 38.5052 \\ \hline 23 & 28.8450 & 32.4529 & 36.6179 & 41.4305 \\ \hline 24 & 30.4219 & 34.4265 & 39.0826 & 44.5020 \\ \hline 25 & 32.0303 & 36.4593 & 41.6459 & 47.7271 \\ \hline 26 & 33.6709 & 38.5530 & 44.3177 & 51.1135 \\ \hline 27 & 35.3443 & 40.7096 & 47.0842 & 54.6691 \\ \hline 28 & 37.0512 & 42.9309 & 49.9676 & 58.4026 \\ \hline 29 & 38.7922 & 45.2188 & 52.9663 & 62.3227 \\ \hline 30 & 40.5681 & 47.5754 & 56.0849 & 66.4389 \\ \hline 40 & 60.4020 & 75.4013 & 95.0255 & 120.7998 \\ \hline \end{tabular} Using the previous table, complete the following table to show Amy the effect of different options that are available to her. Round your answers to the nearest dollar. rour findings Amy's friend's fondness for tax-sheltered accounts, because, according to this analysis, they effectively eam nonshelter at accounts. Using only the factors taken into account in this analysis, Amy condudes that the account is the best, in part, because Your findings Amy's friend's fondiness for tax-sheltered accounts, because, according to this analysis, they effectively eam nonsheltered accounts. Using only the factors taken into account in this analysis, Amy concludes that the account is the best, in part, because it's the only one that would save her $ in income taxes every year. Amy is tempted to use the money she would have sent to the IRs for fun but wants toknow how much more she could earn if she put it toward her annual investment. First, she computes that her new annual investment would be $ Next, Amy applies the interest factor from the table of to reach an accumulated total of $ Before she commits any money to an account, Amy wants to see how much her savings would earn using different investment tactics. (For now assume there are no limitations or restrictions on her retirement contributions.) she asked you to help and provided the following information: - She plans to invest 5,000 every vear for 30 vears. - She has found an investment account that earns 5% per year. - She is in a 20% income tax bracket. \begin{tabular}{|l|llll|} \hline 13 & 14.6803 & 15.6178 & 16.6268 & 17.7130 \\ \hline 14 & 15.9739 & 17.0863 & 18.2919 & 19.5986 \\ \hline 15 & 17.2934 & 18.5989 & 20.0236 & 21.5786 \\ \hline 16 & 18.6393 & 20.1569 & 21.8245 & 23.6575 \\ \hline 17 & 20.0121 & 21.7616 & 23.6975 & 25.8404 \\ \hline 18 & 21.4123 & 23.4144 & 25.6454 & 28.1324 \\ \hline 19 & 22.8406 & 25.1169 & 27.6712 & 30.5390 \\ \hline 20 & 24.2974 & 26.8704 & 29.7781 & 33.0660 \\ \hline 21 & 25.7833 & 28.6765 & 31.9692 & 35.7193 \\ \hline 22 & 27.2990 & 30.5368 & 34.2480 & 38.5052 \\ \hline 23 & 28.8450 & 32.4529 & 36.6179 & 41.4305 \\ \hline 24 & 30.4219 & 34.4265 & 39.0826 & 44.5020 \\ \hline 25 & 32.0303 & 36.4593 & 41.6459 & 47.7271 \\ \hline 26 & 33.6709 & 38.5530 & 44.3177 & 51.1135 \\ \hline 27 & 35.3443 & 40.7096 & 47.0842 & 54.6691 \\ \hline 28 & 37.0512 & 42.9309 & 49.9676 & 58.4026 \\ \hline 29 & 38.7922 & 45.2188 & 52.9663 & 62.3227 \\ \hline 30 & 40.5681 & 47.5754 & 56.0849 & 66.4389 \\ \hline 40 & 60.4020 & 75.4013 & 95.0255 & 120.7998 \\ \hline \end{tabular} Using the previous table, complete the following table to show Amy the effect of different options that are available to her. Round your answers to the nearest dollar. rour findings Amy's friend's fondness for tax-sheltered accounts, because, according to this analysis, they effectively eam nonshelter at accounts. Using only the factors taken into account in this analysis, Amy condudes that the account is the best, in part, because Your findings Amy's friend's fondiness for tax-sheltered accounts, because, according to this analysis, they effectively eam nonsheltered accounts. Using only the factors taken into account in this analysis, Amy concludes that the account is the best, in part, because it's the only one that would save her $ in income taxes every year. Amy is tempted to use the money she would have sent to the IRs for fun but wants toknow how much more she could earn if she put it toward her annual investment. First, she computes that her new annual investment would be $ Next, Amy applies the interest factor from the table of to reach an accumulated total of $