Answered step by step

Verified Expert Solution

Question

1 Approved Answer

begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|} hline L & M & N & & P & & R & S & T & & V & W hline &

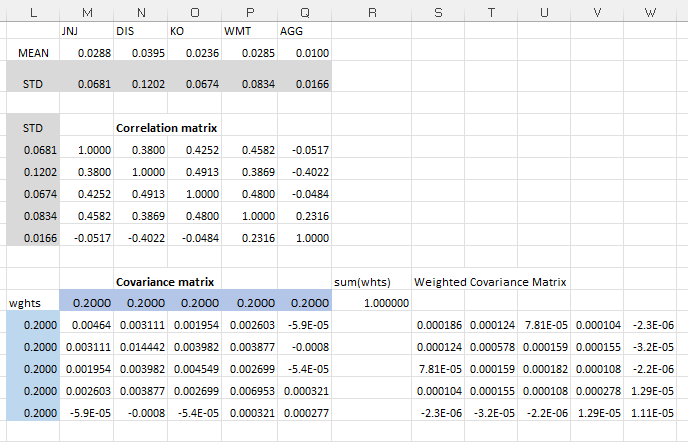

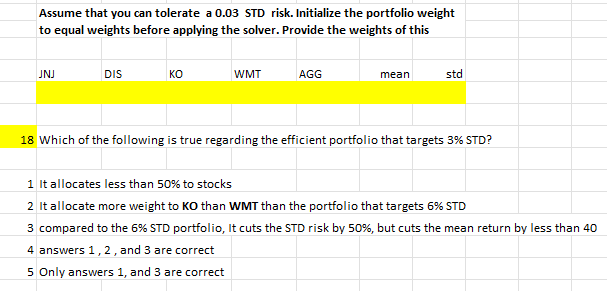

\begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|} \hline L & M & N & & P & & R & S & T & & V & W \\ \hline & JNJ & DIS & KO & WMT & AGG & & & & & & \\ \hline MEAN & 0.0288 & 0.0395 & 0.0236 & 0.0285 & 0.0100 & & & & & & \\ \hline STD & 0.0681 & 0.1202 & 0.0674 & 0.0834 & 0.0166 & & & & & & \\ \hline STD & & \multicolumn{2}{|c|}{ Correlation matrix } & & & & & & & & \\ \hline 0.0681 & 1.0000 & 0.3800 & 0.4252 & 0.4582 & -0.0517 & & & & & & \\ \hline 0.1202 & 0.3800 & 1.0000 & 0.4913 & 0.3869 & -0.4022 & & & & & & \\ \hline 0.0674 & 0.4252 & 0.4913 & 1.0000 & 0.4800 & -0.0484 & & & & & & \\ \hline 0.0834 & 0.4582 & 0.3869 & 0.4800 & 1.0000 & 0.2316 & & & & & & \\ \hline \multirow[t]{2}{*}{0.0166} & -0.0517 & -0.4022 & -0.0484 & 0.2316 & 1.0000 & & & & & & \\ \hline & & \multicolumn{2}{|c|}{ Covariance matrix } & & & sum(whts) & \multicolumn{3}{|c|}{ Weighted Covariance Matrix } & & \\ \hline wghts & 0.2000 & 0.2000 & 0.2000 & 0.2000 & 0.2000 & 1.000000 & & & & & \\ \hline 0.2000 & 0.00464 & 0.003111 & 0.001954 & 0.002603 & 5.9E05 & & 0.000186 & 0.000124 & 7.81E05 & 0.000104 & 2.3E06 \\ \hline 0.2000 & 0.003111 & 0.014442 & 0.003982 & 0.003877 & -0.0008 & & 0.000124 & 0.000578 & 0.000159 & 0.000155 & 3.2E05 \\ \hline 0.2000 & 0.001954 & 0.003982 & 0.004549 & 0.002699 & 5.4E05 & & 7.81E05 & 0.000159 & 0.000182 & 0.000108 & 2.2E06 \\ \hline 0.2000 & 0.002603 & 0.003877 & 0.002699 & 0.006953 & 0.000321 & & 0.000104 & 0.000155 & 0.000108 & 0.000278 & 1.29E05 \\ \hline 0.2000 & 5.9E05 & -0.0008 & 5.4E05 & 0.000321 & 0.000277 & & 2.3E06 & 3.2E05 & 2.2E06 & 1.29E05 & 1.11E05 \\ \hline \end{tabular} Assume that you can tolerate a 0.03 STD risk. Initialize the portfolio weight to equal weights before applying the solver. Provide the weights of this \begin{tabular}{|l|l|l|l|l|} \hline JNJ DIS KO & WMT & \\ \hline \end{tabular} 18 Which of the following is true regarding the efficient portfolio that targets 3% STD? 1 It allocates less than 50% to stocks 2 It allocate more weight to KO than WMT than the portfolio that targets 6\% STD 3 compared to the 6% STD portfolio, It cuts the STD risk by 50%, but cuts the mean return by less than 40 4 answers 1,2 , and 3 are correct 5 Only answers 1 , and 3 are correct

\begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|} \hline L & M & N & & P & & R & S & T & & V & W \\ \hline & JNJ & DIS & KO & WMT & AGG & & & & & & \\ \hline MEAN & 0.0288 & 0.0395 & 0.0236 & 0.0285 & 0.0100 & & & & & & \\ \hline STD & 0.0681 & 0.1202 & 0.0674 & 0.0834 & 0.0166 & & & & & & \\ \hline STD & & \multicolumn{2}{|c|}{ Correlation matrix } & & & & & & & & \\ \hline 0.0681 & 1.0000 & 0.3800 & 0.4252 & 0.4582 & -0.0517 & & & & & & \\ \hline 0.1202 & 0.3800 & 1.0000 & 0.4913 & 0.3869 & -0.4022 & & & & & & \\ \hline 0.0674 & 0.4252 & 0.4913 & 1.0000 & 0.4800 & -0.0484 & & & & & & \\ \hline 0.0834 & 0.4582 & 0.3869 & 0.4800 & 1.0000 & 0.2316 & & & & & & \\ \hline \multirow[t]{2}{*}{0.0166} & -0.0517 & -0.4022 & -0.0484 & 0.2316 & 1.0000 & & & & & & \\ \hline & & \multicolumn{2}{|c|}{ Covariance matrix } & & & sum(whts) & \multicolumn{3}{|c|}{ Weighted Covariance Matrix } & & \\ \hline wghts & 0.2000 & 0.2000 & 0.2000 & 0.2000 & 0.2000 & 1.000000 & & & & & \\ \hline 0.2000 & 0.00464 & 0.003111 & 0.001954 & 0.002603 & 5.9E05 & & 0.000186 & 0.000124 & 7.81E05 & 0.000104 & 2.3E06 \\ \hline 0.2000 & 0.003111 & 0.014442 & 0.003982 & 0.003877 & -0.0008 & & 0.000124 & 0.000578 & 0.000159 & 0.000155 & 3.2E05 \\ \hline 0.2000 & 0.001954 & 0.003982 & 0.004549 & 0.002699 & 5.4E05 & & 7.81E05 & 0.000159 & 0.000182 & 0.000108 & 2.2E06 \\ \hline 0.2000 & 0.002603 & 0.003877 & 0.002699 & 0.006953 & 0.000321 & & 0.000104 & 0.000155 & 0.000108 & 0.000278 & 1.29E05 \\ \hline 0.2000 & 5.9E05 & -0.0008 & 5.4E05 & 0.000321 & 0.000277 & & 2.3E06 & 3.2E05 & 2.2E06 & 1.29E05 & 1.11E05 \\ \hline \end{tabular} Assume that you can tolerate a 0.03 STD risk. Initialize the portfolio weight to equal weights before applying the solver. Provide the weights of this \begin{tabular}{|l|l|l|l|l|} \hline JNJ DIS KO & WMT & \\ \hline \end{tabular} 18 Which of the following is true regarding the efficient portfolio that targets 3% STD? 1 It allocates less than 50% to stocks 2 It allocate more weight to KO than WMT than the portfolio that targets 6\% STD 3 compared to the 6% STD portfolio, It cuts the STD risk by 50%, but cuts the mean return by less than 40 4 answers 1,2 , and 3 are correct 5 Only answers 1 , and 3 are correct Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started