Answered step by step

Verified Expert Solution

Question

1 Approved Answer

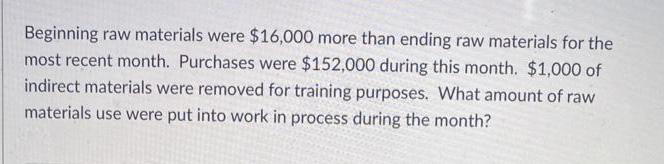

Beginning raw materials were $16,000 more than ending raw materials for the most recent month. Purchases were $152,000 during this month. $1,000 of indirect

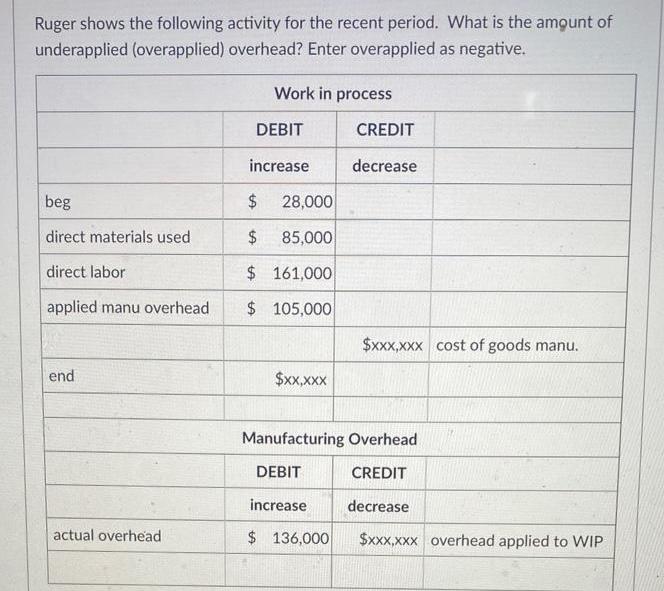

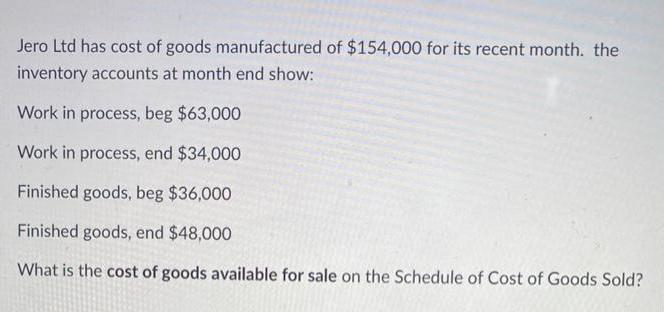

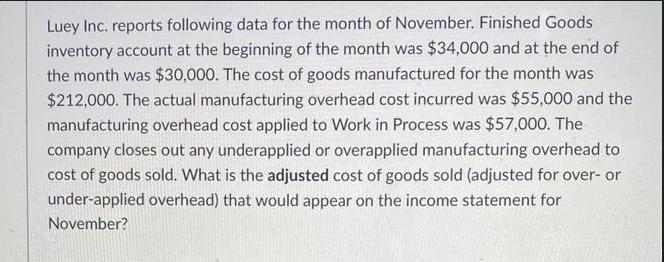

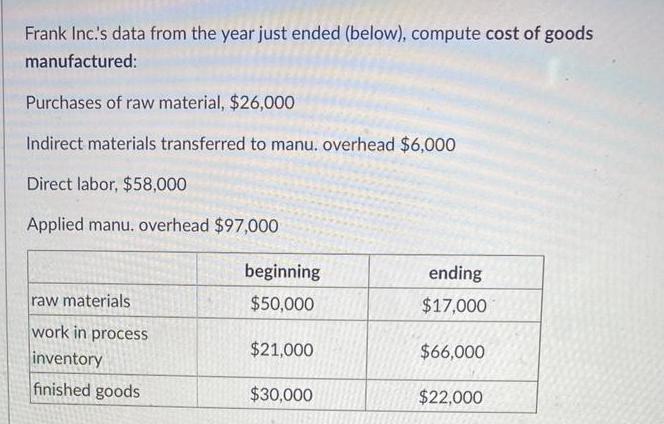

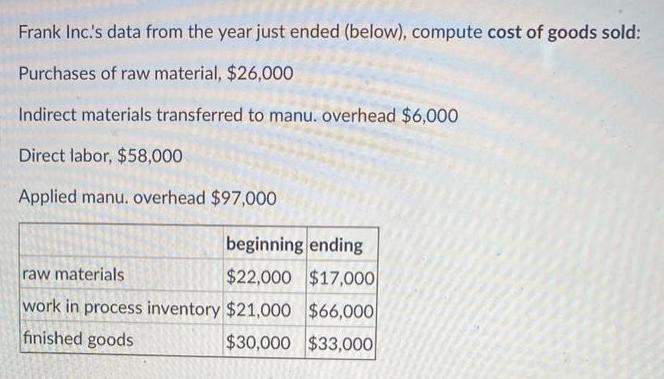

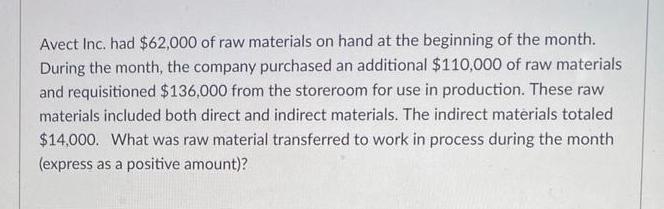

Beginning raw materials were $16,000 more than ending raw materials for the most recent month. Purchases were $152,000 during this month. $1,000 of indirect materials were removed for training purposes. What amount of raw materials use were put into work in process during the month? Ruger shows the following activity for the recent period. What is the amount of underapplied (overapplied) overhead? Enter overapplied as negative. beg direct materials used direct labor applied manu overhead end actual overhead Work in process DEBIT increase $ 28,000 $ 85,000 $ 161,000 $ 105,000 $XX,XXX DEBIT increase CREDIT $ 136,000 decrease Manufacturing Overhead CREDIT decrease $xxx,xxx overhead applied to WIP $xxx,xxx cost of goods manu. Jero Ltd has cost of goods manufactured of $154,000 for its recent month. the inventory accounts at month end show: Work in process, beg $63,000 Work in process, end $34,000 Finished goods, beg $36,000 Finished goods, end $48,000 What is the cost of goods available for sale on the Schedule of Cost of Goods Sold? Luey Inc. reports following data for the month of November. Finished Goods inventory account at the beginning of the month was $34,000 and at the end of the month was $30,000. The cost of goods manufactured for the month was $212,000. The actual manufacturing overhead cost incurred was $55,000 and the manufacturing overhead cost applied to Work in Process was $57,000. The company closes out any underapplied or overapplied manufacturing overhead to cost of goods sold. What is the adjusted cost of goods sold (adjusted for over- or under-applied overhead) that would appear on the income statement for November? Frank Inc.'s data from the year just ended (below), compute cost of goods manufactured: Purchases of raw material, $26,000 Indirect materials transferred to manu. overhead $6,000 Direct labor, $58,000 Applied manu. overhead $97,000 raw materials work in process inventory finished goods beginning $50,000 $21,000 $30,000 ending $17,000 $66,000 $22,000 Frank Inc.'s data from the year just ended (below), compute cost of goods sold: Purchases of raw material, $26,000 Indirect materials transferred to manu. overhead $6,000 Direct labor, $58,000 Applied manu. overhead $97,000 beginning ending raw materials $22,000 $17,000 work in process inventory $21,000 $66,000 finished goods $30,000 $33,000 Avect Inc. had $62,000 of raw materials on hand at the beginning of the month. During the month, the company purchased an additional $110,000 of raw materials and requisitioned $136,000 from the storeroom for use in production. These raw materials included both direct and indirect materials. The indirect materials totaled $14,000. What was raw material transferred to work in process during the month (express as a positive amount)?

Step by Step Solution

★★★★★

3.51 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

1 The raw materials used in production can be calculated using the following formula Raw Materials UsedBeginning Raw MaterialsEnding Raw MaterialsPurchasesIndirect Materials Removed Given Beginning Ra...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started