Answered step by step

Verified Expert Solution

Question

1 Approved Answer

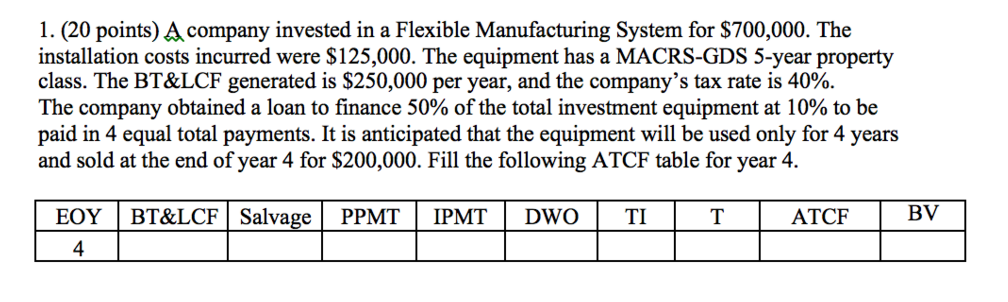

Before-Tax-and-Loan Cash Flow ,PPMT Principal payment, IPMT (interest payment for a given period), TI (taxable income), ATCF(After tax cash flow), BV (Book value), 1. (20

Before-Tax-and-Loan Cash Flow ,PPMT Principal payment, IPMT (interest payment for a given period), TI (taxable income), ATCF(After tax cash flow), BV (Book value),

1. (20 points) A company invested in a Flexible Manufacturing System for $700,000. The installation costs incurred were S125,000. The equipment has a MACRS-GDS 5-year property class. The BT&LCF generated is $250,000 per year, and the company's tax rate is 40%. The company obtained a loan to finance 50% of the total investment equipment at 10% to be paid in 4 equal total payments. It is anticipated that the equipment will be used only for 4 years and sold at the end of year 4 for S200,000. Fill the following ATCF table for year 4. EOY BT&LCF Salvage PPMT IPMT DWO TI TATCF BV 4Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started