Answered step by step

Verified Expert Solution

Question

1 Approved Answer

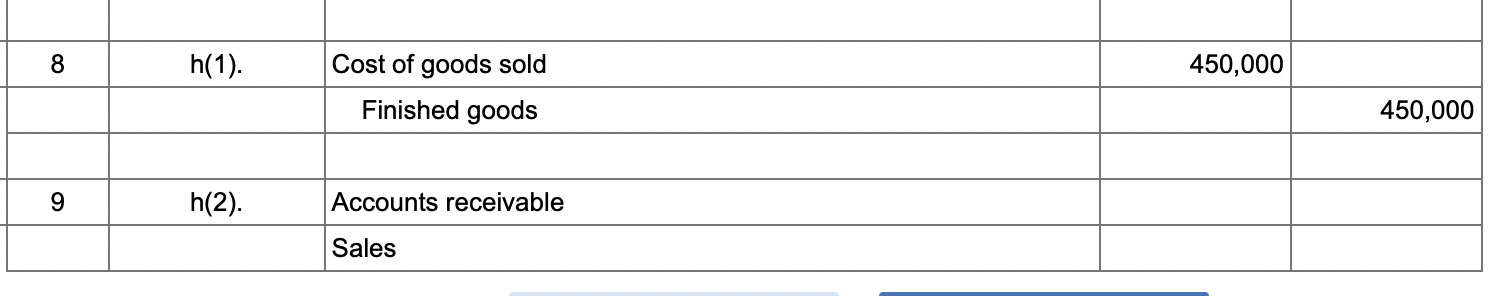

begin{tabular}{|l|l|l|l|l|} hline 8 & h(1). & Cost of goods sold & 450,000 & hline & & Finished goods & & 450,000 hline &

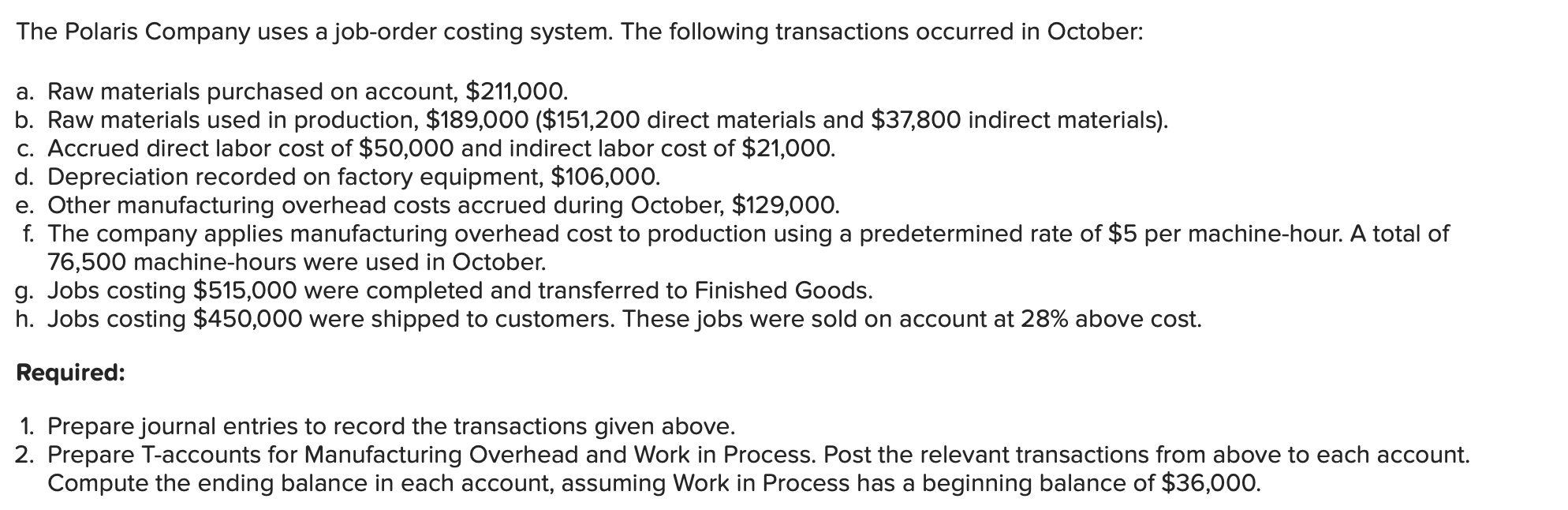

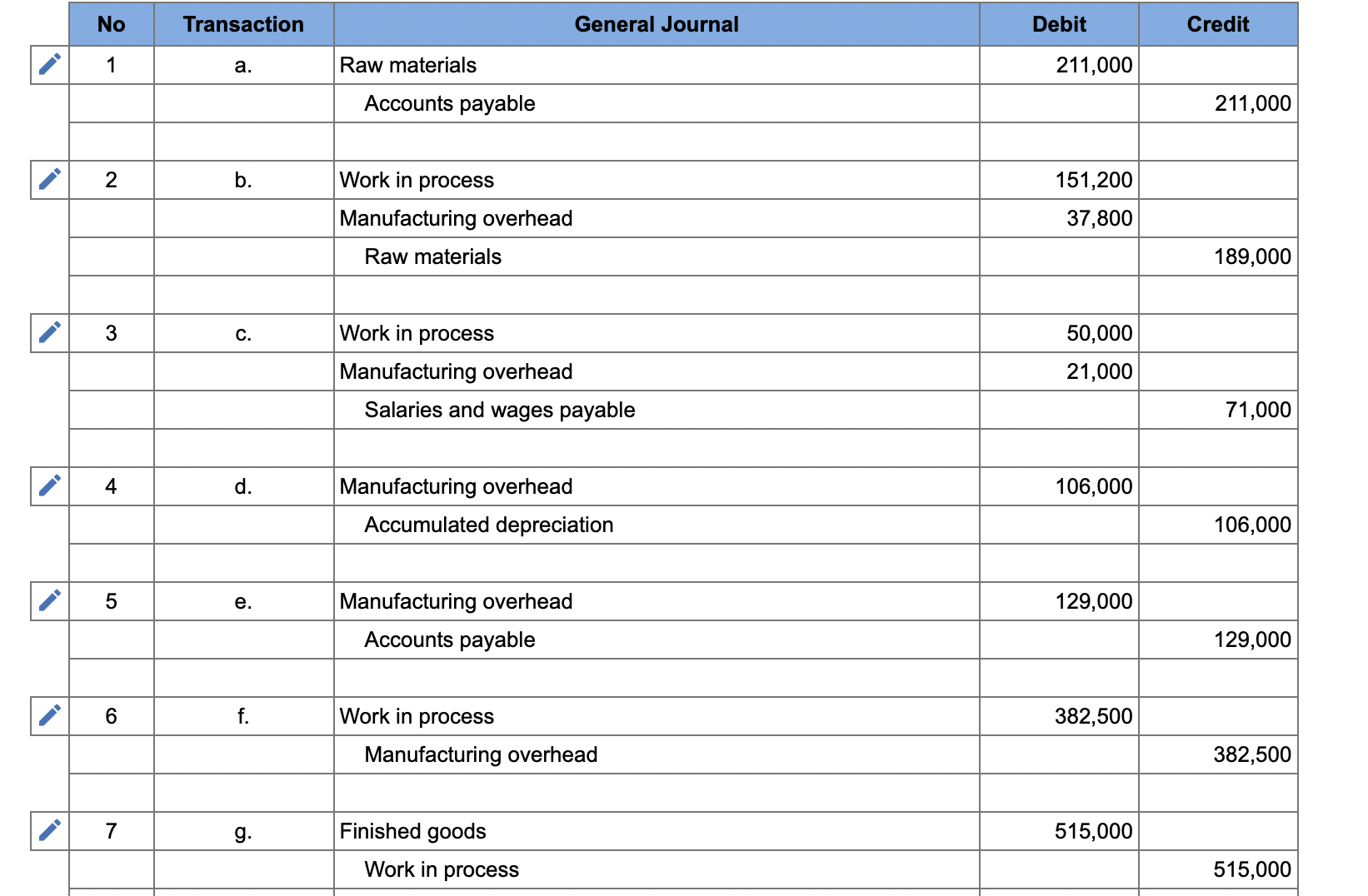

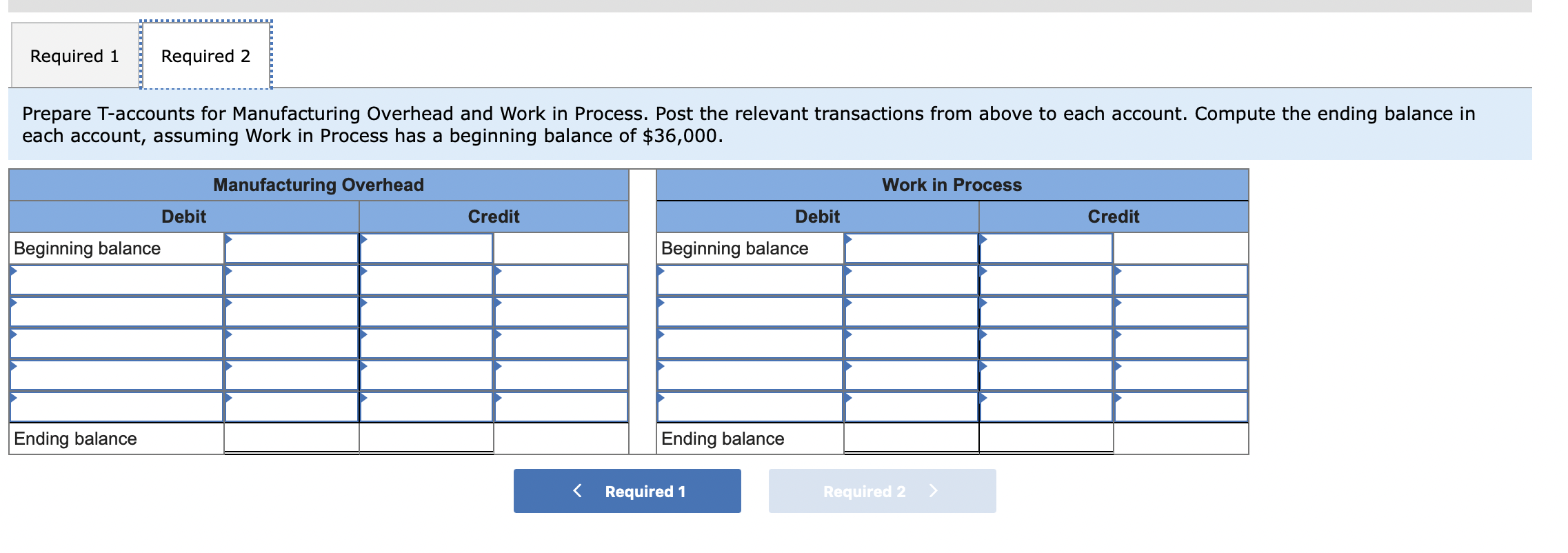

\begin{tabular}{|l|l|l|l|l|} \hline 8 & h(1). & Cost of goods sold & 450,000 & \\ \hline & & Finished goods & & 450,000 \\ \hline & & & & \\ \hline 9 & h(2). & Accounts receivable & & \\ \hline & & Sales & & \\ \hline \end{tabular} Prepare T-accounts for Manufacturing Overhead and Work in Process. Post the relevant transactions from above to each account. Compute the ending balance in each account, assuming Work in Process has a beginning balance of $36,000. The Polaris Company uses a job-order costing system. The following transactions occurred in October: a. Raw materials purchased on account, $211,000. b. Raw materials used in production, $189,000 ( $151,200 direct materials and $37,800 indirect materials). c. Accrued direct labor cost of $50,000 and indirect labor cost of $21,000. d. Depreciation recorded on factory equipment, $106,000. e. Other manufacturing overhead costs accrued during October, $129,000. f. The company applies manufacturing overhead cost to production using a predetermined rate of $5 per machine-hour. A total of 76,500 machine-hours were used in October. g. Jobs costing $515,000 were completed and transferred to Finished Goods. h. Jobs costing $450,000 were shipped to customers. These jobs were sold on account at 28% above cost. Required: 1. Prepare journal entries to record the transactions given above. 2. Prepare T-accounts for Manufacturing Overhead and Work in Process. Post the relevant transactions from above to each account. Compute the ending balance in each account, assuming Work in Process has a beginning balance of $36,000

\begin{tabular}{|l|l|l|l|l|} \hline 8 & h(1). & Cost of goods sold & 450,000 & \\ \hline & & Finished goods & & 450,000 \\ \hline & & & & \\ \hline 9 & h(2). & Accounts receivable & & \\ \hline & & Sales & & \\ \hline \end{tabular} Prepare T-accounts for Manufacturing Overhead and Work in Process. Post the relevant transactions from above to each account. Compute the ending balance in each account, assuming Work in Process has a beginning balance of $36,000. The Polaris Company uses a job-order costing system. The following transactions occurred in October: a. Raw materials purchased on account, $211,000. b. Raw materials used in production, $189,000 ( $151,200 direct materials and $37,800 indirect materials). c. Accrued direct labor cost of $50,000 and indirect labor cost of $21,000. d. Depreciation recorded on factory equipment, $106,000. e. Other manufacturing overhead costs accrued during October, $129,000. f. The company applies manufacturing overhead cost to production using a predetermined rate of $5 per machine-hour. A total of 76,500 machine-hours were used in October. g. Jobs costing $515,000 were completed and transferred to Finished Goods. h. Jobs costing $450,000 were shipped to customers. These jobs were sold on account at 28% above cost. Required: 1. Prepare journal entries to record the transactions given above. 2. Prepare T-accounts for Manufacturing Overhead and Work in Process. Post the relevant transactions from above to each account. Compute the ending balance in each account, assuming Work in Process has a beginning balance of $36,000 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started