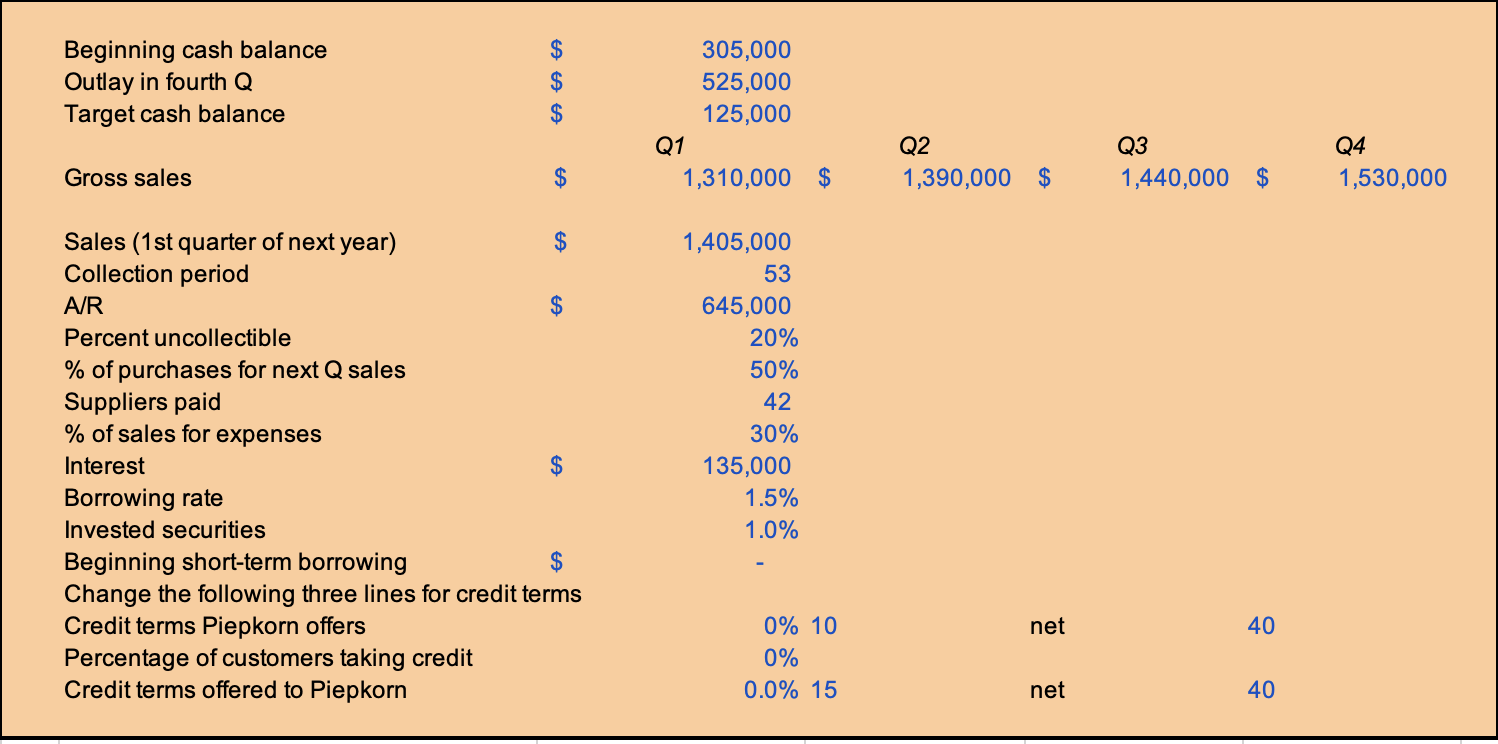

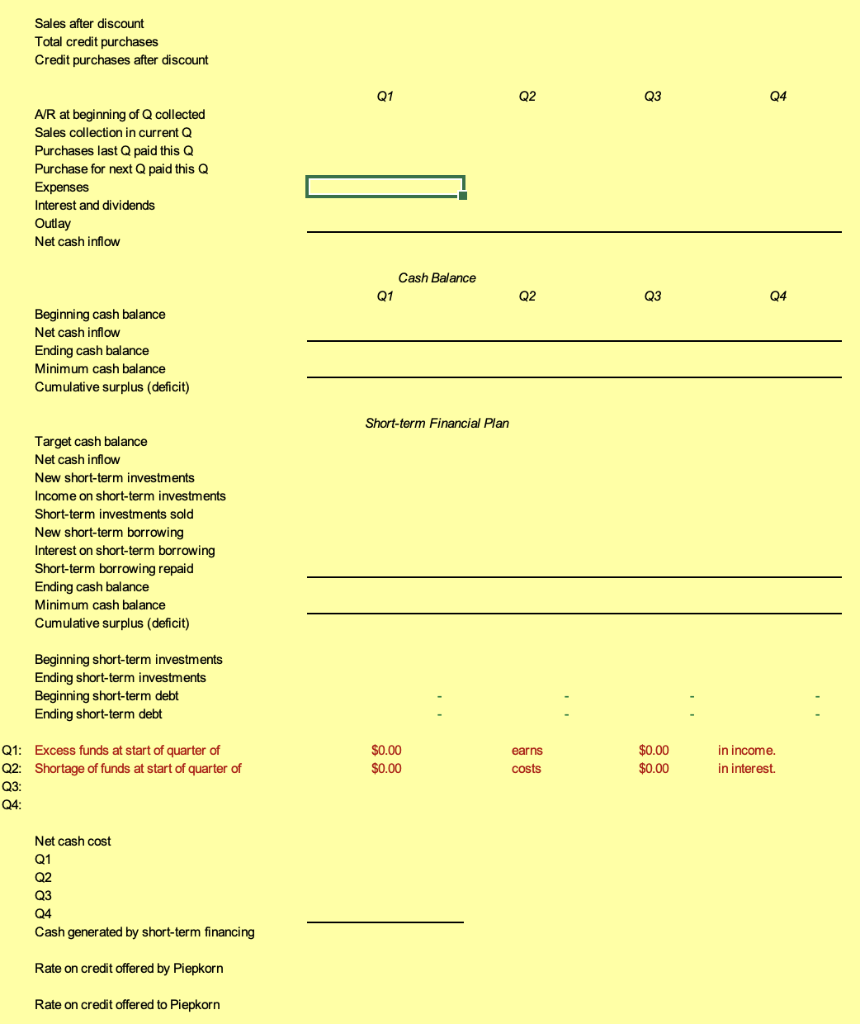

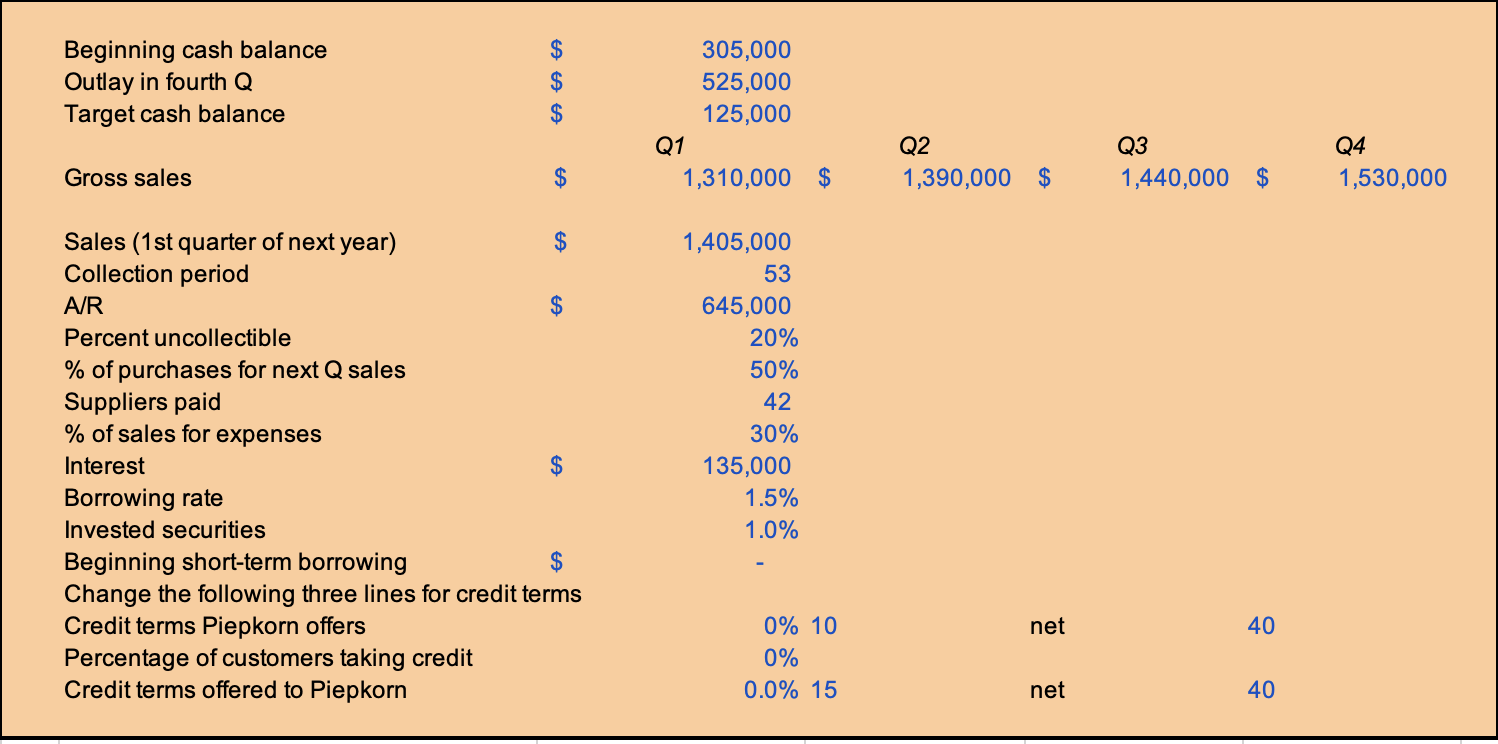

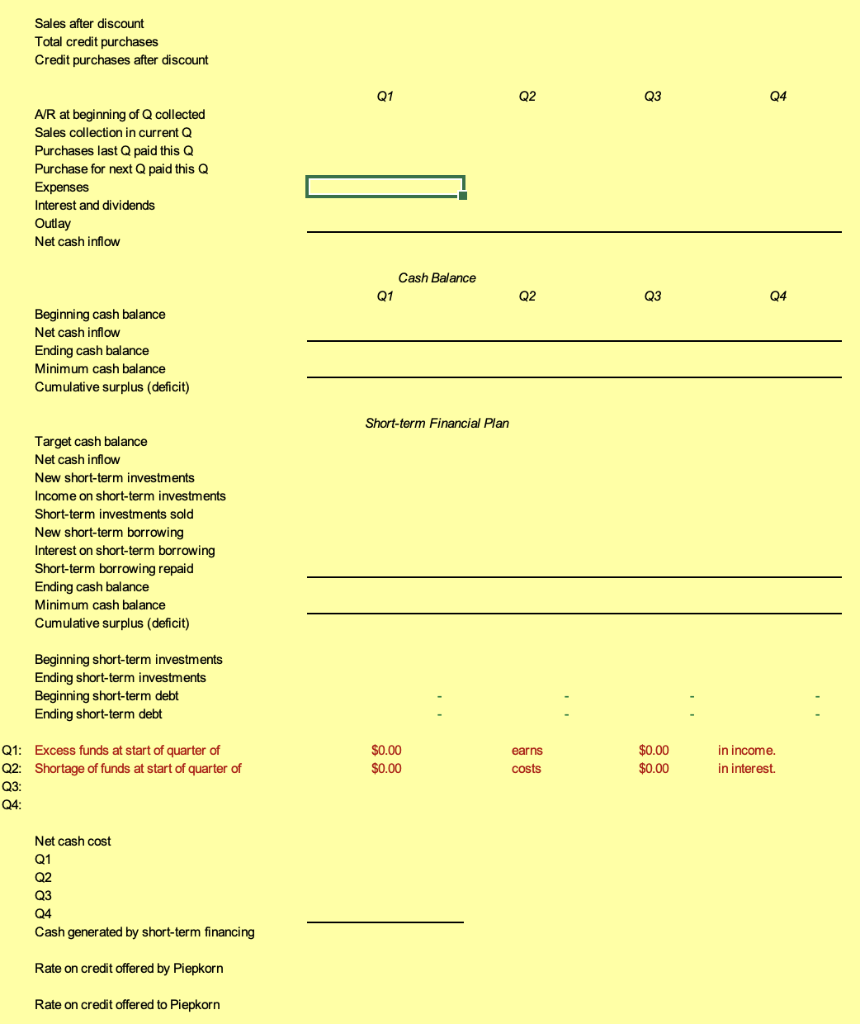

Beginning cash balance Outlay in fourth Q Target cash balance A A A 305,000 525,000 125,000 Q1 Q4 Q2 1,390,000 $ Q3 1,440,000 $ Gross sales $ 1,310,000 $ 1,530,000 Sales (1st quarter of next year) $ Collection period AR Percent uncollectible % of purchases for next Q sales Suppliers paid % of sales for expenses Interest $ Borrowing rate Invested securities Beginning short-term borrowing $ Change the following three lines for credit terms Credit terms Piepkorn offers Percentage of customers taking credit Credit terms offered to Piepkorn 1,405,000 53 645,000 20% 50% 42 30% 135,000 1.5% 1.0% net 40 0% 10 0% 0.0% 15 net 40 Sales after discount Total credit purchases Credit purchases after discount Q1 Q2 Q3 24 A/R at beginning of Q collected Sales collection in current Q Purchases last Q paid this Q Purchase for next Qpaid this Q Expenses Interest and dividends Outlay Net cash inflow Cash Balance Q1 Q2 Q3 Q4 Beginning cash balance Net cash inflow Ending cash balance Minimum cash balance Cumulative surplus (deficit) Short-term Financial Plan Target cash balance Net cash inflow New short-term investments Income on short-term investments Short-term investments sold New short-term borrowing Interest on short-term borrowing Short-term borrowing repaid Ending cash balance Minimum cash balance Cumulative surplus (deficit) Beginning short-term investments Ending short-term investments Beginning short-term debt Ending short-term debt $0.00 $0.00 earns costs $0.00 $0.00 in income. in interest. Q1: Excess funds at start of quarter of Q2: Shortage of funds at start of quarter of Q3: Q4: Net cash cost Q1 Q2 Q3 Q4 Cash generated by short-term financing Rate on credit offered by Piepkorn Rate on credit offered to Piepkorn Beginning cash balance Outlay in fourth Q Target cash balance A A A 305,000 525,000 125,000 Q1 Q4 Q2 1,390,000 $ Q3 1,440,000 $ Gross sales $ 1,310,000 $ 1,530,000 Sales (1st quarter of next year) $ Collection period AR Percent uncollectible % of purchases for next Q sales Suppliers paid % of sales for expenses Interest $ Borrowing rate Invested securities Beginning short-term borrowing $ Change the following three lines for credit terms Credit terms Piepkorn offers Percentage of customers taking credit Credit terms offered to Piepkorn 1,405,000 53 645,000 20% 50% 42 30% 135,000 1.5% 1.0% net 40 0% 10 0% 0.0% 15 net 40 Sales after discount Total credit purchases Credit purchases after discount Q1 Q2 Q3 24 A/R at beginning of Q collected Sales collection in current Q Purchases last Q paid this Q Purchase for next Qpaid this Q Expenses Interest and dividends Outlay Net cash inflow Cash Balance Q1 Q2 Q3 Q4 Beginning cash balance Net cash inflow Ending cash balance Minimum cash balance Cumulative surplus (deficit) Short-term Financial Plan Target cash balance Net cash inflow New short-term investments Income on short-term investments Short-term investments sold New short-term borrowing Interest on short-term borrowing Short-term borrowing repaid Ending cash balance Minimum cash balance Cumulative surplus (deficit) Beginning short-term investments Ending short-term investments Beginning short-term debt Ending short-term debt $0.00 $0.00 earns costs $0.00 $0.00 in income. in interest. Q1: Excess funds at start of quarter of Q2: Shortage of funds at start of quarter of Q3: Q4: Net cash cost Q1 Q2 Q3 Q4 Cash generated by short-term financing Rate on credit offered by Piepkorn Rate on credit offered to Piepkorn