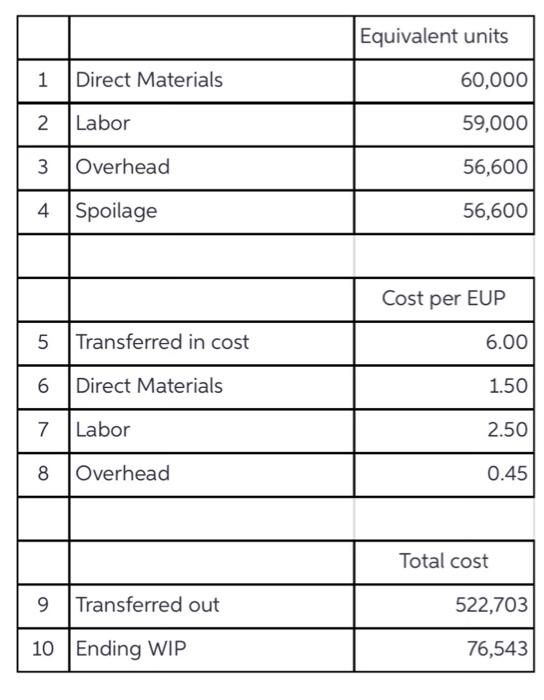

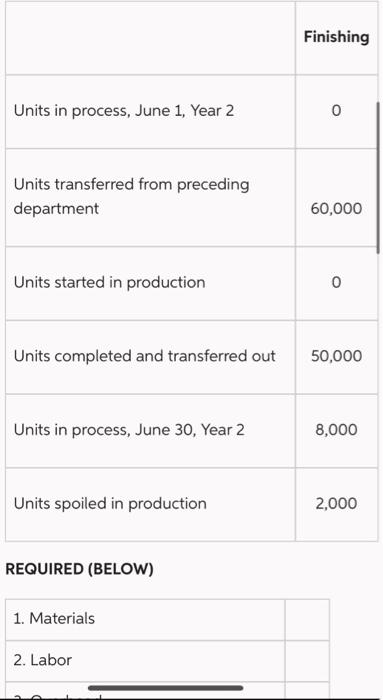

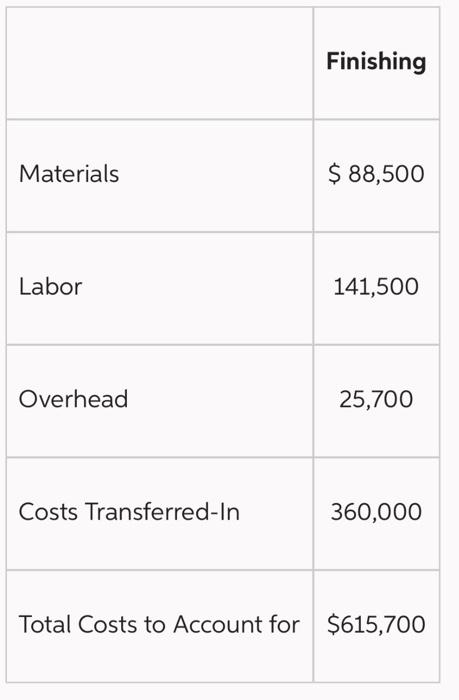

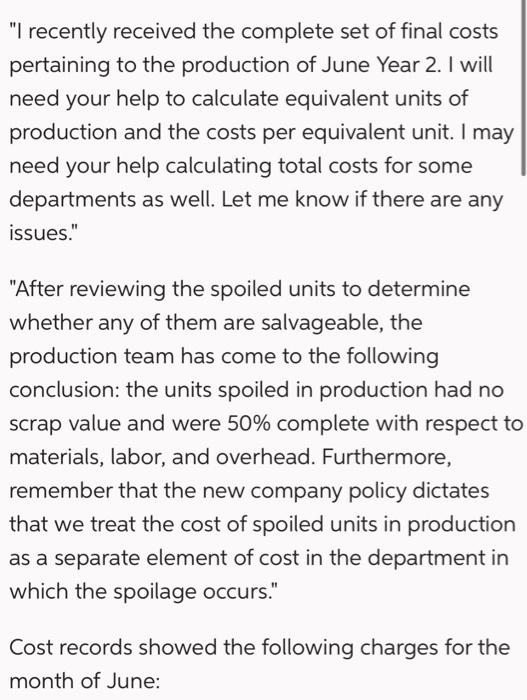

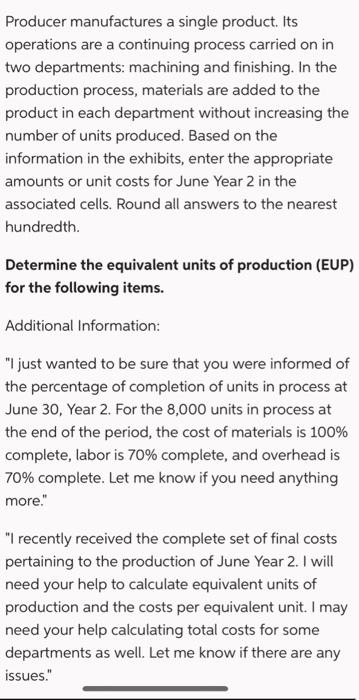

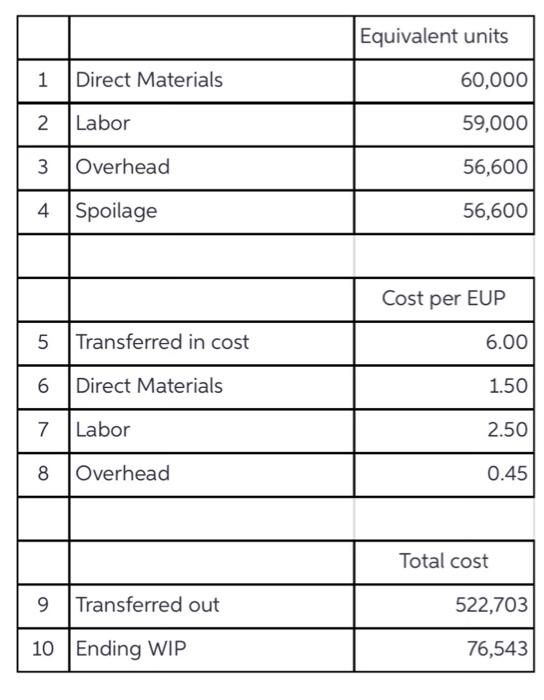

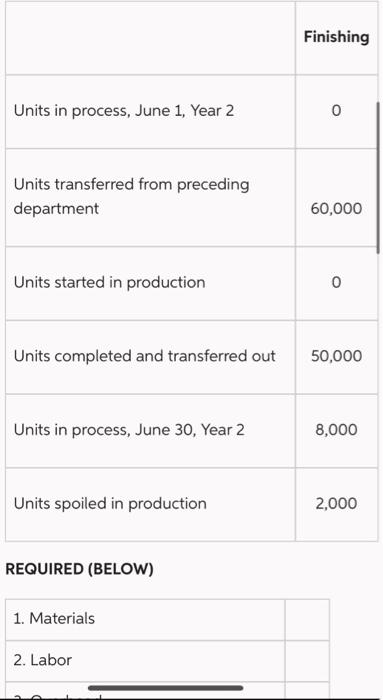

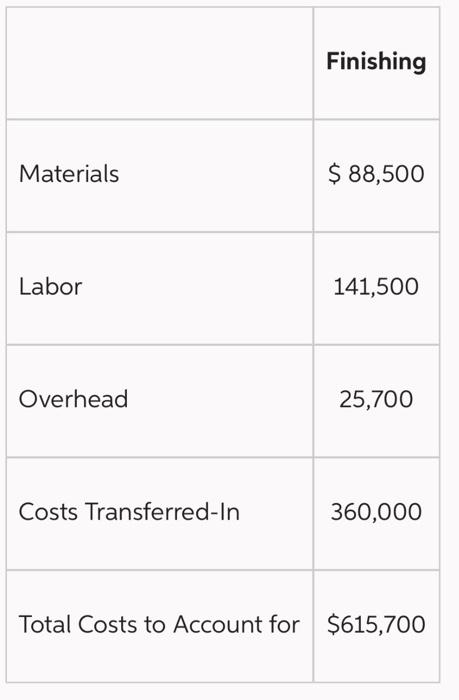

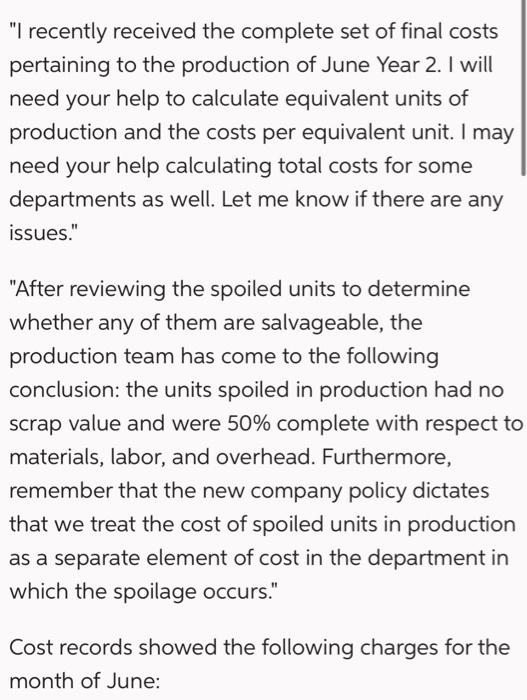

\begin{tabular}{|c|l|r|} \hline & & Equivalent units \\ \hline 1 & Direct Materials & 60,000 \\ \hline 2 & Labor & 59,000 \\ \hline 3 & Overhead & 56,600 \\ \hline 4 & Spoilage & 56,600 \\ \hline & & \\ \hline & & Cost per EUP \\ \hline 5 & Transferred in cost & 6.00 \\ \hline 6 & Direct Materials & 1.50 \\ \hline 7 & Labor & 2.50 \\ \hline 8 & Overhead & 0.45 \\ \hline & & Total cost \\ \hline & & 522,703 \\ \hline 9 & Transferred out & 76,543 \\ \hline 10 & Ending WIP & \\ \hline \end{tabular} \begin{tabular}{|l|c|} \hline & Finishing \\ \hline Units in process, June 1, Year 2 & 0 \\ \hline \begin{tabular}{l} Units transferred from preceding \\ department \end{tabular} & 60,000 \\ \hline Units started in production & 0 \\ \hline Units completed and transferred out & 50,000 \\ \hline Units in process, June 30, Year 2 & 8,000 \\ \hline \end{tabular} REQUIRED (BELOW) 1. Materials 2. Labor \begin{tabular}{|l|l|} \hline & Finishing \\ \hline Materials & $88,500 \\ \hline Labor & 141,500 \\ \hline Overhead & 25,700 \\ \hline Costs Transferred-In & 360,000 \\ \hline Total Costs to Account for & $615,700 \\ \hline \end{tabular} "I recently received the complete set of final costs pertaining to the production of June Year 2. I will need your help to calculate equivalent units of production and the costs per equivalent unit. I may need your help calculating total costs for some departments as well. Let me know if there are any issues." "After reviewing the spoiled units to determine whether any of them are salvageable, the production team has come to the following conclusion: the units spoiled in production had no scrap value and were 50% complete with respect to materials, labor, and overhead. Furthermore, remember that the new company policy dictates that we treat the cost of spoiled units in production as a separate element of cost in the department in which the spoilage occurs." Cost records showed the following charges for the month of June: Producer manufactures a single product. Its operations are a continuing process carried on in two departments: machining and finishing. In the production process, materials are added to the product in each department without increasing the number of units produced. Based on the information in the exhibits, enter the appropriate amounts or unit costs for June Year 2 in the associated cells. Round all answers to the nearest hundredth. Determine the equivalent units of production (EUP) for the following items. Additional Information: "I just wanted to be sure that you were informed of the percentage of completion of units in process at June 30 , Year 2. For the 8,000 units in process at the end of the period, the cost of materials is 100% complete, labor is 70% complete, and overhead is 70% complete. Let me know if you need anything more." "I recently received the complete set of final costs pertaining to the production of June Year 2. I will need your help to calculate equivalent units of production and the costs per equivalent unit. I may need your help calculating total costs for some departments as well. Let me know if there are any issues