Question

Begin by reviewing the tax return scenario below. Then, prepare 2016 gift tax returns (Form 709) for both of the Smiths to compute the total

Begin by reviewing the tax return scenario below. Then, prepare 2016 gift tax returns (Form 709) for both of the Smiths to compute the total taxable gifts (line 3) for Robert and Angela. Stop with line 3 of page 1, but complete pages 2 and 3 of the return.

A fill-in 2016 Form 709 PDF can be found in the course. Instructions for Form 709 can be found at https://www.irs.gov/forms. Save the tax returns separately in PDF format, with your last name in the filename, and submit the two PDF files. TAX RETURN SCENARIO

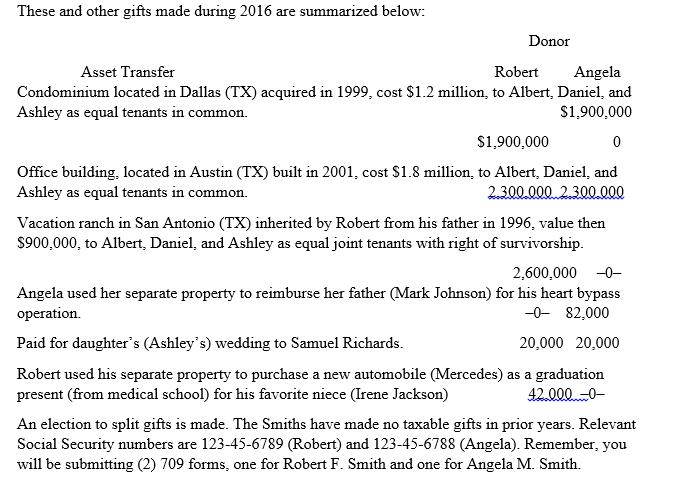

Robert F. and Angela M. Smith, ages 70 and 65, are retired physicians who live at 824 Randolph Street, Arlington, Texas 76099. Their 3 adult children (Albert Smith, Daniel Smith, and Ashley Turner) are mature and responsible people. The Smiths have heard that some in Congress have proposed lowering the Federal gift tax exclusion to $3 million. Although this change likely will not occur, the Smiths feel they should take advantage of the more generous exclusion available under existing law. Thus, the Smiths make transfers of many of their high value investments. These and other gifts made during 2016 are summarized below:

These and other gifts made during 2016 are summarized below: Donor Asset Transfer Robert Angela Condominium located in Dallas (TX) acquired in 1999, cost $1.2 million, to Albert, Daniel, and Ashley as equal tenants in common. S1,900,000 $1,900,000 Office building, located in Austin (TX) built in 2001, cost S1.8 million, to Albert, Daniel, and Ashley as equal tenants in common. 2.300.000 2.300 000 Vacation ranch in San Antonio (TX) inherited by Robert from his father in 1996, value then $900,000, to Albert, Daniel, and Ashley as equal joint tenants with right of survivorship. 2,600,000 -0- Angela used her separate property to reimburse her father (Mark Johnson) for his heart bypass operation. -0- 82,000 Paid for daughter's (Ashley's) wedding to Samuel Richards. 20,000 20,000 Robert used his separate property to purchase a new automobile (Mercedes) as a graduation present (from medical school) for his favorite niece (Irene Jackson) 42.000 -0- An election to split gifts is made. The Smiths have made no taxable gifts in prior years. Relevant Social Security numbers are 123-45-6789 (Robert) and 123-45-6788 (Angela). Remember, you will be submitting (2) 709 forms, one for Robert F. Smith and one for Angela M. Smith.

Step by Step Solution

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 1 attachment)

61b86347e4b32_87426.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started