Answered step by step

Verified Expert Solution

Question

1 Approved Answer

begin{tabular}{|c|c|} hline Read aloud & + hline Ending Inventory & $350,000 hline Equipment and Vehicles & $2,425,000 hline Goodwill & $180,000

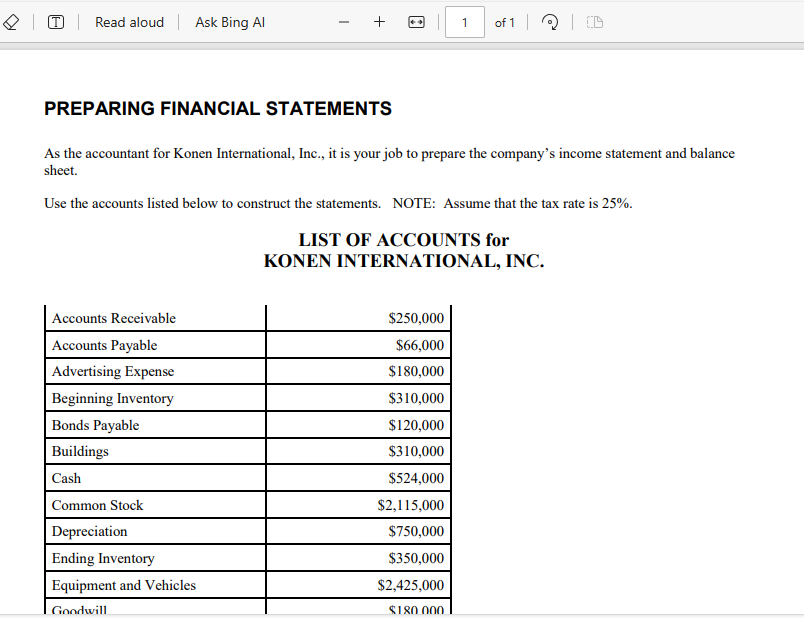

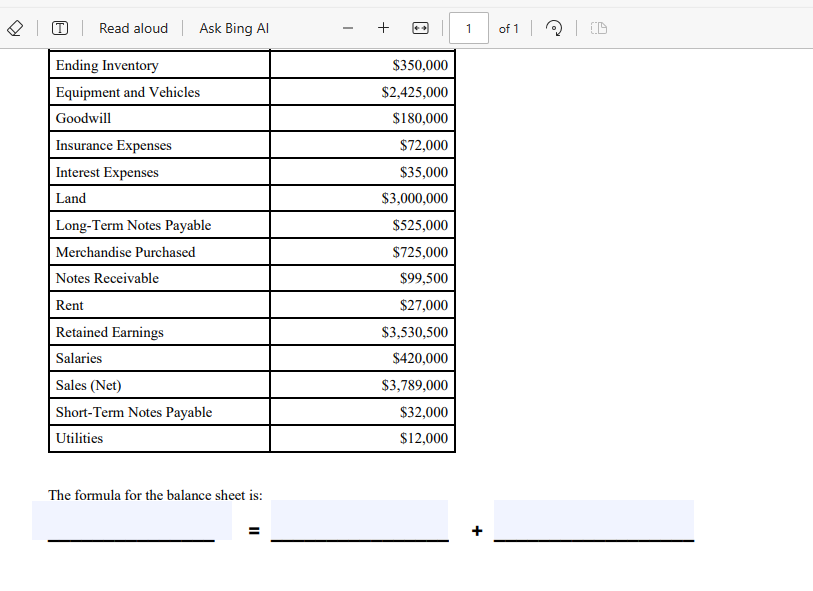

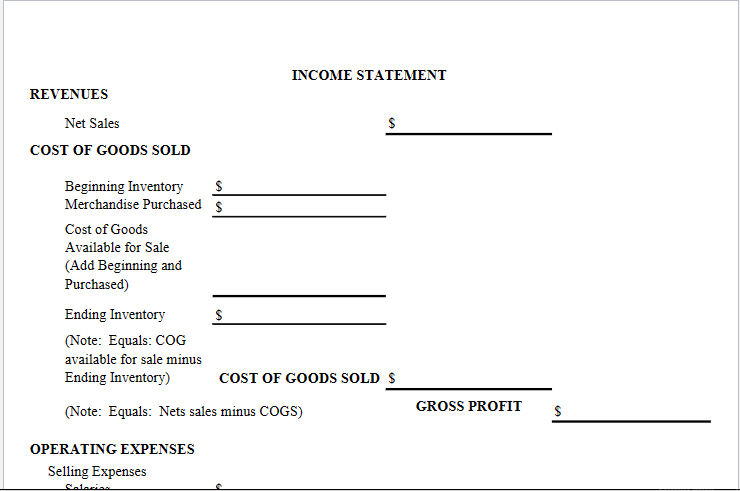

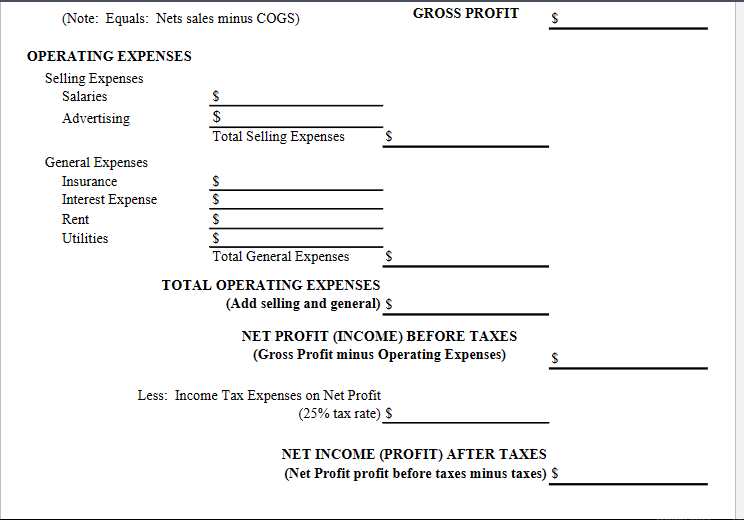

\begin{tabular}{|c|c|} \hline Read aloud & + \\ \hline Ending Inventory & $350,000 \\ \hline Equipment and Vehicles & $2,425,000 \\ \hline Goodwill & $180,000 \\ \hline Insurance Expenses & $72,000 \\ \hline Interest Expenses & $35,000 \\ \hline Land & $3,000,000 \\ \hline Long-Term Notes Payable & $525,000 \\ \hline Merchandise Purchased & $725,000 \\ \hline Notes Receivable & $99,500 \\ \hline Rent & $27,000 \\ \hline Retained Earnings & $3,530,500 \\ \hline Salaries & $420,000 \\ \hline Sales (Net) & $3,789,000 \\ \hline Short-Term Notes Payable & $32,000 \\ \hline Utilities & $12,000 \\ \hline \end{tabular} The formula for the balance sheet is: (Note: Equals: Nets sales minus COGS) GROSS PROFIT $ OPERATING EXPENSES Selling Expenses Salaries Advertising TotalSellingExpenses$$ General Expenses Insurance Interest Expense Rent Utilities $$TotalGeneralExpenses$$ TOTAL OPERATING EXPENSES (Add selling and general) $ NET PROFIT (INCOME) BEFORE TAXES (Gross Profit minus Operating Expenses) $ Less: Income Tax Expenses on Net Profit ( 25% tax rate) $ NET INCOME (PROFIT) AFTER TAXES (Net Profit profit before taxes minus taxes) $ As the accountant for Konen International, Inc., it is your job to prepare the company's income statement and balance sheet. Use the accounts listed below to construct the statements. NOTE: Assume that the tax rate is 25%. LIST OF ACCOUNTS for KONEN INTERNATIONAL, INC. INCOME STATEMENT REVENUES Net Sales COST OF GOODS SOLD BeginningInventoryMerchandisePurchased$$$ Cost of Goods Available for Sale (Add Beginning and Purchased) Ending Inventory (Note: Equals: COG available for sale minus Ending Inventory) COST OF GOODS SOLD \$ (Note: Equals: Nets sales minus COGS) $ $ GROSS PROFIT OPERATING EXPENSES Selling Expenses

\begin{tabular}{|c|c|} \hline Read aloud & + \\ \hline Ending Inventory & $350,000 \\ \hline Equipment and Vehicles & $2,425,000 \\ \hline Goodwill & $180,000 \\ \hline Insurance Expenses & $72,000 \\ \hline Interest Expenses & $35,000 \\ \hline Land & $3,000,000 \\ \hline Long-Term Notes Payable & $525,000 \\ \hline Merchandise Purchased & $725,000 \\ \hline Notes Receivable & $99,500 \\ \hline Rent & $27,000 \\ \hline Retained Earnings & $3,530,500 \\ \hline Salaries & $420,000 \\ \hline Sales (Net) & $3,789,000 \\ \hline Short-Term Notes Payable & $32,000 \\ \hline Utilities & $12,000 \\ \hline \end{tabular} The formula for the balance sheet is: (Note: Equals: Nets sales minus COGS) GROSS PROFIT $ OPERATING EXPENSES Selling Expenses Salaries Advertising TotalSellingExpenses$$ General Expenses Insurance Interest Expense Rent Utilities $$TotalGeneralExpenses$$ TOTAL OPERATING EXPENSES (Add selling and general) $ NET PROFIT (INCOME) BEFORE TAXES (Gross Profit minus Operating Expenses) $ Less: Income Tax Expenses on Net Profit ( 25% tax rate) $ NET INCOME (PROFIT) AFTER TAXES (Net Profit profit before taxes minus taxes) $ As the accountant for Konen International, Inc., it is your job to prepare the company's income statement and balance sheet. Use the accounts listed below to construct the statements. NOTE: Assume that the tax rate is 25%. LIST OF ACCOUNTS for KONEN INTERNATIONAL, INC. INCOME STATEMENT REVENUES Net Sales COST OF GOODS SOLD BeginningInventoryMerchandisePurchased$$$ Cost of Goods Available for Sale (Add Beginning and Purchased) Ending Inventory (Note: Equals: COG available for sale minus Ending Inventory) COST OF GOODS SOLD \$ (Note: Equals: Nets sales minus COGS) $ $ GROSS PROFIT OPERATING EXPENSES Selling Expenses Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started