Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Before we begin, please help me to see if I am on the right Track. TIA The balance sheet and income statement for Joe's Fish

Before we begin, please help me to see if I am on the right Track.

TIA

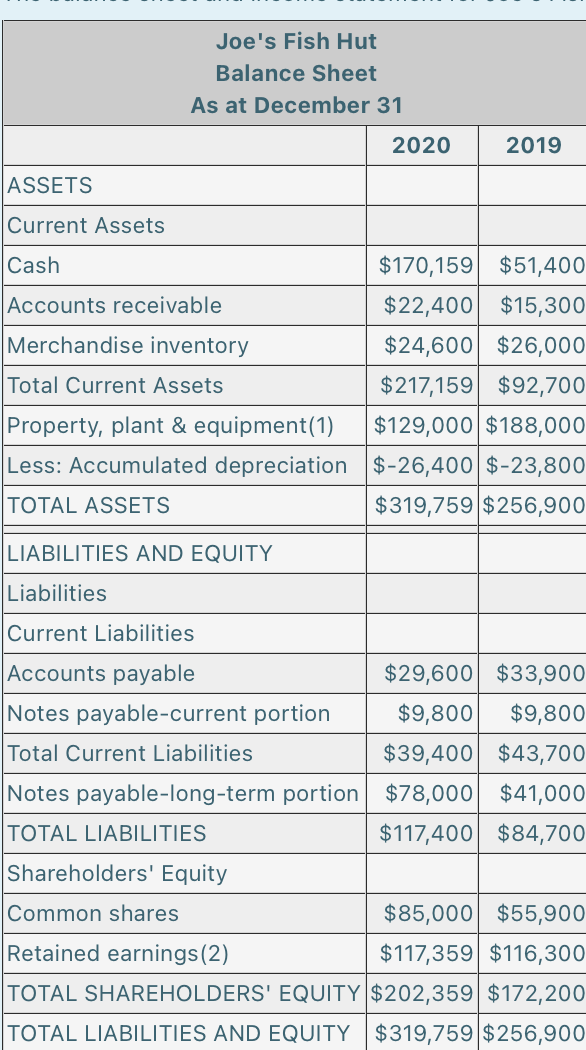

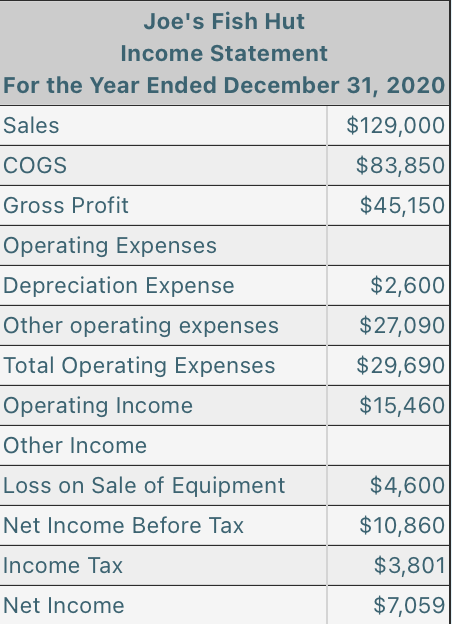

The balance sheet and income statement for Joe's Fish Hut are presented below:

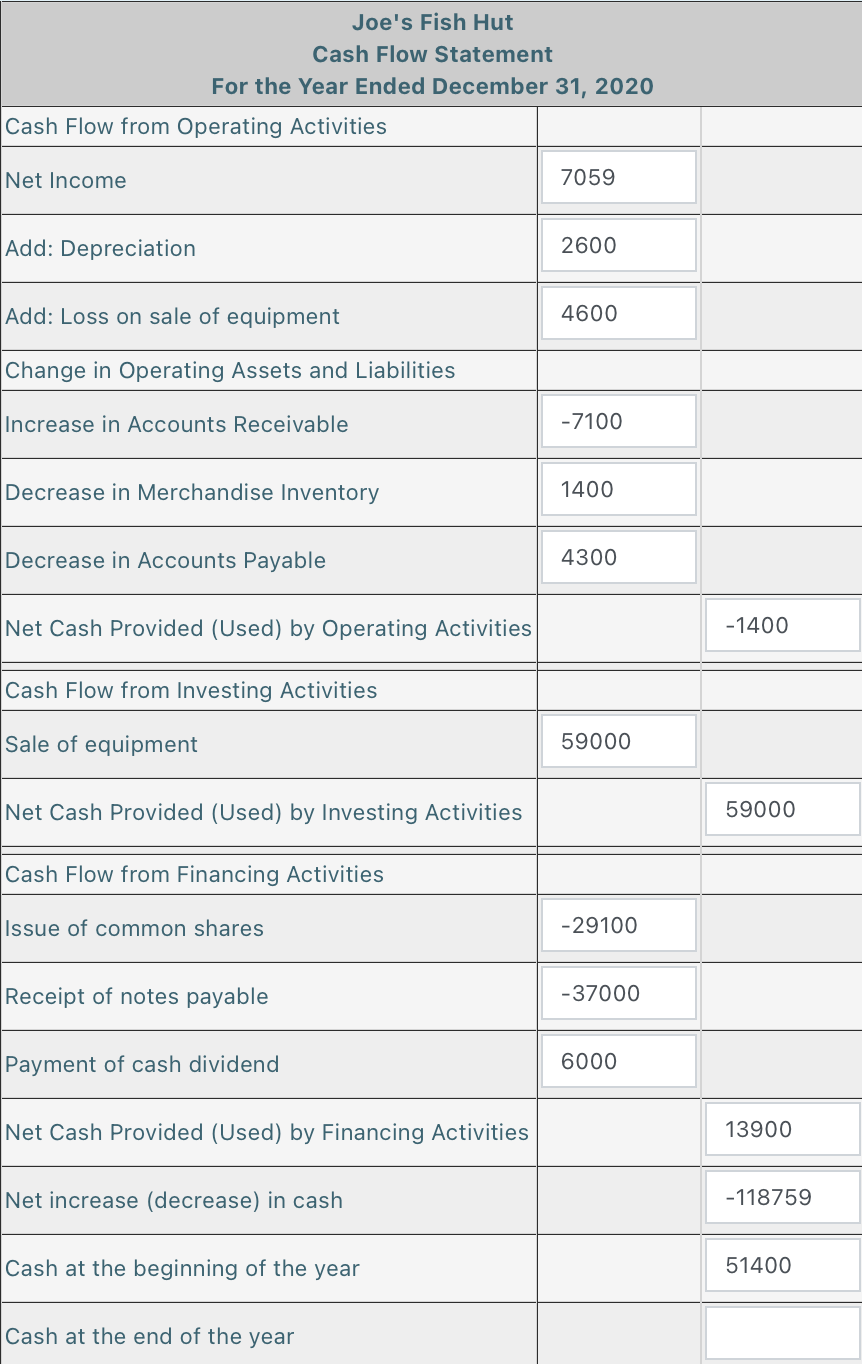

Additional Information: 1. Property, Plant & Equipment During 2020, equipment was sold for a loss of $4,600. The cash proceeds from the sale totaled $54,400. 2. Retained Earnings Joe's Fish Hut declared and paid $6,000 in dividends in 2020.

Create the cash flow statement using the indirect method.

Do not enter dollar signs or commas in the input boxes. Use the negative sign for a decrease in cash.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started