Answered step by step

Verified Expert Solution

Question

1 Approved Answer

begin{tabular}{|c|c|c|c|} hline & A & B & C hline 1 & multicolumn{3}{|l|}{ THE KROGER CO. } hline 2 & multicolumn{3}{|l|}{ CONSOLIDATED BALANCE SHEETS

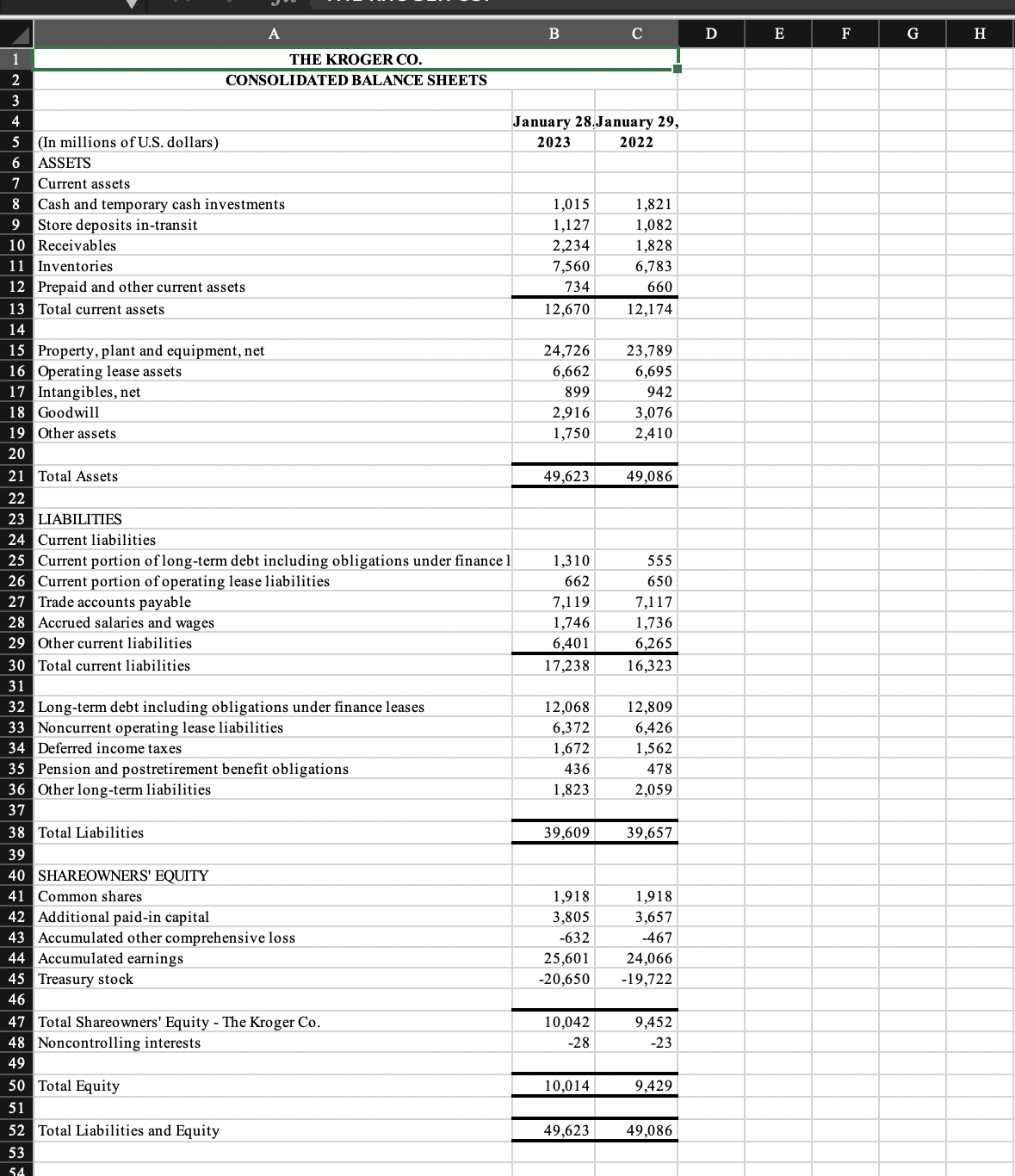

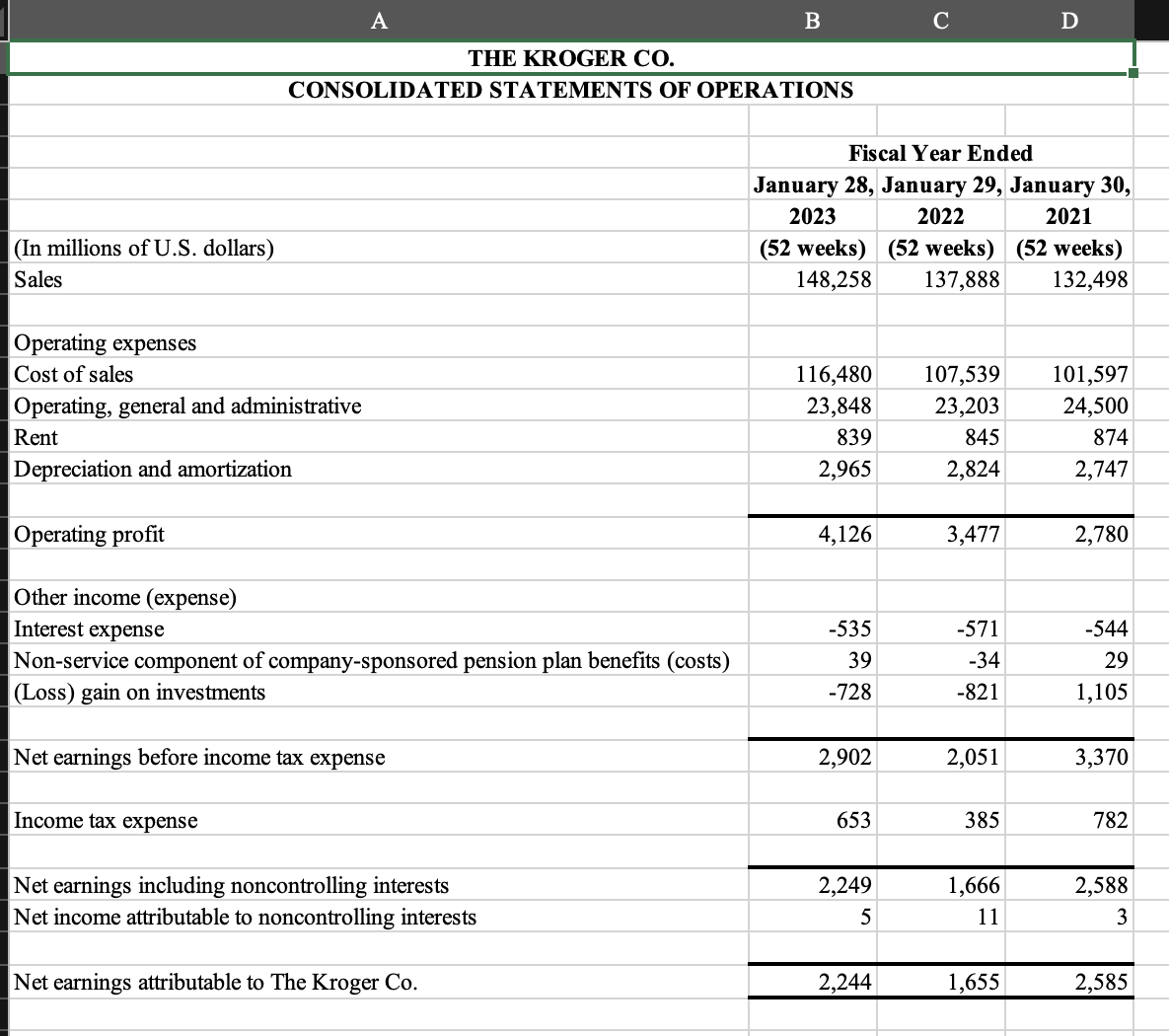

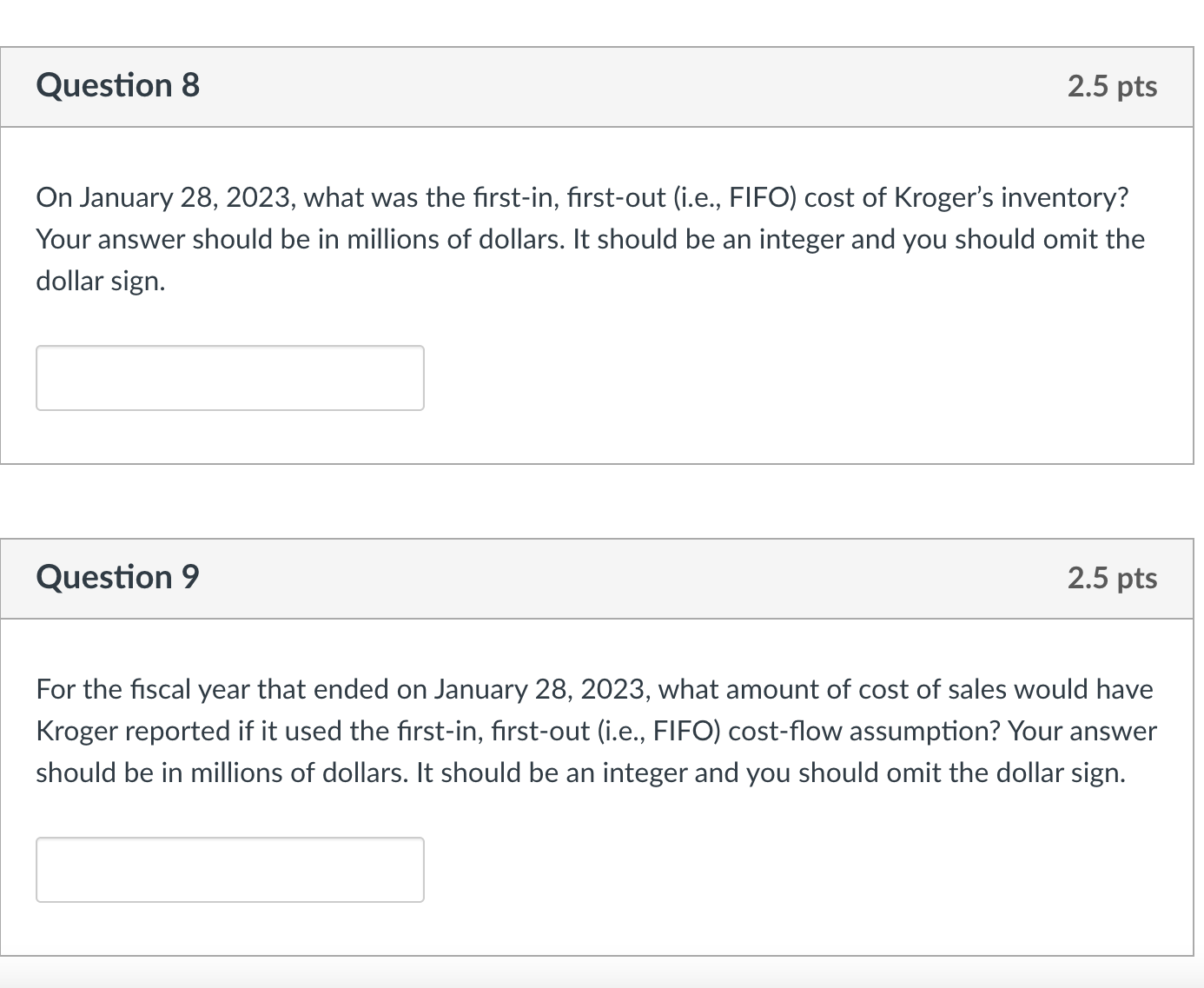

\begin{tabular}{|c|c|c|c|} \hline & A & B & C \\ \hline 1 & \multicolumn{3}{|l|}{ THE KROGER CO. } \\ \hline 2 & \multicolumn{3}{|l|}{ CONSOLIDATED BALANCE SHEETS } \\ \hline 3 & & & \\ \hline 4 & & \multicolumn{2}{|c|}{ January 28.January 29} \\ \hline 5 & (In millions of U.S. dollars) & 2023 & 2022 \\ \hline 6 & ASSETS & & \\ \hline 7 & Current assets & & \\ \hline 8 & Cash and temporary cash investments & 1,015 & 1,821 \\ \hline 9 & Store deposits in-transit & 1,127 & 1,082 \\ \hline 10 & Receivables & 2,234 & 1,828 \\ \hline 11 & Inventories & 7,560 & 6,783 \\ \hline 12 & Prepaid and other current assets & 734 & 660 \\ \hline 13 & Total current assets & 12,670 & 12,174 \\ \hline \multicolumn{4}{|l|}{14} \\ \hline 15 & Property, plant and equipment, net & 24,726 & 23,789 \\ \hline 16 & Operating lease assets & 6,662 & 6,695 \\ \hline 17 & Intangibles, net & 899 & 942 \\ \hline 18 & Goodwill & 2,916 & 3,076 \\ \hline 19 & Other assets & 1,750 & 2,410 \\ \hline \multicolumn{4}{|c|}{20} \\ \hline 21 & Total Assets & 49,623 & 49,086 \\ \hline \multicolumn{4}{|l|}{22} \\ \hline 23 & LIABILITIES & & \\ \hline 24 & Current liabilities & & \\ \hline 25 & Current portion of long-term debt including obligations under finance 1 & 1,310 & 555 \\ \hline 26 & Current portion of operating lease liabilities & 662 & 650 \\ \hline 27 & Trade accounts payable & 7,119 & 7,117 \\ \hline 28 & Accrued salaries and wages & 1,746 & 1,736 \\ \hline 29 & Other current liabilities & 6,401 & 6,265 \\ \hline 30 & Total current liabilities & 17,238 & 16,323 \\ \hline \multicolumn{4}{|l|}{31} \\ \hline 32 & Long-term debt including obligations under finance leases & 12,068 & 12,809 \\ \hline 33 & Noncurrent operating lease liabilities & 6,372 & 6,426 \\ \hline 34 & Deferred income taxes & 1,672 & 1,562 \\ \hline 35 & Pension and postretirement benefit obligations & 436 & 478 \\ \hline 36 & Other long-term liabilities & 1,823 & 2,059 \\ \hline \multicolumn{4}{|l|}{37} \\ \hline 38 & Total Liabilities & 39,609 & 39,657 \\ \hline \multicolumn{4}{|l|}{39} \\ \hline 40 & SHAREOWNERS' EQUITY & & \\ \hline 41 & Common shares & 1,918 & 1,918 \\ \hline 42 & Additional paid-in capital & 3,805 & 3,657 \\ \hline 43 & Accumulated other comprehensive loss & -632 & -467 \\ \hline 44 & Accumulated earnings & 25,601 & 24,066 \\ \hline 45 & Treasury stock & 20,650 & 19,722 \\ \hline \multicolumn{4}{|l|}{46} \\ \hline 47 & Total Shareowners' Equity - The Kroger Co. & 10,042 & 9,452 \\ \hline 48 & Noncontrolling interests & -28 & -23 \\ \hline \multicolumn{4}{|c|}{49} \\ \hline 50 & Total Equity & 10,014 & 9,429 \\ \hline \multicolumn{4}{|l|}{51} \\ \hline 52 & Total Liabilities and Equity & 49,623 & 49,086 \\ \hline 53 & & & \\ \hline \end{tabular} A B C D THE KROGER CO. \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{ CONSOLIDATED STATEMENTS OF OPERATIONS } \\ \hline & \multicolumn{3}{|c|}{ Fiscal Year Ended } \\ \hline & January 28, & January 29, & January 30, \\ \hline & 2023 & 2022 & 2021 \\ \hline (In millions of U.S. dollars) & (52 weeks) & (52 weeks) & (52 weeks) \\ \hline Sales & 148,258 & 137,888 & 132,498 \\ \hline \multicolumn{4}{|l|}{ Operating expenses } \\ \hline Cost of sales & 116,480 & 107,539 & 101,597 \\ \hline Operating, general and administrative & 23,848 & 23,203 & 24,500 \\ \hline Rent & 839 & 845 & 874 \\ \hline Depreciation and amortization & 2,965 & 2,824 & 2,747 \\ \hline Operating profit & 4,126 & 3,477 & 2,780 \\ \hline \multicolumn{4}{|l|}{ Other income (expense) } \\ \hline Interest expense & -535 & -571 & -544 \\ \hline Non-service component of company-sponsored pension plan benefits (costs) & 39 & -34 & 29 \\ \hline (Loss) gain on investments & -728 & -821 & 1,105 \\ \hline Net earnings before income tax expense & 2,902 & 2,051 & 3,370 \\ \hline Income tax expense & 653 & 385 & 782 \\ \hline Net earnings including noncontrolling interests & 2,249 & 1,666 & 2,588 \\ \hline Net income attributable to noncontrolling interests & 5 & 11 & 3 \\ \hline Net earnings attributable to The Kroger Co. & 2,244 & 1,655 & 2,585 \\ \hline \end{tabular} On January 28, 2023, what was the first-in, first-out (i.e., FIFO) cost of Kroger's inventory? Your answer should be in millions of dollars. It should be an integer and you should omit the dollar sign. Question 9 2.5 pts For the fiscal year that ended on January 28, 2023, what amount of cost of sales would have Kroger reported if it used the first-in, first-out (i.e., FIFO) cost-flow assumption? Your answer should be in millions of dollars. It should be an integer and you should omit the dollar sign

\begin{tabular}{|c|c|c|c|} \hline & A & B & C \\ \hline 1 & \multicolumn{3}{|l|}{ THE KROGER CO. } \\ \hline 2 & \multicolumn{3}{|l|}{ CONSOLIDATED BALANCE SHEETS } \\ \hline 3 & & & \\ \hline 4 & & \multicolumn{2}{|c|}{ January 28.January 29} \\ \hline 5 & (In millions of U.S. dollars) & 2023 & 2022 \\ \hline 6 & ASSETS & & \\ \hline 7 & Current assets & & \\ \hline 8 & Cash and temporary cash investments & 1,015 & 1,821 \\ \hline 9 & Store deposits in-transit & 1,127 & 1,082 \\ \hline 10 & Receivables & 2,234 & 1,828 \\ \hline 11 & Inventories & 7,560 & 6,783 \\ \hline 12 & Prepaid and other current assets & 734 & 660 \\ \hline 13 & Total current assets & 12,670 & 12,174 \\ \hline \multicolumn{4}{|l|}{14} \\ \hline 15 & Property, plant and equipment, net & 24,726 & 23,789 \\ \hline 16 & Operating lease assets & 6,662 & 6,695 \\ \hline 17 & Intangibles, net & 899 & 942 \\ \hline 18 & Goodwill & 2,916 & 3,076 \\ \hline 19 & Other assets & 1,750 & 2,410 \\ \hline \multicolumn{4}{|c|}{20} \\ \hline 21 & Total Assets & 49,623 & 49,086 \\ \hline \multicolumn{4}{|l|}{22} \\ \hline 23 & LIABILITIES & & \\ \hline 24 & Current liabilities & & \\ \hline 25 & Current portion of long-term debt including obligations under finance 1 & 1,310 & 555 \\ \hline 26 & Current portion of operating lease liabilities & 662 & 650 \\ \hline 27 & Trade accounts payable & 7,119 & 7,117 \\ \hline 28 & Accrued salaries and wages & 1,746 & 1,736 \\ \hline 29 & Other current liabilities & 6,401 & 6,265 \\ \hline 30 & Total current liabilities & 17,238 & 16,323 \\ \hline \multicolumn{4}{|l|}{31} \\ \hline 32 & Long-term debt including obligations under finance leases & 12,068 & 12,809 \\ \hline 33 & Noncurrent operating lease liabilities & 6,372 & 6,426 \\ \hline 34 & Deferred income taxes & 1,672 & 1,562 \\ \hline 35 & Pension and postretirement benefit obligations & 436 & 478 \\ \hline 36 & Other long-term liabilities & 1,823 & 2,059 \\ \hline \multicolumn{4}{|l|}{37} \\ \hline 38 & Total Liabilities & 39,609 & 39,657 \\ \hline \multicolumn{4}{|l|}{39} \\ \hline 40 & SHAREOWNERS' EQUITY & & \\ \hline 41 & Common shares & 1,918 & 1,918 \\ \hline 42 & Additional paid-in capital & 3,805 & 3,657 \\ \hline 43 & Accumulated other comprehensive loss & -632 & -467 \\ \hline 44 & Accumulated earnings & 25,601 & 24,066 \\ \hline 45 & Treasury stock & 20,650 & 19,722 \\ \hline \multicolumn{4}{|l|}{46} \\ \hline 47 & Total Shareowners' Equity - The Kroger Co. & 10,042 & 9,452 \\ \hline 48 & Noncontrolling interests & -28 & -23 \\ \hline \multicolumn{4}{|c|}{49} \\ \hline 50 & Total Equity & 10,014 & 9,429 \\ \hline \multicolumn{4}{|l|}{51} \\ \hline 52 & Total Liabilities and Equity & 49,623 & 49,086 \\ \hline 53 & & & \\ \hline \end{tabular} A B C D THE KROGER CO. \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{ CONSOLIDATED STATEMENTS OF OPERATIONS } \\ \hline & \multicolumn{3}{|c|}{ Fiscal Year Ended } \\ \hline & January 28, & January 29, & January 30, \\ \hline & 2023 & 2022 & 2021 \\ \hline (In millions of U.S. dollars) & (52 weeks) & (52 weeks) & (52 weeks) \\ \hline Sales & 148,258 & 137,888 & 132,498 \\ \hline \multicolumn{4}{|l|}{ Operating expenses } \\ \hline Cost of sales & 116,480 & 107,539 & 101,597 \\ \hline Operating, general and administrative & 23,848 & 23,203 & 24,500 \\ \hline Rent & 839 & 845 & 874 \\ \hline Depreciation and amortization & 2,965 & 2,824 & 2,747 \\ \hline Operating profit & 4,126 & 3,477 & 2,780 \\ \hline \multicolumn{4}{|l|}{ Other income (expense) } \\ \hline Interest expense & -535 & -571 & -544 \\ \hline Non-service component of company-sponsored pension plan benefits (costs) & 39 & -34 & 29 \\ \hline (Loss) gain on investments & -728 & -821 & 1,105 \\ \hline Net earnings before income tax expense & 2,902 & 2,051 & 3,370 \\ \hline Income tax expense & 653 & 385 & 782 \\ \hline Net earnings including noncontrolling interests & 2,249 & 1,666 & 2,588 \\ \hline Net income attributable to noncontrolling interests & 5 & 11 & 3 \\ \hline Net earnings attributable to The Kroger Co. & 2,244 & 1,655 & 2,585 \\ \hline \end{tabular} On January 28, 2023, what was the first-in, first-out (i.e., FIFO) cost of Kroger's inventory? Your answer should be in millions of dollars. It should be an integer and you should omit the dollar sign. Question 9 2.5 pts For the fiscal year that ended on January 28, 2023, what amount of cost of sales would have Kroger reported if it used the first-in, first-out (i.e., FIFO) cost-flow assumption? Your answer should be in millions of dollars. It should be an integer and you should omit the dollar sign Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started