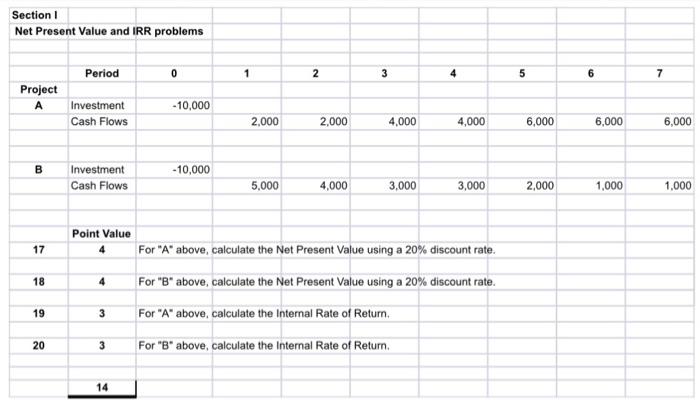

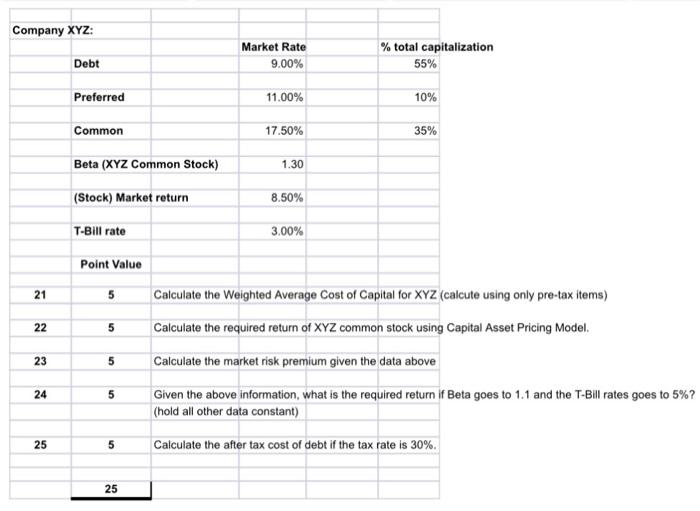

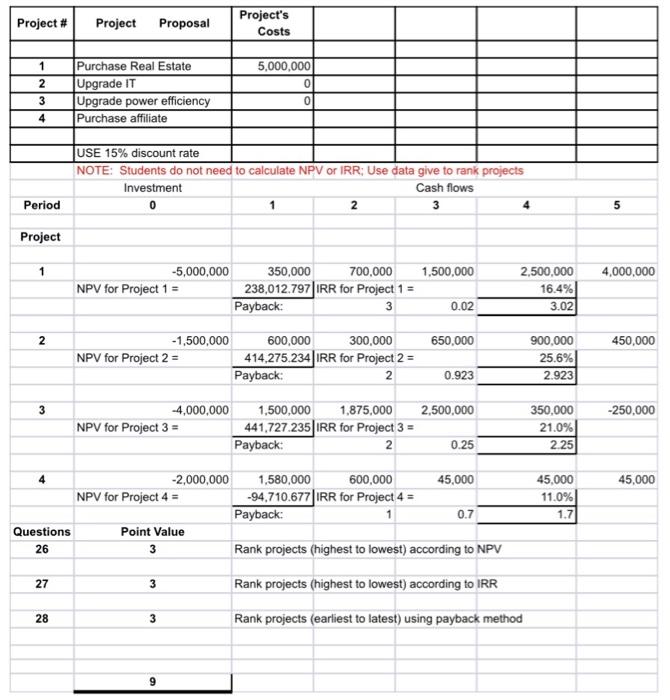

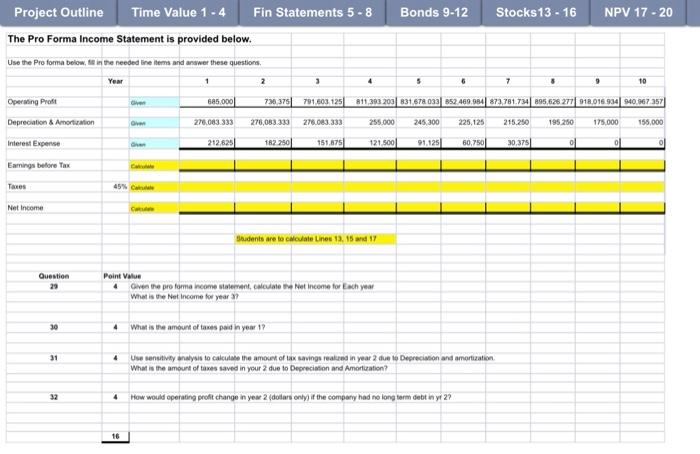

\begin{tabular}{|c|c|c|c|c|c|c|c|c|c|} \hline \multirow{2}{*}{\multicolumn{10}{|c|}{\begin{tabular}{l} Section I \\ Net Present Value and IRR problems \end{tabular}}} \\ \hline & & & & & & & & & \\ \hline & & & & & & & & & \\ \hline & Period & 0 & 1 & 2 & 3 & 4 & 5 & 6 & 7 \\ \hline \multicolumn{10}{|c|}{ Project } \\ \hline \multirow[t]{4}{*}{ A } & Investment & 10,000 & & & & & & & \\ \hline & Cash Flows & & 2,000 & 2,000 & 4,000 & 4,000 & 6,000 & 6,000 & 6,000 \\ \hline & & & & & & & & & \\ \hline & & & & & & & & & \\ \hline \multirow[t]{5}{*}{ B } & Investment & 10,000 & & & & & & & \\ \hline & Cash Flows & & 5,000 & 4,000 & 3,000 & 3,000 & 2,000 & 1,000 & 1,000 \\ \hline & & & & & & & & & \\ \hline & & & & & & & & & \\ \hline & Point Value & & & & & & & & \\ \hline 17 & 4 & \multicolumn{6}{|c|}{ For " A " above, calculate the Net Present Value using a 20% discount rate. } & & \\ \hline & & & & & & & & & \\ \hline 18 & 4 & \multicolumn{6}{|c|}{ For " B " above, calculate the Net Present Value using a 20% discount rate. } & & \\ \hline & & & & & & & & & \\ \hline 19 & 3 & \multicolumn{4}{|c|}{ For " A " above, calculate the Internal Rate of Return. } & & & & \\ \hline & & & & & & & & & \\ \hline 20 & 3 & \multicolumn{4}{|c|}{ For " B " above, calculate the Internal Rate of Return. } & & & & \\ \hline & & & & & & & & & \\ \hline & & & & & & & & & \\ \hline & 14 & & & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Company XYZ: } & \\ \hline & & & Market Rate & % total capitalization & \\ \hline & Debt & & 9.00% & 55% & \\ \hline & & & & & \\ \hline & Preferred & & 11.00% & 10% & \\ \hline & & & & & \\ \hline & Common & & 17.50% & 35% & \\ \hline & & & & & \\ \hline & \multicolumn{2}{|c|}{ Beta (XYZ Common Stock) } & 1.30 & & \\ \hline & & & & & \\ \hline & \multicolumn{2}{|c|}{ (Stock) Market return } & 8.50% & & \\ \hline & & & & & \\ \hline & T-Bill rate & & 3.00% & & \\ \hline & & & & & \\ \hline & Point Value & & & & \\ \hline 21 & 5 & \multicolumn{4}{|c|}{ Calculate the Weighted Average Cost of Capital for XYZ (calcute using only pre-tax items) } \\ \hline 22 & 5 & \multicolumn{4}{|c|}{ Calculate the required return of XYZ common stock using Capital Asset Pricing Model. } \\ \hline & & & & & \\ \hline 23 & 5 & \multicolumn{3}{|c|}{ Calculate the market risk premium given the data above } & \\ \hline \multirow[t]{2}{*}{24} & 5 & \multicolumn{4}{|c|}{ Given the above information, what is the required return if Beta goes to 1.1 and the T-Bill rates goes to 5% ? } \\ \hline & & \multicolumn{2}{|c|}{ (hold all other data constant) } & & \\ \hline 25 & 5 & \multicolumn{3}{|c|}{ Calculate the after tax cost of debt if the tax rate is 30%. } & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & 25 & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline Project \# & Proposal & \begin{tabular}{|r|} Project's \\ Costs \end{tabular} & & & & \\ \hline & & & & & & \\ \hline 1 & Purchase Real Estate & 5,000,000 & & & & \\ \hline 2 & Upgrade IT & 0 & & & & \\ \hline 3 & Upgrade power efficiency & 0 & & & & \\ \hline \multirow[t]{5}{*}{4} & Purchase affiliate & & & & & \\ \hline & & & & & & \\ \hline & USE 15% discount rate & & & & & \\ \hline & \multicolumn{5}{|c|}{ NOTE: Students do not need to calculate NPV or IRR: Use data give to rank projects } & \\ \hline & Investment & \multicolumn{5}{|c|}{ Cash flows } \\ \hline Period & 0 & 1 & 2 & 3 & 4 & 5 \\ \hline \multirow{2}{*}{\multicolumn{7}{|c|}{ Project }} \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \multirow[t]{3}{*}{1} & 5,000,000 & 350,000 & 700,000 & 1.500,000 & 2,500,000 & 4,000,000 \\ \hline & \multirow[t]{2}{*}{ NPV for Project 1 = } & 238,012.797 & \multicolumn{2}{|c|}{ VIRR for Project 1 = } & 16.4% & \\ \hline & & Payback: & 3 & 0.02 & 3.02 & \\ \hline \multirow[t]{3}{*}{2} & 1,500,000 & 600,000 & 300,000 & 650,000 & 900,000 & 450,000 \\ \hline & \multirow[t]{2}{*}{ NPV for Project 2 = } & 414,275,234 & \multicolumn{2}{|c|}{ IRR for Project 2=} & 25.6% & \\ \hline & & Payback: & 2 & 0.923 & 2.923 & \\ \hline \multirow[t]{3}{*}{3} & 4,000,000 & 1,500,000 & 1,875,000 & 2,500,000 & 350,000 & 250,000 \\ \hline & \multirow[t]{2}{*}{ NPV for Project 3=} & 441,727.235 & \multicolumn{2}{|c|}{ IRR for Project 3=} & 21.0% & \\ \hline & & Payback: & 2 & 0.25 & 2.25 & \\ \hline \multirow[t]{3}{*}{4} & 2,000,000 & 1,580,000 & 600,000 & 45,000 & 45,000 & 45,000 \\ \hline & \multirow[t]{2}{*}{ NPV for Project 4=} & 94,710.677 & \multicolumn{2}{|c|}{ IRR for Project 4 = } & 11.0% & \\ \hline & & Payback: & 1 & 0.7 & 1.7 & \\ \hline Questions & Point Value & & & & & \\ \hline 26 & 3 & Rank projects & (highest to lowes & according to & & \\ \hline & & & & & & \\ \hline 27 & 3 & Rank projects & (highest to lowes & according to & & \\ \hline 28 & 3 & Rank projects ( & (earliest to latest) & sing payback & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & 9 & & & & & \\ \hline \end{tabular} Project Outline Time Value 1 - 4 Fin Statements 5 - 8 Bonds 9-12 Stocks 13 - 16 NPV 1720 The Pro Forma Income Statement is provided below. Use the Pro forma below, A in the needed line items and anawer these questions