Answered step by step

Verified Expert Solution

Question

1 Approved Answer

begin{tabular}{|c|c|c|c|c|c|c|c|} hline & A & B & c & D & E & F & G hline 1 & & multicolumn{3}{|c|}{ Master Budget Project

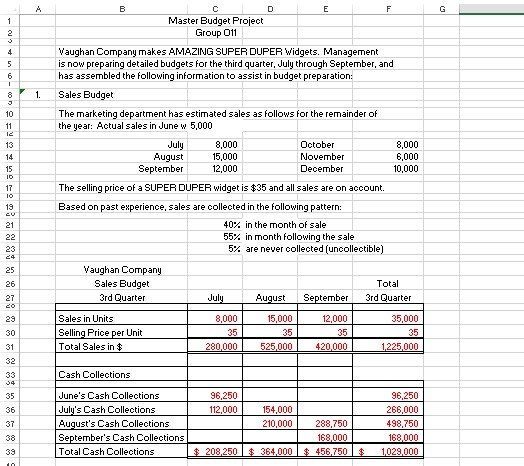

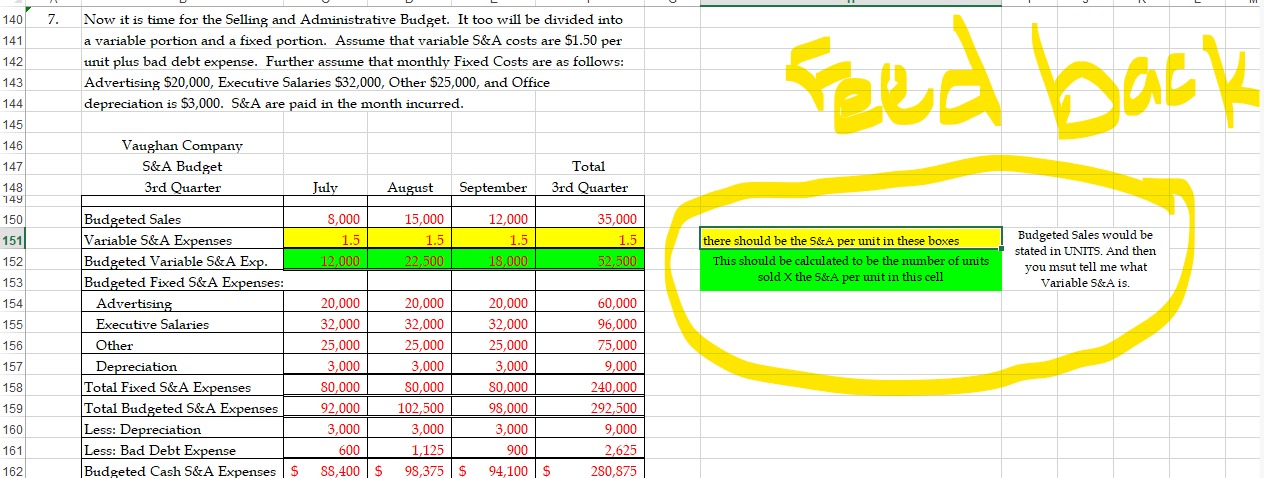

\begin{tabular}{|c|c|c|c|c|c|c|c|} \hline & A & B & c & D & E & F & G \\ \hline 1 & & \multicolumn{3}{|c|}{ Master Budget Project } & & & \\ \hline 2 & & & Group 011 & & & & \\ \hline 4 & & \multicolumn{5}{|c|}{ Vaughan Company makes AMAZING SUPER DUPER Widgets. Management } & \\ \hline 5 & & \multicolumn{5}{|c|}{ is now preparing detailed budgets for the third quarter, July through September, and } & \\ \hline 6 & & \multicolumn{5}{|c|}{ has assembled the following information to assist in budget preparation: } & \\ \hlinei & & & & & & & \\ \hline \begin{tabular}{l} 8 \\ j \end{tabular} & 1. & Sales Budget & & & & & \\ \hline 10 & & \multicolumn{5}{|c|}{ The marketing department has estimated sales as follows for the remainder of } & \\ \hline 11 & & \multicolumn{3}{|l|}{ the year: Actual sales in June w 5,000} & & & \\ \hline \begin{tabular}{ll} IE \\ 13 \end{tabular} & & July & 8,000 & & Dotober & 8000 & \\ \hline 14 & & August & 15,000 & & November & 6,000 & \\ \hline 15 & & September & 12,000 & & December & 10,000 & \\ \hline 10 & & \multirow{2}{*}{\multicolumn{5}{|c|}{ The selling price of a SUPER DUPER widget is $35 and all sales are on account. }} & \\ \hline \begin{tabular}{ll} 16 \\ 10 \end{tabular} & & & & & & & \\ \hline 19 & & \multicolumn{4}{|c|}{ Based on past experience, sales are collected in the following pattern: } & & \\ \hline 21 & & & 40% & in the month & of sale & & \\ \hline 22 & & & 55% & in month foll & lowing the sale & & \\ \hline 23 & & & 5% & are never coll & llected [uncolle & ectible] & \\ \hline 24 & & & & & & & \\ \hline 25 & & Vaughan Company & & & & & \\ \hline 26 & & Sales Budget & & & & Total & \\ \hline 27 & & 3rd Quarter & July & August & September & 3rd Quarter & \\ \hline 29 & & Sales in Units & 8,000 & 15,000 & 12,000 & 35,000 & \\ \hline 30 & & Selling Price per Unit & 35 & 35 & 35 & 35 & \\ \hline 31 & & Total Sales in $ & 280,000 & 525,000 & 420,000 & 1,225,000 & \\ \hline 32 & & & & & & & \\ \hline 33 & & Cash Collections & & & & & \\ \hline 54 & & & & & & & \\ \hline 35 & & June's Cash Collections & 96,250 & & & 96,250 & \\ \hline 36 & & July's Cash Collections & 112,000 & 154,000 & & 266,000 & \\ \hline 37 & & August's Cash Collections & & 210,000 & 288,750 & 498,750 & \\ \hline 38 & & September's Cash Collections & & & 168,000 & 168,000 & \\ \hline 39 & & Total Cash Collections & $208,250 & $364,000 & $456,750 & 1,029,000 & \\ \hline \end{tabular} 7. Now it is time for the Selling and Administrative Budget. It too will be divided into a variable portion and a fixed portion. Assume that variable S\&A costs are $1.50 per unit plus bad debt expense. Further assume that monthly Fixed Costs are as follows: Advertising \$20,000, Executive Salaries $32,000, Other $25,000, and Office \begin{tabular}{|c|c|c|c|c|c|c|c|} \hline & A & B & c & D & E & F & G \\ \hline 1 & & \multicolumn{3}{|c|}{ Master Budget Project } & & & \\ \hline 2 & & & Group 011 & & & & \\ \hline 4 & & \multicolumn{5}{|c|}{ Vaughan Company makes AMAZING SUPER DUPER Widgets. Management } & \\ \hline 5 & & \multicolumn{5}{|c|}{ is now preparing detailed budgets for the third quarter, July through September, and } & \\ \hline 6 & & \multicolumn{5}{|c|}{ has assembled the following information to assist in budget preparation: } & \\ \hlinei & & & & & & & \\ \hline \begin{tabular}{l} 8 \\ j \end{tabular} & 1. & Sales Budget & & & & & \\ \hline 10 & & \multicolumn{5}{|c|}{ The marketing department has estimated sales as follows for the remainder of } & \\ \hline 11 & & \multicolumn{3}{|l|}{ the year: Actual sales in June w 5,000} & & & \\ \hline \begin{tabular}{ll} IE \\ 13 \end{tabular} & & July & 8,000 & & Dotober & 8000 & \\ \hline 14 & & August & 15,000 & & November & 6,000 & \\ \hline 15 & & September & 12,000 & & December & 10,000 & \\ \hline 10 & & \multirow{2}{*}{\multicolumn{5}{|c|}{ The selling price of a SUPER DUPER widget is $35 and all sales are on account. }} & \\ \hline \begin{tabular}{ll} 16 \\ 10 \end{tabular} & & & & & & & \\ \hline 19 & & \multicolumn{4}{|c|}{ Based on past experience, sales are collected in the following pattern: } & & \\ \hline 21 & & & 40% & in the month & of sale & & \\ \hline 22 & & & 55% & in month foll & lowing the sale & & \\ \hline 23 & & & 5% & are never coll & llected [uncolle & ectible] & \\ \hline 24 & & & & & & & \\ \hline 25 & & Vaughan Company & & & & & \\ \hline 26 & & Sales Budget & & & & Total & \\ \hline 27 & & 3rd Quarter & July & August & September & 3rd Quarter & \\ \hline 29 & & Sales in Units & 8,000 & 15,000 & 12,000 & 35,000 & \\ \hline 30 & & Selling Price per Unit & 35 & 35 & 35 & 35 & \\ \hline 31 & & Total Sales in $ & 280,000 & 525,000 & 420,000 & 1,225,000 & \\ \hline 32 & & & & & & & \\ \hline 33 & & Cash Collections & & & & & \\ \hline 54 & & & & & & & \\ \hline 35 & & June's Cash Collections & 96,250 & & & 96,250 & \\ \hline 36 & & July's Cash Collections & 112,000 & 154,000 & & 266,000 & \\ \hline 37 & & August's Cash Collections & & 210,000 & 288,750 & 498,750 & \\ \hline 38 & & September's Cash Collections & & & 168,000 & 168,000 & \\ \hline 39 & & Total Cash Collections & $208,250 & $364,000 & $456,750 & 1,029,000 & \\ \hline \end{tabular} 7. Now it is time for the Selling and Administrative Budget. It too will be divided into a variable portion and a fixed portion. Assume that variable S\&A costs are $1.50 per unit plus bad debt expense. Further assume that monthly Fixed Costs are as follows: Advertising \$20,000, Executive Salaries $32,000, Other $25,000, and Office

\begin{tabular}{|c|c|c|c|c|c|c|c|} \hline & A & B & c & D & E & F & G \\ \hline 1 & & \multicolumn{3}{|c|}{ Master Budget Project } & & & \\ \hline 2 & & & Group 011 & & & & \\ \hline 4 & & \multicolumn{5}{|c|}{ Vaughan Company makes AMAZING SUPER DUPER Widgets. Management } & \\ \hline 5 & & \multicolumn{5}{|c|}{ is now preparing detailed budgets for the third quarter, July through September, and } & \\ \hline 6 & & \multicolumn{5}{|c|}{ has assembled the following information to assist in budget preparation: } & \\ \hlinei & & & & & & & \\ \hline \begin{tabular}{l} 8 \\ j \end{tabular} & 1. & Sales Budget & & & & & \\ \hline 10 & & \multicolumn{5}{|c|}{ The marketing department has estimated sales as follows for the remainder of } & \\ \hline 11 & & \multicolumn{3}{|l|}{ the year: Actual sales in June w 5,000} & & & \\ \hline \begin{tabular}{ll} IE \\ 13 \end{tabular} & & July & 8,000 & & Dotober & 8000 & \\ \hline 14 & & August & 15,000 & & November & 6,000 & \\ \hline 15 & & September & 12,000 & & December & 10,000 & \\ \hline 10 & & \multirow{2}{*}{\multicolumn{5}{|c|}{ The selling price of a SUPER DUPER widget is $35 and all sales are on account. }} & \\ \hline \begin{tabular}{ll} 16 \\ 10 \end{tabular} & & & & & & & \\ \hline 19 & & \multicolumn{4}{|c|}{ Based on past experience, sales are collected in the following pattern: } & & \\ \hline 21 & & & 40% & in the month & of sale & & \\ \hline 22 & & & 55% & in month foll & lowing the sale & & \\ \hline 23 & & & 5% & are never coll & llected [uncolle & ectible] & \\ \hline 24 & & & & & & & \\ \hline 25 & & Vaughan Company & & & & & \\ \hline 26 & & Sales Budget & & & & Total & \\ \hline 27 & & 3rd Quarter & July & August & September & 3rd Quarter & \\ \hline 29 & & Sales in Units & 8,000 & 15,000 & 12,000 & 35,000 & \\ \hline 30 & & Selling Price per Unit & 35 & 35 & 35 & 35 & \\ \hline 31 & & Total Sales in $ & 280,000 & 525,000 & 420,000 & 1,225,000 & \\ \hline 32 & & & & & & & \\ \hline 33 & & Cash Collections & & & & & \\ \hline 54 & & & & & & & \\ \hline 35 & & June's Cash Collections & 96,250 & & & 96,250 & \\ \hline 36 & & July's Cash Collections & 112,000 & 154,000 & & 266,000 & \\ \hline 37 & & August's Cash Collections & & 210,000 & 288,750 & 498,750 & \\ \hline 38 & & September's Cash Collections & & & 168,000 & 168,000 & \\ \hline 39 & & Total Cash Collections & $208,250 & $364,000 & $456,750 & 1,029,000 & \\ \hline \end{tabular} 7. Now it is time for the Selling and Administrative Budget. It too will be divided into a variable portion and a fixed portion. Assume that variable S\&A costs are $1.50 per unit plus bad debt expense. Further assume that monthly Fixed Costs are as follows: Advertising \$20,000, Executive Salaries $32,000, Other $25,000, and Office \begin{tabular}{|c|c|c|c|c|c|c|c|} \hline & A & B & c & D & E & F & G \\ \hline 1 & & \multicolumn{3}{|c|}{ Master Budget Project } & & & \\ \hline 2 & & & Group 011 & & & & \\ \hline 4 & & \multicolumn{5}{|c|}{ Vaughan Company makes AMAZING SUPER DUPER Widgets. Management } & \\ \hline 5 & & \multicolumn{5}{|c|}{ is now preparing detailed budgets for the third quarter, July through September, and } & \\ \hline 6 & & \multicolumn{5}{|c|}{ has assembled the following information to assist in budget preparation: } & \\ \hlinei & & & & & & & \\ \hline \begin{tabular}{l} 8 \\ j \end{tabular} & 1. & Sales Budget & & & & & \\ \hline 10 & & \multicolumn{5}{|c|}{ The marketing department has estimated sales as follows for the remainder of } & \\ \hline 11 & & \multicolumn{3}{|l|}{ the year: Actual sales in June w 5,000} & & & \\ \hline \begin{tabular}{ll} IE \\ 13 \end{tabular} & & July & 8,000 & & Dotober & 8000 & \\ \hline 14 & & August & 15,000 & & November & 6,000 & \\ \hline 15 & & September & 12,000 & & December & 10,000 & \\ \hline 10 & & \multirow{2}{*}{\multicolumn{5}{|c|}{ The selling price of a SUPER DUPER widget is $35 and all sales are on account. }} & \\ \hline \begin{tabular}{ll} 16 \\ 10 \end{tabular} & & & & & & & \\ \hline 19 & & \multicolumn{4}{|c|}{ Based on past experience, sales are collected in the following pattern: } & & \\ \hline 21 & & & 40% & in the month & of sale & & \\ \hline 22 & & & 55% & in month foll & lowing the sale & & \\ \hline 23 & & & 5% & are never coll & llected [uncolle & ectible] & \\ \hline 24 & & & & & & & \\ \hline 25 & & Vaughan Company & & & & & \\ \hline 26 & & Sales Budget & & & & Total & \\ \hline 27 & & 3rd Quarter & July & August & September & 3rd Quarter & \\ \hline 29 & & Sales in Units & 8,000 & 15,000 & 12,000 & 35,000 & \\ \hline 30 & & Selling Price per Unit & 35 & 35 & 35 & 35 & \\ \hline 31 & & Total Sales in $ & 280,000 & 525,000 & 420,000 & 1,225,000 & \\ \hline 32 & & & & & & & \\ \hline 33 & & Cash Collections & & & & & \\ \hline 54 & & & & & & & \\ \hline 35 & & June's Cash Collections & 96,250 & & & 96,250 & \\ \hline 36 & & July's Cash Collections & 112,000 & 154,000 & & 266,000 & \\ \hline 37 & & August's Cash Collections & & 210,000 & 288,750 & 498,750 & \\ \hline 38 & & September's Cash Collections & & & 168,000 & 168,000 & \\ \hline 39 & & Total Cash Collections & $208,250 & $364,000 & $456,750 & 1,029,000 & \\ \hline \end{tabular} 7. Now it is time for the Selling and Administrative Budget. It too will be divided into a variable portion and a fixed portion. Assume that variable S\&A costs are $1.50 per unit plus bad debt expense. Further assume that monthly Fixed Costs are as follows: Advertising \$20,000, Executive Salaries $32,000, Other $25,000, and Office Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started