Answered step by step

Verified Expert Solution

Question

1 Approved Answer

begin{tabular}{|c|c|c|c|c|} hline multicolumn{2}{|c|}{ Cash Receipts } & multicolumn{3}{|c|}{ Cash Payments } hline multirow{2}{*}{Dec.4$Date} & Cash Debit & multirow{2}{*}{1416CheckNo.} & multicolumn{2}{|c|}{ Cash Credit }

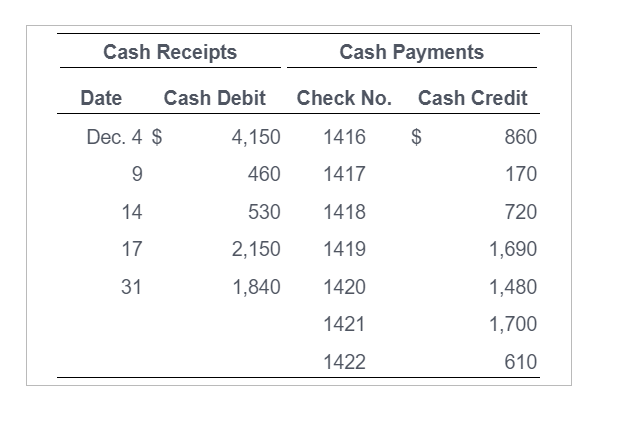

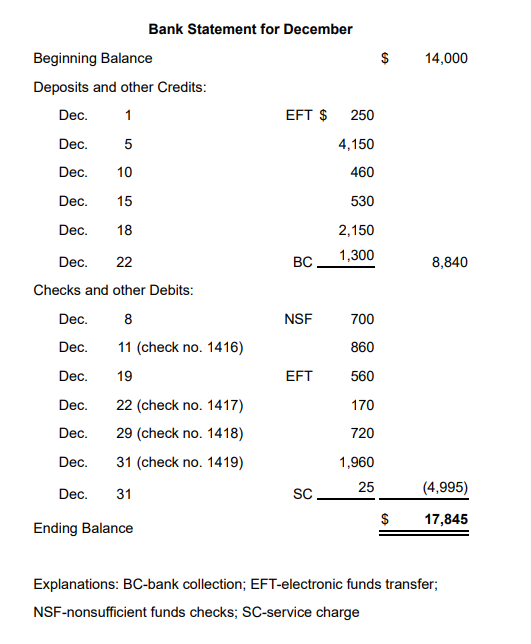

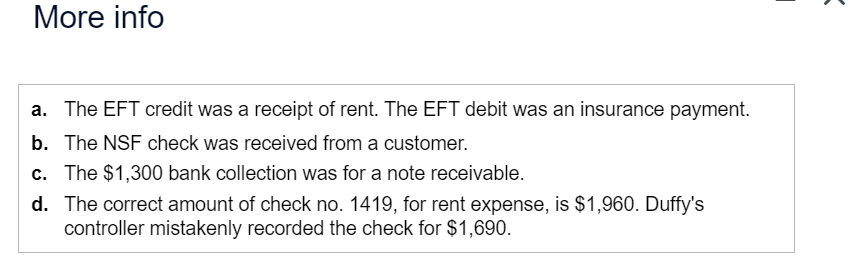

\begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{2}{|c|}{ Cash Receipts } & \multicolumn{3}{|c|}{ Cash Payments } \\ \hline \multirow{2}{*}{Dec.4$Date} & Cash Debit & \multirow{2}{*}{1416CheckNo.} & \multicolumn{2}{|c|}{ Cash Credit } \\ \hline & 4,150 & & $ & 860 \\ \hline 9 & 460 & 1417 & & 170 \\ \hline 14 & 530 & 1418 & & 720 \\ \hline 17 & 2,150 & 1419 & & 1,690 \\ \hline \multirow[t]{3}{*}{31} & 1,840 & 1420 & & 1,480 \\ \hline & & 1421 & & 1,700 \\ \hline & & 1422 & & 610 \\ \hline \end{tabular} Requirements 1. Prepare the bank reconciliation of Duffy Insurance at December 31, 2024. 2. Journalize any required entries from the bank reconciliation. Rank Statement for necomher Explanations: BC-bank collection; EFT-electronic funds transfer; NSF-nonsufficient funds checks; SC-service charge More info a. The EFT credit was a receipt of rent. The EFT debit was an insurance payment. b. The NSF check was received from a customer. c. The $1,300 bank collection was for a note receivable. d. The correct amount of check no. 1419 , for rent expense, is $1,960. Duffy's controller mistakenly recorded the check for $1,690. The December cash records of Duffy Insurance follow: (Click the icon to view the checkbook.) Duffy's Cash account shows a balance of $15,900 at December 31. On December 31, Duffy Insurance received the following bank statement: (Click the icon to view the December bank statement.) Additional data for the bank reconciliation follow: (Click the icon to view the additional information.) Read the requirements

\begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{2}{|c|}{ Cash Receipts } & \multicolumn{3}{|c|}{ Cash Payments } \\ \hline \multirow{2}{*}{Dec.4$Date} & Cash Debit & \multirow{2}{*}{1416CheckNo.} & \multicolumn{2}{|c|}{ Cash Credit } \\ \hline & 4,150 & & $ & 860 \\ \hline 9 & 460 & 1417 & & 170 \\ \hline 14 & 530 & 1418 & & 720 \\ \hline 17 & 2,150 & 1419 & & 1,690 \\ \hline \multirow[t]{3}{*}{31} & 1,840 & 1420 & & 1,480 \\ \hline & & 1421 & & 1,700 \\ \hline & & 1422 & & 610 \\ \hline \end{tabular} Requirements 1. Prepare the bank reconciliation of Duffy Insurance at December 31, 2024. 2. Journalize any required entries from the bank reconciliation. Rank Statement for necomher Explanations: BC-bank collection; EFT-electronic funds transfer; NSF-nonsufficient funds checks; SC-service charge More info a. The EFT credit was a receipt of rent. The EFT debit was an insurance payment. b. The NSF check was received from a customer. c. The $1,300 bank collection was for a note receivable. d. The correct amount of check no. 1419 , for rent expense, is $1,960. Duffy's controller mistakenly recorded the check for $1,690. The December cash records of Duffy Insurance follow: (Click the icon to view the checkbook.) Duffy's Cash account shows a balance of $15,900 at December 31. On December 31, Duffy Insurance received the following bank statement: (Click the icon to view the December bank statement.) Additional data for the bank reconciliation follow: (Click the icon to view the additional information.) Read the requirements Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started