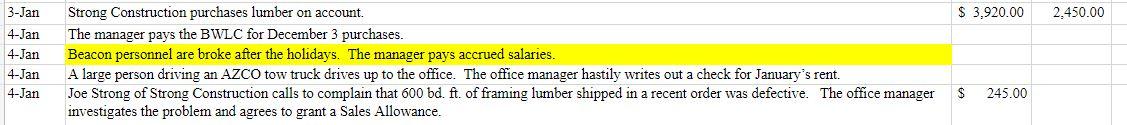

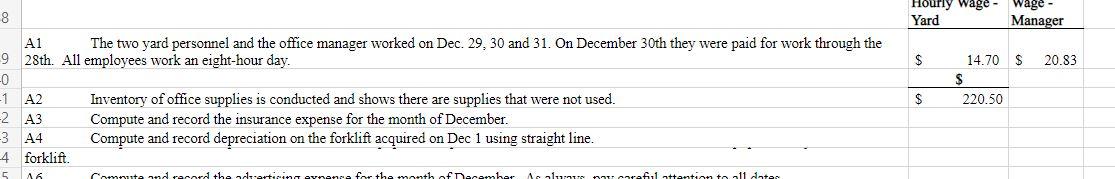

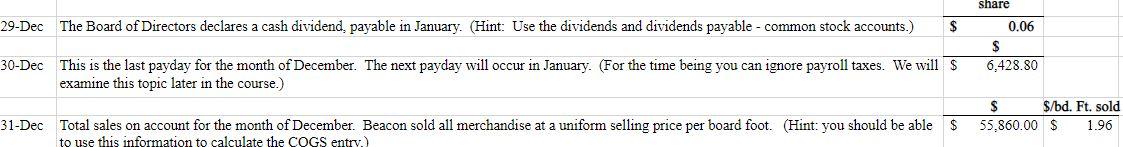

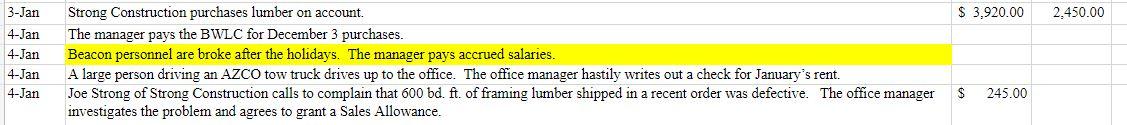

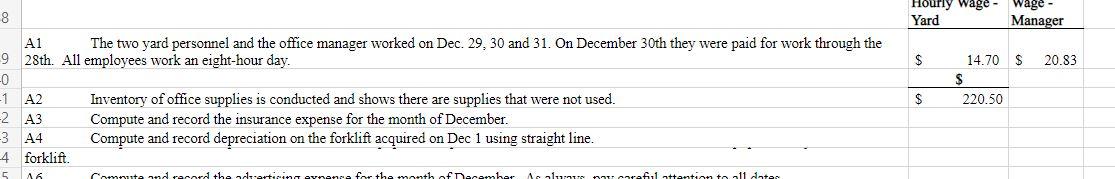

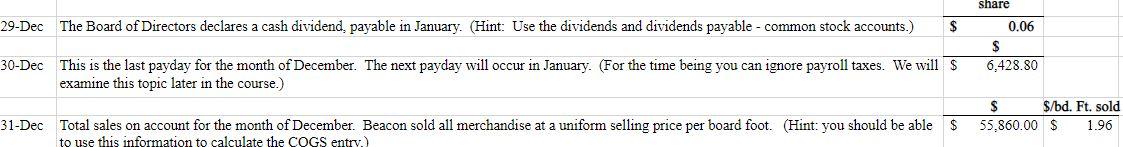

\begin{tabular}{|l|l|} \hline 3-Jan & Strong Construction purchases lumber on account. \\ \hline 4-Jan & The manager pays the BWLC for December 3 purchases. \\ \hline 4-Jan & Beacon personnel are broke after the holidays. The manager pays accrued salaries. \\ \hline 4-Jan & A large person driving an AZCO tow truck drives up to the office. The office manager hastily writes out a check for January's rent. \\ \hline 4-Jan & Joe Strong of Strong Construction calls to complain that 600 bd. ft. of framing lumber shipped in a recent order was defective. The office manager \\ investigates the problem and agrees to grant a Sales Allowance. \end{tabular} A1 The two yard personnel and the office manager worked on Dec. 29,30 and 31 . On December 30 th they were paid for work through the 28th. All employees work an eight-hour day. Inventory of office supplies is conducted and shows there are supplies that were not used. \begin{tabular}{l|l|l} \hline Yard & Manager \\ \hline$ & 14.70 & $20.83 \\ \hline \multicolumn{2}{|c|}{$} & \\ \hline$ & 220.50 & \end{tabular} Compute and record the insurance expense for the month of December. Compute and record depreciation on the forklift acquired on Dec 1 using straight line. forklift. 29-Dec The Board of Directors declares a cash dividend, payable in January. (Hint: Use the dividends and dividends payable - common stock accounts.) \begin{tabular}{lr} \multicolumn{2}{c}{ share } \\ \hline$ & 0.06 \end{tabular} 30-Dec This is the last payday for the month of December. The next payday will occur in January. (For the time being you can ignore payroll taxes. We will $6,428.80$ examine this topic later in the course.) 31-Dec Total sales on account for the month of December. Beacon sold all merchandise at a uniform selling price per board foot. (Hint: you should be able \begin{tabular}{l|ll} & $ & $/bd. Ft. sold \\ \hline$55,860.00 & $ & 1.96 \end{tabular} \begin{tabular}{|l|l|} \hline 3-Jan & Strong Construction purchases lumber on account. \\ \hline 4-Jan & The manager pays the BWLC for December 3 purchases. \\ \hline 4-Jan & Beacon personnel are broke after the holidays. The manager pays accrued salaries. \\ \hline 4-Jan & A large person driving an AZCO tow truck drives up to the office. The office manager hastily writes out a check for January's rent. \\ \hline 4-Jan & Joe Strong of Strong Construction calls to complain that 600 bd. ft. of framing lumber shipped in a recent order was defective. The office manager \\ investigates the problem and agrees to grant a Sales Allowance. \end{tabular} A1 The two yard personnel and the office manager worked on Dec. 29,30 and 31 . On December 30 th they were paid for work through the 28th. All employees work an eight-hour day. Inventory of office supplies is conducted and shows there are supplies that were not used. \begin{tabular}{l|l|l} \hline Yard & Manager \\ \hline$ & 14.70 & $20.83 \\ \hline \multicolumn{2}{|c|}{$} & \\ \hline$ & 220.50 & \end{tabular} Compute and record the insurance expense for the month of December. Compute and record depreciation on the forklift acquired on Dec 1 using straight line. forklift. 29-Dec The Board of Directors declares a cash dividend, payable in January. (Hint: Use the dividends and dividends payable - common stock accounts.) \begin{tabular}{lr} \multicolumn{2}{c}{ share } \\ \hline$ & 0.06 \end{tabular} 30-Dec This is the last payday for the month of December. The next payday will occur in January. (For the time being you can ignore payroll taxes. We will $6,428.80$ examine this topic later in the course.) 31-Dec Total sales on account for the month of December. Beacon sold all merchandise at a uniform selling price per board foot. (Hint: you should be able \begin{tabular}{l|ll} & $ & $/bd. Ft. sold \\ \hline$55,860.00 & $ & 1.96 \end{tabular}