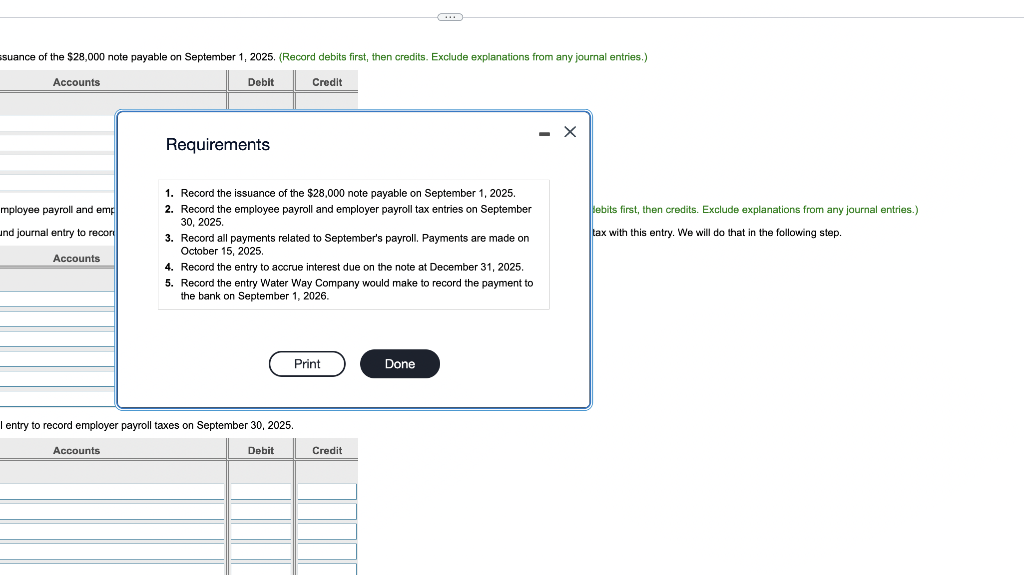

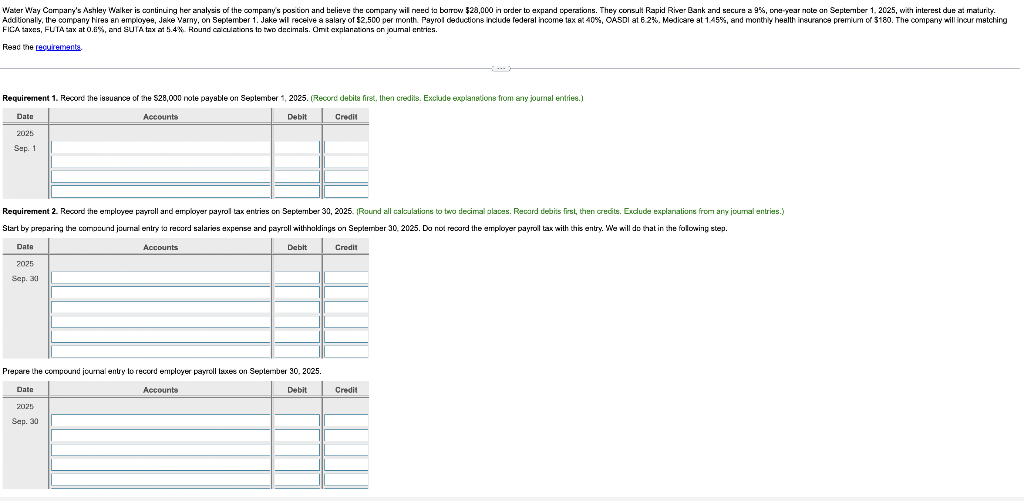

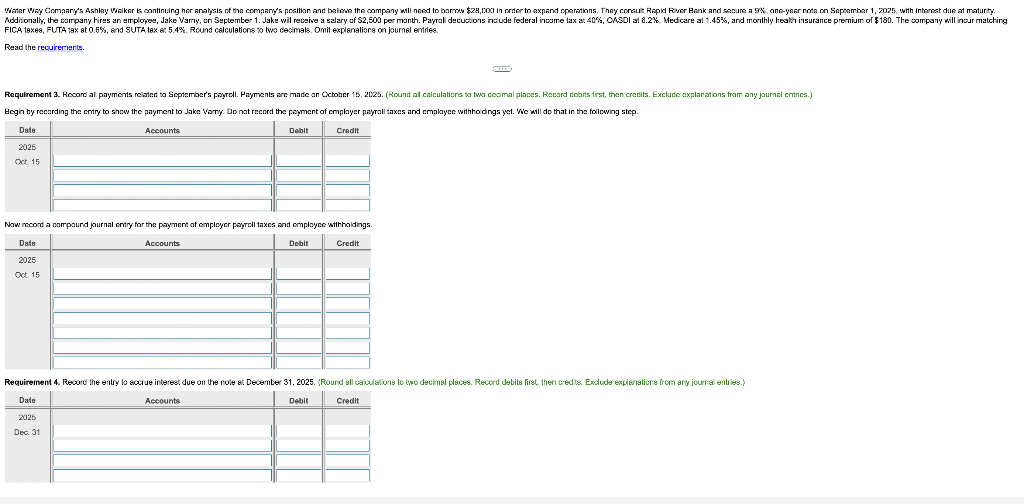

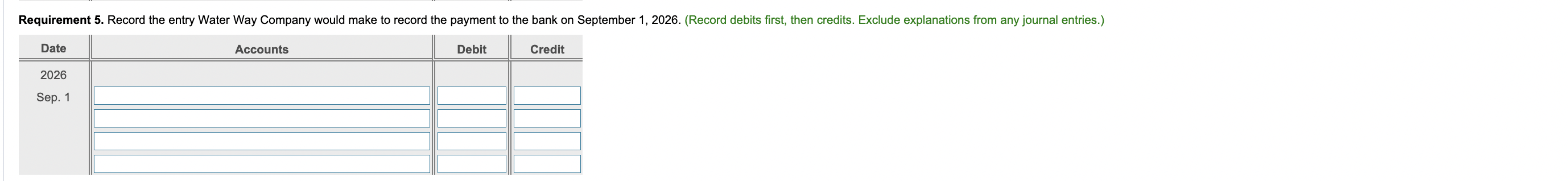

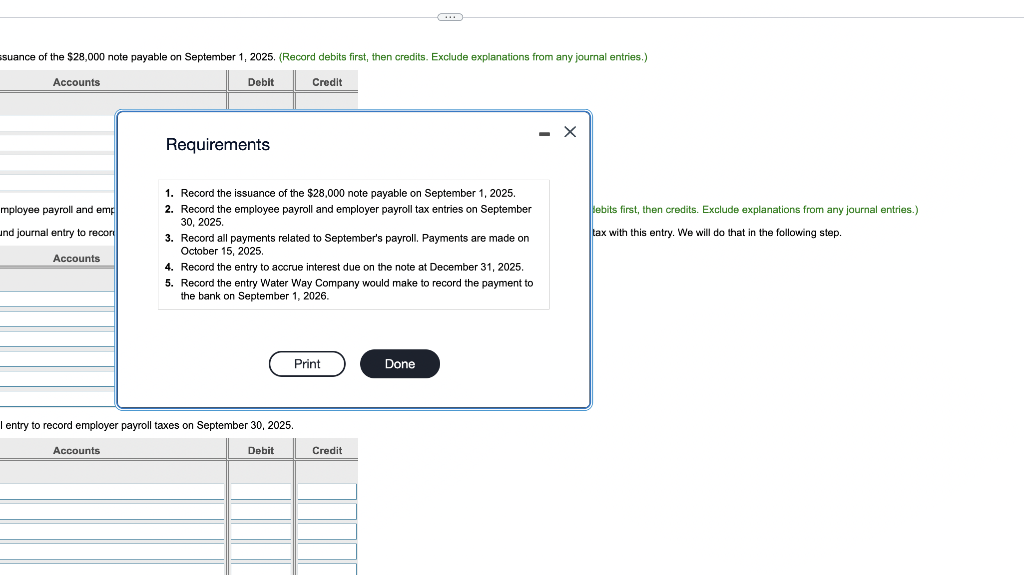

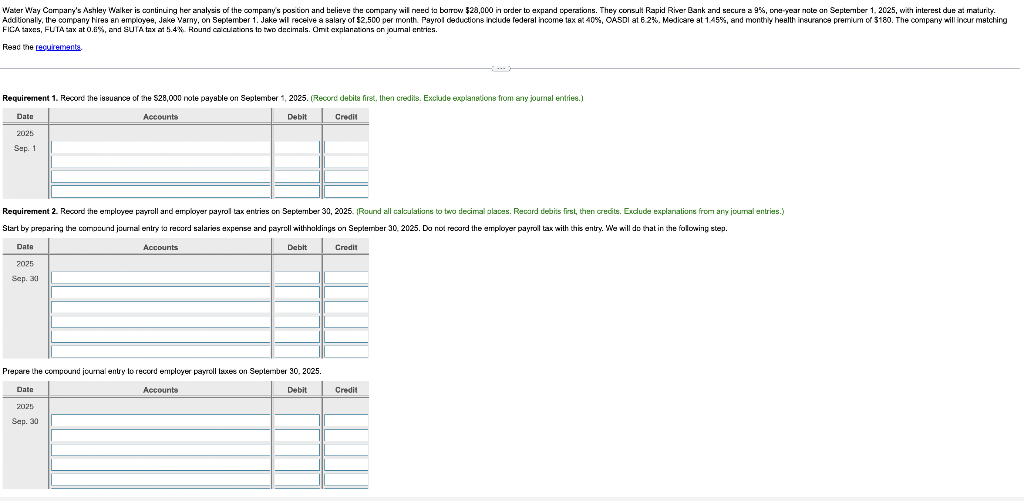

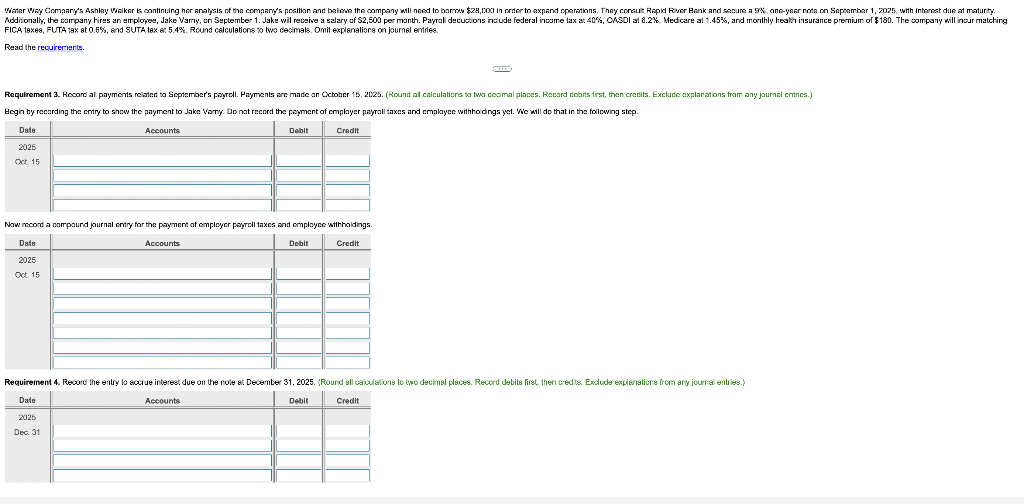

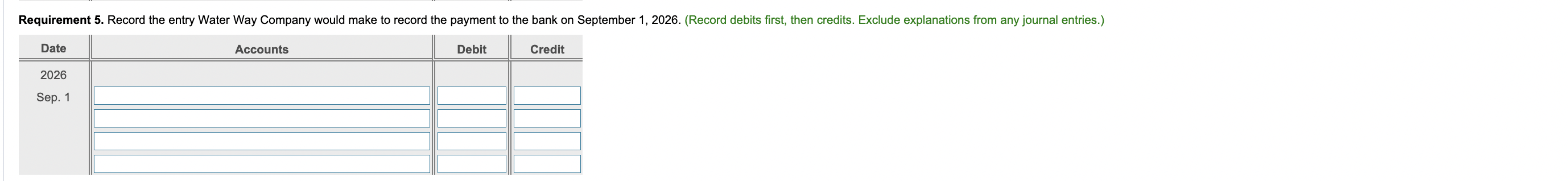

\begin{tabular}{l} mployee payroll and emp \\ und journal entry to recort \\ 1. Record the issuance of the $28,000 note payable on September 1,2025. 2. Record the employee payroll and employer payroll tax entries on September 30,2025 . 3. Record all payments related to September's payroll. Payments are made on October 15,2025 . 4. Record the entry to accrue interest due on the note at December 31,2025. 5. Record the entry Water Way Company would make to record the payment to the bank on September 1,2026 . \\ \hline \end{tabular} I entry to record employer payroll taxes on September 30, 2025. Rese the cecuiremants. \begin{tabular}{c|c|c|c|c} Date & Aecounts & Debit & Credit \\ \hline \hline 2025 & & & & \end{tabular} \begin{tabular}{c|c|c|c|c} Date & Accounts & Deblt & Crodit \\ \hline 2025 & & & & \end{tabular} Prepere the compound jourial entry lo record e'mployer pergroll laxkes on Sepleriber 30, 2025. \begin{tabular}{c|c|c|c|c} Date & Acceunts & Debit & Credit \\ \hline 2025 & & & & \\ \hline Sap. 30 & & & & \end{tabular} Resad the recuiremerts. \begin{tabular}{c||c|c||c|c|} Date & Accounts & Deblt & Credit \\ \hline \hline 2026 & & & & \\ \hline Oct 15 & & & & \\ \hline & & & & \\ \hline \end{tabular} Now moond a campaund journal entry tor the payment of employer payrell taxnss and emplayne with haldings. \begin{tabular}{c||c|c||c|c|} Date & Accounts & Debit & Credit \\ \hline \hline 2026 & & & \\ \hline Dec. 31 & & & \\ \hline \end{tabular} \begin{tabular}{l} mployee payroll and emp \\ und journal entry to recort \\ 1. Record the issuance of the $28,000 note payable on September 1,2025. 2. Record the employee payroll and employer payroll tax entries on September 30,2025 . 3. Record all payments related to September's payroll. Payments are made on October 15,2025 . 4. Record the entry to accrue interest due on the note at December 31,2025. 5. Record the entry Water Way Company would make to record the payment to the bank on September 1,2026 . \\ \hline \end{tabular} I entry to record employer payroll taxes on September 30, 2025. Rese the cecuiremants. \begin{tabular}{c|c|c|c|c} Date & Aecounts & Debit & Credit \\ \hline \hline 2025 & & & & \end{tabular} \begin{tabular}{c|c|c|c|c} Date & Accounts & Deblt & Crodit \\ \hline 2025 & & & & \end{tabular} Prepere the compound jourial entry lo record e'mployer pergroll laxkes on Sepleriber 30, 2025. \begin{tabular}{c|c|c|c|c} Date & Acceunts & Debit & Credit \\ \hline 2025 & & & & \\ \hline Sap. 30 & & & & \end{tabular} Resad the recuiremerts. \begin{tabular}{c||c|c||c|c|} Date & Accounts & Deblt & Credit \\ \hline \hline 2026 & & & & \\ \hline Oct 15 & & & & \\ \hline & & & & \\ \hline \end{tabular} Now moond a campaund journal entry tor the payment of employer payrell taxnss and emplayne with haldings. \begin{tabular}{c||c|c||c|c|} Date & Accounts & Debit & Credit \\ \hline \hline 2026 & & & \\ \hline Dec. 31 & & & \\ \hline \end{tabular}