Question

Beginning inventory and purchases and sales data for T-shirts are as follows: Apr. 3 Inventory 24 units e $10 11 Purchase 26 units e

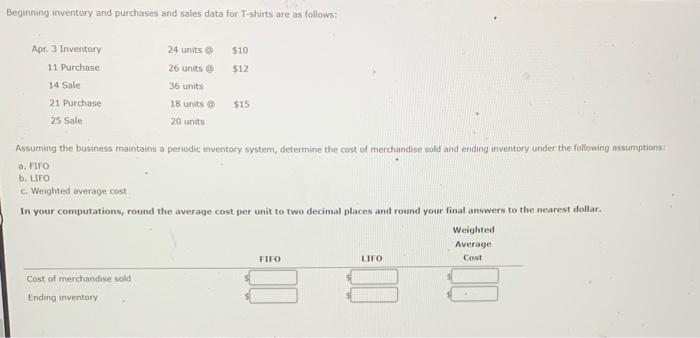

Beginning inventory and purchases and sales data for T-shirts are as follows: Apr. 3 Inventory 24 units e $10 11 Purchase 26 units e $12 14 Sale 36 units 21 Purchase 18 units e $15 25 Sale 20 units Assuming the business maintains a periodic inventory system, determine the cost of merchandise sold and ending inventory under the following assumptions: a. FIFO b. LIFO c. Weighted average cost In your computations, round the average cost per unit to two decimal places and round your final answers to the nearest dollar. Weighted Average FIFO LIFO Cost Cost of merchandise sold Ending inventory

Step by Step Solution

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

FIFO method Apr 3 Beginning Inventory 24 units 10 240 240 Apr 11 Purchases 26 units 12 312 552 Apr 1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

College Accounting

Authors: Heintz and Parry

20th Edition

1285892070, 538489669, 9781111790301, 978-1285892078, 9780538489669, 1111790302, 978-0538745192

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App