Answered step by step

Verified Expert Solution

Question

1 Approved Answer

begin{tabular}{lr} Equipment & 6,000 Delivery expense & 25,300 Insurance expense & 650 Interest expense & 1,450 Interest revenue & 2,020

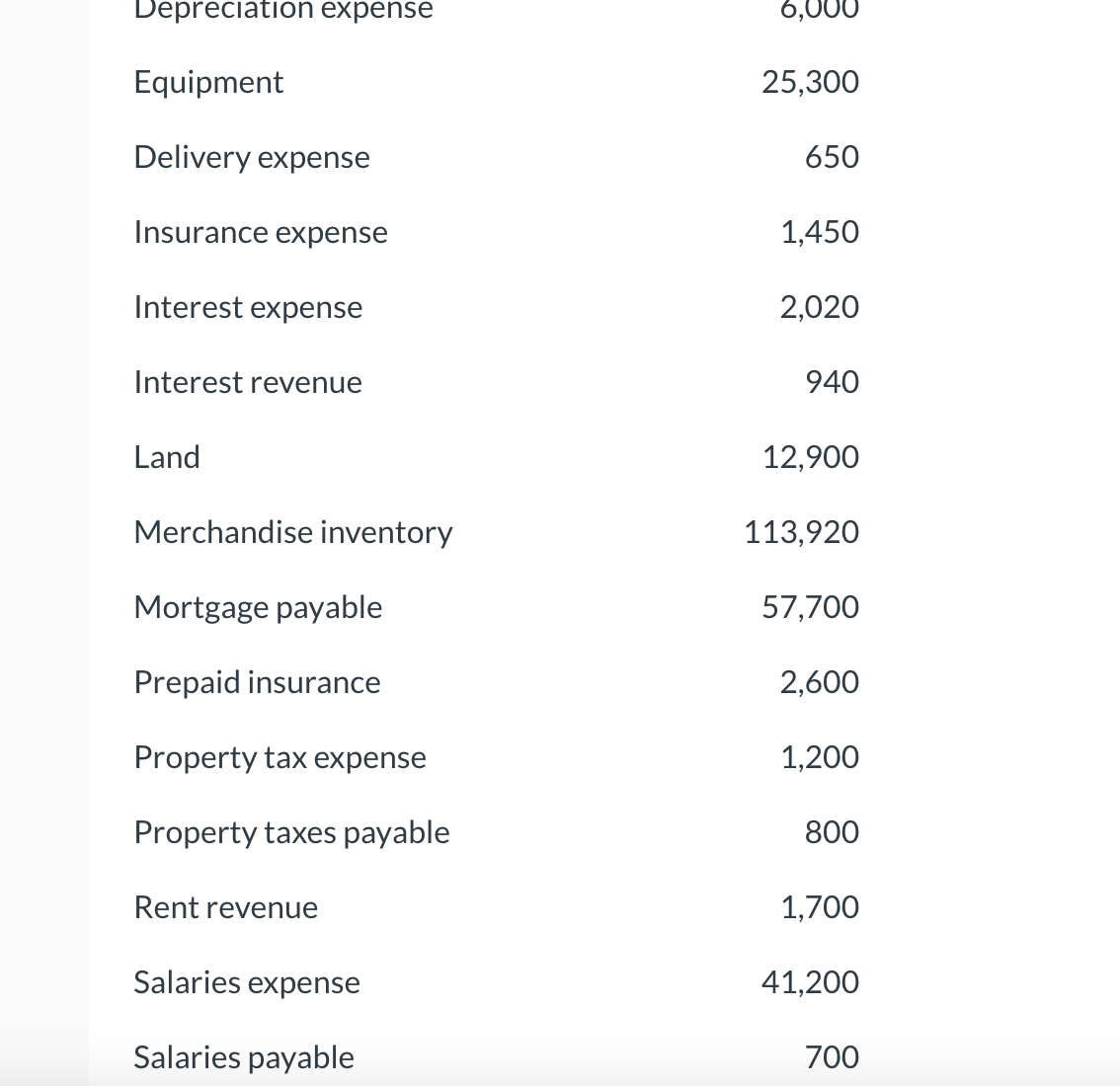

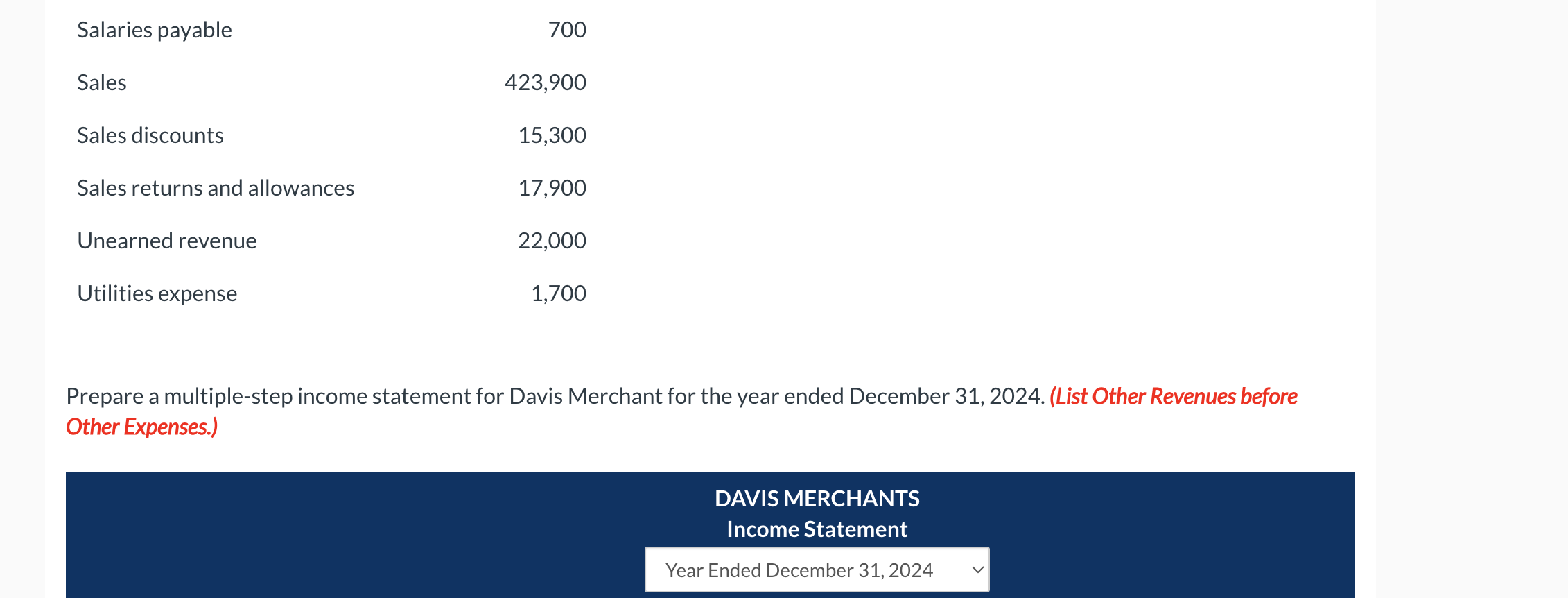

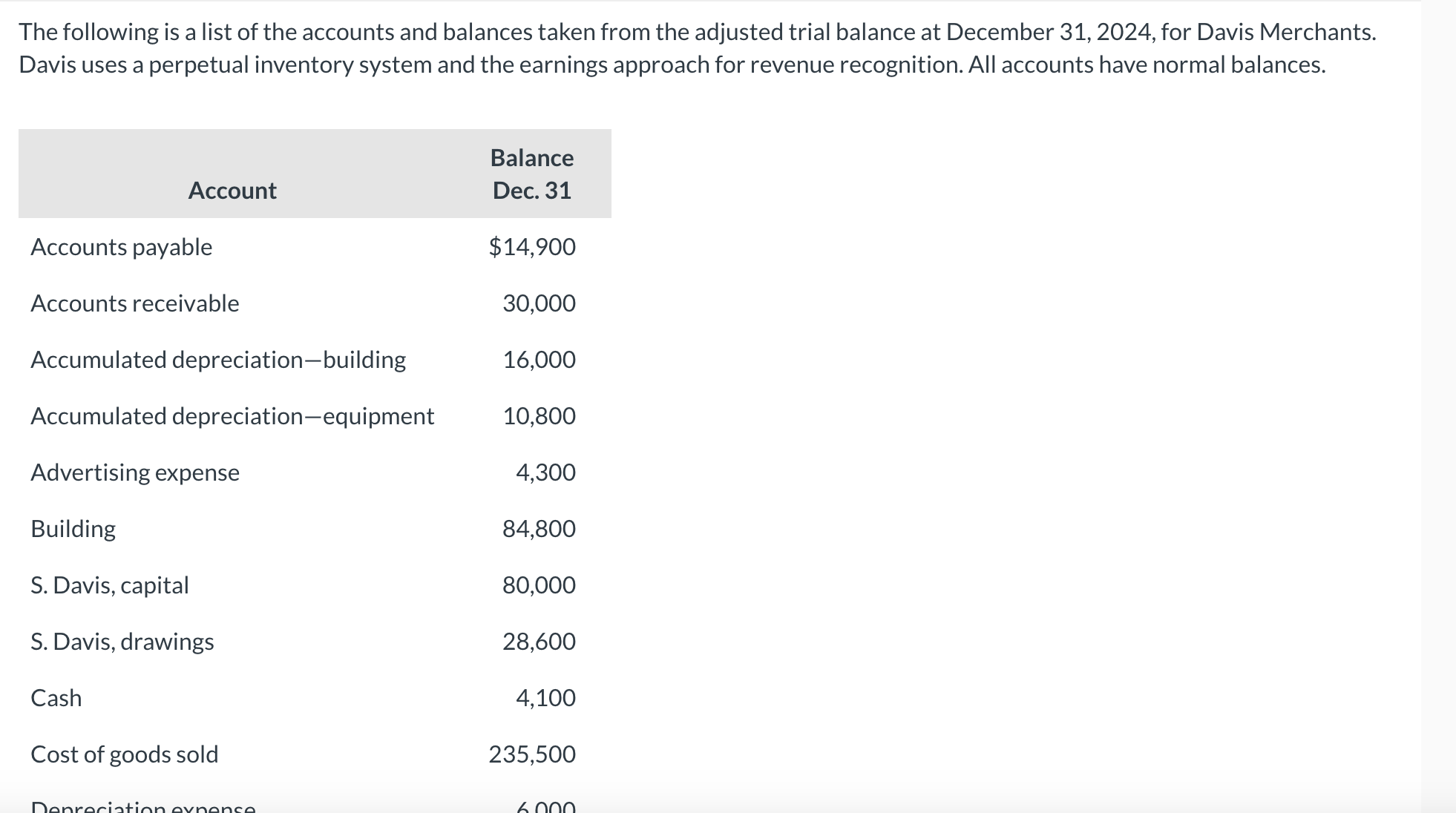

\begin{tabular}{lr} Equipment & 6,000 \\ Delivery expense & 25,300 \\ Insurance expense & 650 \\ Interest expense & 1,450 \\ Interest revenue & 2,020 \\ Land & 940 \\ Merchandise inventory & 12,900 \\ Mortgage payable & 113,920 \\ Prepaid insurance & 57,700 \\ Property tax expense & 2,600 \\ Property taxes payable & 1,200 \\ Rent revenue & 800 \\ Salaries expense & 1,700 \\ Salaries payable & 41,200 \\ \hline 700 \end{tabular} Prepare a multiple-step income statement for Davis Merchant for the year ended December 31, 2024. (List Other Revenues before Other Expenses.) The following is a list of the accounts and balances taken from the adjusted trial balance at December 31,2024 , for Davis Merchants. Davis uses a perpetual inventory system and the earnings approach for revenue recognition. All accounts have normal balances

\begin{tabular}{lr} Equipment & 6,000 \\ Delivery expense & 25,300 \\ Insurance expense & 650 \\ Interest expense & 1,450 \\ Interest revenue & 2,020 \\ Land & 940 \\ Merchandise inventory & 12,900 \\ Mortgage payable & 113,920 \\ Prepaid insurance & 57,700 \\ Property tax expense & 2,600 \\ Property taxes payable & 1,200 \\ Rent revenue & 800 \\ Salaries expense & 1,700 \\ Salaries payable & 41,200 \\ \hline 700 \end{tabular} Prepare a multiple-step income statement for Davis Merchant for the year ended December 31, 2024. (List Other Revenues before Other Expenses.) The following is a list of the accounts and balances taken from the adjusted trial balance at December 31,2024 , for Davis Merchants. Davis uses a perpetual inventory system and the earnings approach for revenue recognition. All accounts have normal balances Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started