Answered step by step

Verified Expert Solution

Question

1 Approved Answer

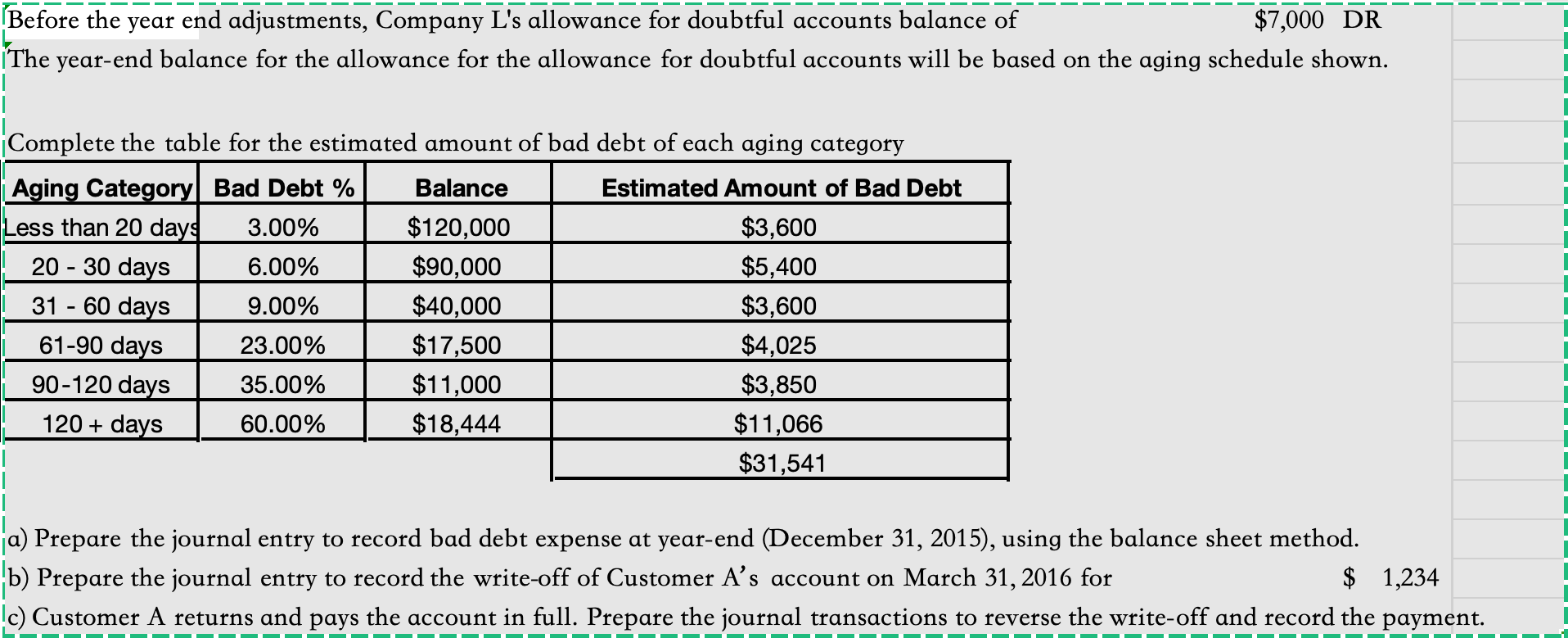

Before the year end adjustments, Company L's allowance for doubtful accounts balance of $7,000 DR The year-end balance for the allowance for the allowance

Before the year end adjustments, Company L's allowance for doubtful accounts balance of $7,000 DR The year-end balance for the allowance for the allowance for doubtful accounts will be based on the aging schedule shown. Complete the table for the estimated amount of bad debt of each aging category Aging Category Bad Debt % Balance Estimated Amount of Bad Debt Less than 20 days 3.00% $120,000 $3,600 20 - 30 days 6.00% $90,000 $5,400 31 - 60 days 9.00% $40,000 $3,600 61-90 days 23.00% $17,500 $4,025 90-120 days 120+ days 35.00% $11,000 $3,850 60.00% $18,444 $11,066 $31,541 a) Prepare the journal entry to record bad debt expense at year-end (December 31, 2015), using the balance sheet method. b) Prepare the journal entry to record the write-off of Customer A's account on March 31, 2016 for (c) Customer A returns and pays the account in full. Prepare the journal transactions to reverse the write-off and record the payment. $ 1,234

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer a To record bad debt expense at yearend December 31 2015 using the balance sheet method we ne...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started