Answered step by step

Verified Expert Solution

Question

1 Approved Answer

begin{tabular}{|c|c|c|c|c|} hline multicolumn{5}{|c|}{begin{tabular}{c} Jayson Company Cash Budget January, February, and March end{tabular}} hline & January & February & March & multirow{2}{*}{begin{tabular}{l} Total

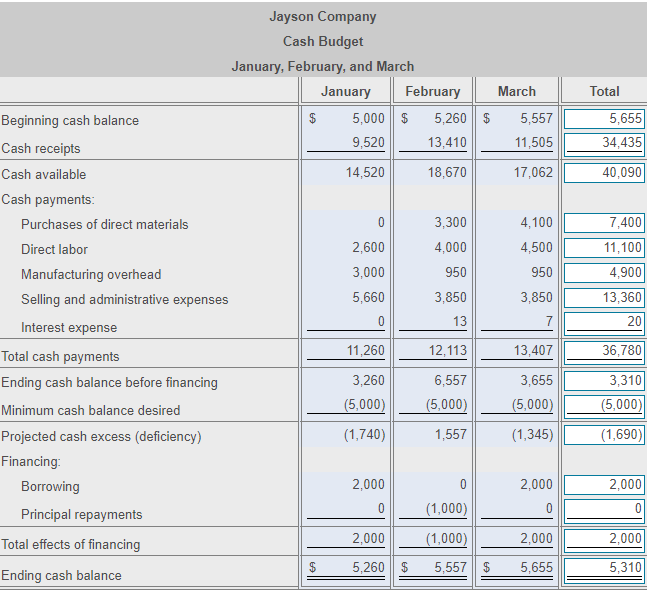

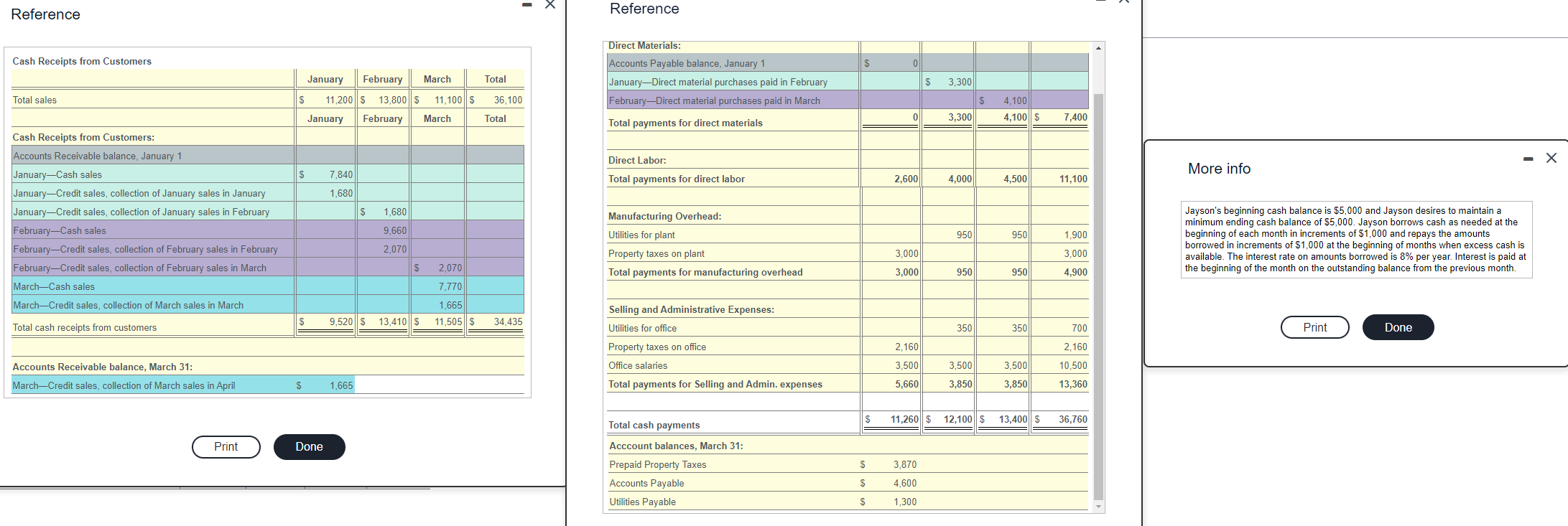

\begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{\begin{tabular}{c} Jayson Company \\ Cash Budget \\ January, February, and March \end{tabular}} \\ \hline & January & February & March & \multirow{2}{*}{\begin{tabular}{l} Total \\ 5,655 \end{tabular}} \\ \hline Beginning cash balance & 5,000 & 5,260 & 5,557 & \\ \hline Cash receipts & 9,520 & 13,410 & 11,505 & 34,435 \\ \hline Cash available & 14,520 & 18,670 & 17,062 & 40,090 \\ \hline Cash payments: & & & & \\ \hline Purchases of direct materials & 0 & 3,300 & 4,100 & 7,400 \\ \hline Direct labor & 2,600 & 4,000 & 4,500 & 11,100 \\ \hline Manufacturing overhead & 3,000 & 950 & 950 & 4,900 \\ \hline Selling and administrative expenses & 5,660 & 3,850 & 3,850 & 13,360 \\ \hline Interest expense & 0 & 13 & 7 & 20 \\ \hline Total cash payments & 11,260 & 12,113 & 13,407 & 36,780 \\ \hline Ending cash balance before financing & 3,260 & 6,557 & 3,655 & 3,310 \\ \hline Minimum cash balance desired & (5,000) & (5,000) & (5,000) & (5,000) \\ \hline Projected cash excess (deficiency) & (1,740) & 1,557 & (1,345) & (1,690) \\ \hline Financing: & & & & \\ \hline Borrowing & 2,000 & 0 & 2,000 & 2,000 \\ \hline Principal repayments & 0 & (1,000) & 0 & 0 \\ \hline Total effects of financing & 2,000 & (1,000) & 2,000 & 2,000 \\ \hline Ending cash balance & 5,260 & & 5,655 & 5,310 \\ \hline \end{tabular} Reference Reference More info Jayson's beginning cash balance is $5,000 and Jayson desires to maintain a minimum ending cash balance of $5,000. Jayson borrows cash as needed at the beginning of each month in increments of $1,000 and repays the amounts borrowed in increments of $1,000 at the beginning of months when excess cash is available. The interest rate on amounts borrowed is 8% per year. Interest is paid the beginning of the month on the outstanding balance from the previous month. \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{\begin{tabular}{c} Jayson Company \\ Cash Budget \\ January, February, and March \end{tabular}} \\ \hline & January & February & March & \multirow{2}{*}{\begin{tabular}{l} Total \\ 5,655 \end{tabular}} \\ \hline Beginning cash balance & 5,000 & 5,260 & 5,557 & \\ \hline Cash receipts & 9,520 & 13,410 & 11,505 & 34,435 \\ \hline Cash available & 14,520 & 18,670 & 17,062 & 40,090 \\ \hline Cash payments: & & & & \\ \hline Purchases of direct materials & 0 & 3,300 & 4,100 & 7,400 \\ \hline Direct labor & 2,600 & 4,000 & 4,500 & 11,100 \\ \hline Manufacturing overhead & 3,000 & 950 & 950 & 4,900 \\ \hline Selling and administrative expenses & 5,660 & 3,850 & 3,850 & 13,360 \\ \hline Interest expense & 0 & 13 & 7 & 20 \\ \hline Total cash payments & 11,260 & 12,113 & 13,407 & 36,780 \\ \hline Ending cash balance before financing & 3,260 & 6,557 & 3,655 & 3,310 \\ \hline Minimum cash balance desired & (5,000) & (5,000) & (5,000) & (5,000) \\ \hline Projected cash excess (deficiency) & (1,740) & 1,557 & (1,345) & (1,690) \\ \hline Financing: & & & & \\ \hline Borrowing & 2,000 & 0 & 2,000 & 2,000 \\ \hline Principal repayments & 0 & (1,000) & 0 & 0 \\ \hline Total effects of financing & 2,000 & (1,000) & 2,000 & 2,000 \\ \hline Ending cash balance & 5,260 & & 5,655 & 5,310 \\ \hline \end{tabular} Reference Reference More info Jayson's beginning cash balance is $5,000 and Jayson desires to maintain a minimum ending cash balance of $5,000. Jayson borrows cash as needed at the beginning of each month in increments of $1,000 and repays the amounts borrowed in increments of $1,000 at the beginning of months when excess cash is available. The interest rate on amounts borrowed is 8% per year. Interest is paid the beginning of the month on the outstanding balance from the previous month

\begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{\begin{tabular}{c} Jayson Company \\ Cash Budget \\ January, February, and March \end{tabular}} \\ \hline & January & February & March & \multirow{2}{*}{\begin{tabular}{l} Total \\ 5,655 \end{tabular}} \\ \hline Beginning cash balance & 5,000 & 5,260 & 5,557 & \\ \hline Cash receipts & 9,520 & 13,410 & 11,505 & 34,435 \\ \hline Cash available & 14,520 & 18,670 & 17,062 & 40,090 \\ \hline Cash payments: & & & & \\ \hline Purchases of direct materials & 0 & 3,300 & 4,100 & 7,400 \\ \hline Direct labor & 2,600 & 4,000 & 4,500 & 11,100 \\ \hline Manufacturing overhead & 3,000 & 950 & 950 & 4,900 \\ \hline Selling and administrative expenses & 5,660 & 3,850 & 3,850 & 13,360 \\ \hline Interest expense & 0 & 13 & 7 & 20 \\ \hline Total cash payments & 11,260 & 12,113 & 13,407 & 36,780 \\ \hline Ending cash balance before financing & 3,260 & 6,557 & 3,655 & 3,310 \\ \hline Minimum cash balance desired & (5,000) & (5,000) & (5,000) & (5,000) \\ \hline Projected cash excess (deficiency) & (1,740) & 1,557 & (1,345) & (1,690) \\ \hline Financing: & & & & \\ \hline Borrowing & 2,000 & 0 & 2,000 & 2,000 \\ \hline Principal repayments & 0 & (1,000) & 0 & 0 \\ \hline Total effects of financing & 2,000 & (1,000) & 2,000 & 2,000 \\ \hline Ending cash balance & 5,260 & & 5,655 & 5,310 \\ \hline \end{tabular} Reference Reference More info Jayson's beginning cash balance is $5,000 and Jayson desires to maintain a minimum ending cash balance of $5,000. Jayson borrows cash as needed at the beginning of each month in increments of $1,000 and repays the amounts borrowed in increments of $1,000 at the beginning of months when excess cash is available. The interest rate on amounts borrowed is 8% per year. Interest is paid the beginning of the month on the outstanding balance from the previous month. \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{\begin{tabular}{c} Jayson Company \\ Cash Budget \\ January, February, and March \end{tabular}} \\ \hline & January & February & March & \multirow{2}{*}{\begin{tabular}{l} Total \\ 5,655 \end{tabular}} \\ \hline Beginning cash balance & 5,000 & 5,260 & 5,557 & \\ \hline Cash receipts & 9,520 & 13,410 & 11,505 & 34,435 \\ \hline Cash available & 14,520 & 18,670 & 17,062 & 40,090 \\ \hline Cash payments: & & & & \\ \hline Purchases of direct materials & 0 & 3,300 & 4,100 & 7,400 \\ \hline Direct labor & 2,600 & 4,000 & 4,500 & 11,100 \\ \hline Manufacturing overhead & 3,000 & 950 & 950 & 4,900 \\ \hline Selling and administrative expenses & 5,660 & 3,850 & 3,850 & 13,360 \\ \hline Interest expense & 0 & 13 & 7 & 20 \\ \hline Total cash payments & 11,260 & 12,113 & 13,407 & 36,780 \\ \hline Ending cash balance before financing & 3,260 & 6,557 & 3,655 & 3,310 \\ \hline Minimum cash balance desired & (5,000) & (5,000) & (5,000) & (5,000) \\ \hline Projected cash excess (deficiency) & (1,740) & 1,557 & (1,345) & (1,690) \\ \hline Financing: & & & & \\ \hline Borrowing & 2,000 & 0 & 2,000 & 2,000 \\ \hline Principal repayments & 0 & (1,000) & 0 & 0 \\ \hline Total effects of financing & 2,000 & (1,000) & 2,000 & 2,000 \\ \hline Ending cash balance & 5,260 & & 5,655 & 5,310 \\ \hline \end{tabular} Reference Reference More info Jayson's beginning cash balance is $5,000 and Jayson desires to maintain a minimum ending cash balance of $5,000. Jayson borrows cash as needed at the beginning of each month in increments of $1,000 and repays the amounts borrowed in increments of $1,000 at the beginning of months when excess cash is available. The interest rate on amounts borrowed is 8% per year. Interest is paid the beginning of the month on the outstanding balance from the previous month Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started