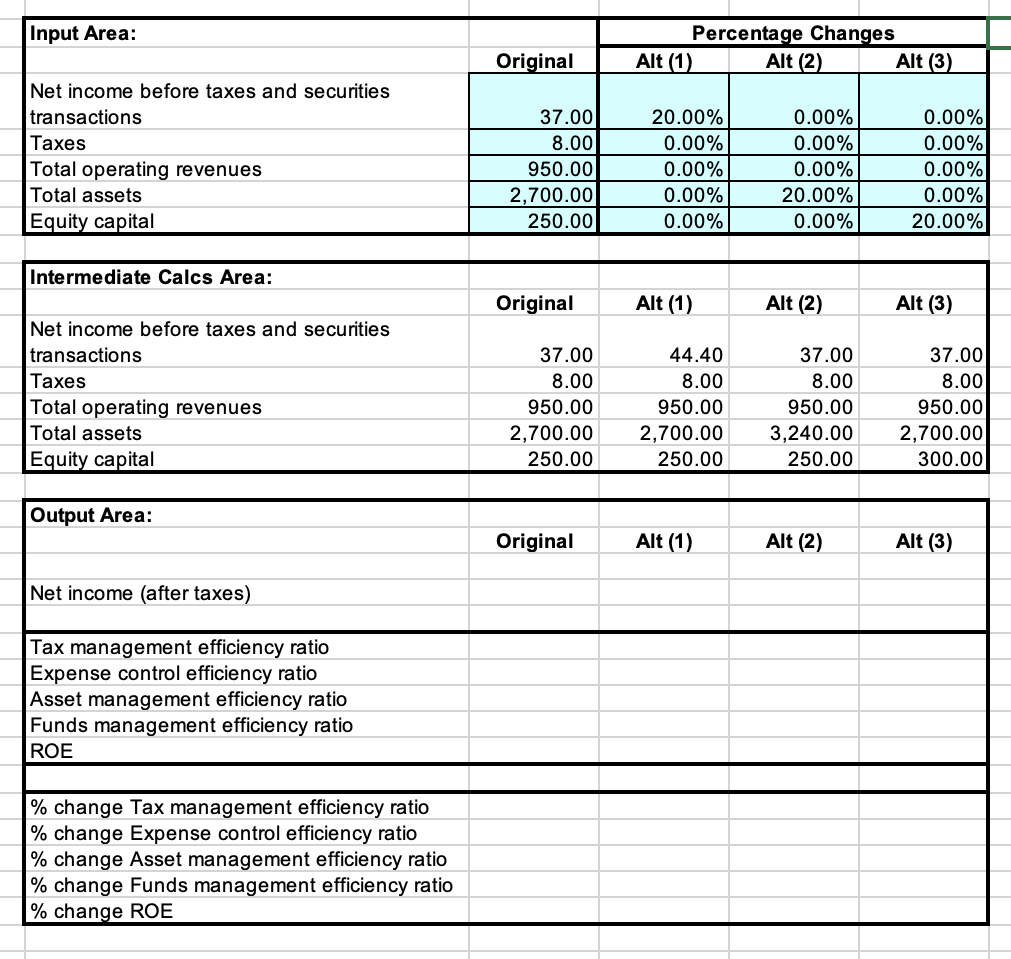

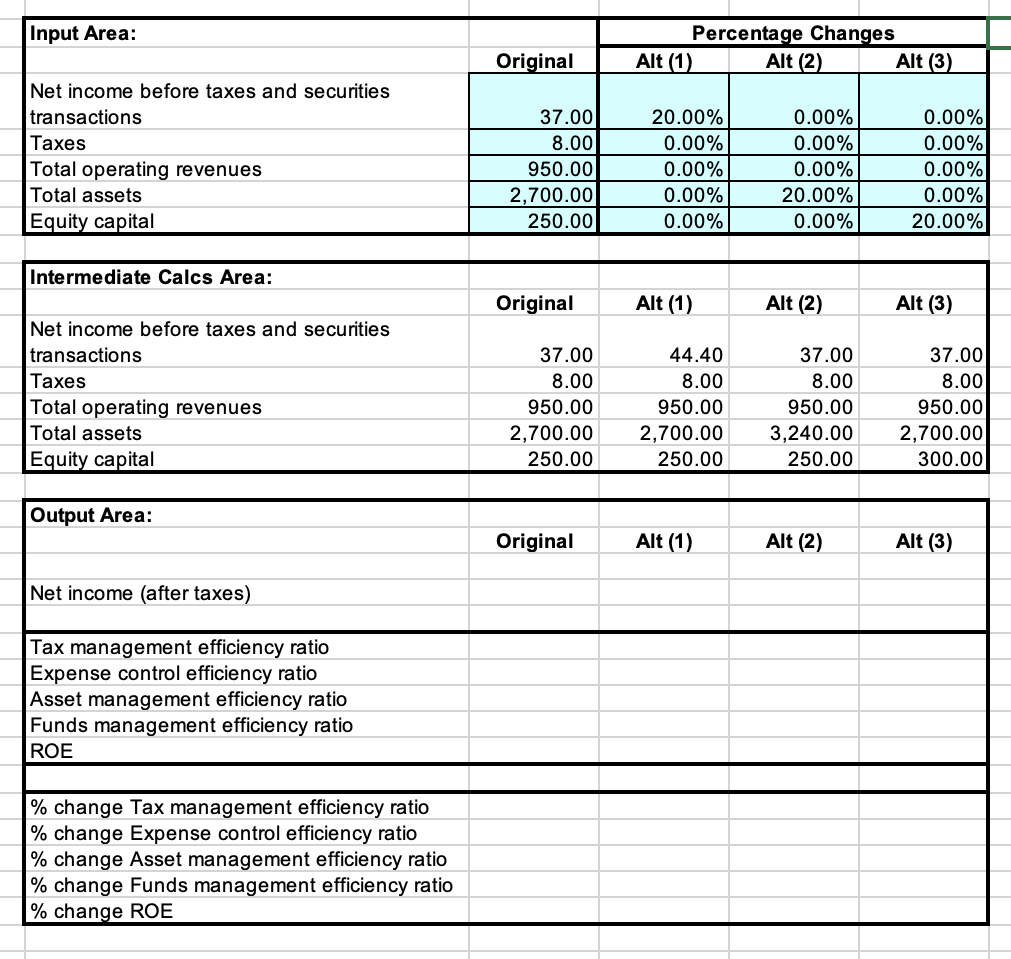

\begin{tabular}{|l|r|r|r|r|} \hline Input Area: & & \multicolumn{3}{|c|}{ Percentage Changes } \\ \cline { 2 - 5 } & \multicolumn{1}{|c|}{ Original } & \multicolumn{1}{|c|}{ Alt (1) } & \multicolumn{1}{|c|}{ Alt (2) } \\ \cline { 2 - 5 } & & & & \\ Net income before taxes and securities & 37.00 & 20.00% & 0.00% & 0.00% \\ \hline transactions & 8.00 & 0.00% & 0.00% & 0.00% \\ \hline Taxes & 950.00 & 0.00% & 0.00% & 0.00% \\ \hline Total operating revenues & 2,700.00 & 0.00% & 20.00% & 0.00% \\ \hline Total assets & 250.00 & 0.00% & 0.00% & 20.00% \\ \hline Equity capital & & & & \end{tabular} \begin{tabular}{|l|r|r|r|r|} \hline Intermediate Calcs Area: & & & & \\ \hline & Original & Alt (1) & Alt (2) & Alt (3) \\ \hline Net income before taxes and securities & & & & \\ transactions & 37.00 & 44.40 & 37.00 & 37.00 \\ \hline Taxes & 8.00 & 8.00 & 8.00 & 8.00 \\ Total operating revenues & 950.00 & 950.00 & 950.00 & 950.00 \\ \hline Total assets & 2,700.00 & 2,700.00 & 3,240.00 & 2,700.00 \\ \hline Equity capital & 250.00 & 250.00 & 250.00 & 300.00 \\ \hline \end{tabular} Output Area: OriginalAlt(1)Alt(2)Alt(3) Net income (after taxes) Tax management efficiency ratio Expense control efficiency ratio Asset management efficiency ratio Funds management efficiency ratio ROE % change Tax management efficiency ratio % change Expense control efficiency ratio % change Asset management efficiency ratio % change Funds management efficiency ratio % change ROE \begin{tabular}{|l|r|r|r|r|} \hline Input Area: & & \multicolumn{3}{|c|}{ Percentage Changes } \\ \cline { 2 - 5 } & \multicolumn{1}{|c|}{ Original } & \multicolumn{1}{|c|}{ Alt (1) } & \multicolumn{1}{|c|}{ Alt (2) } \\ \cline { 2 - 5 } & & & & \\ Net income before taxes and securities & 37.00 & 20.00% & 0.00% & 0.00% \\ \hline transactions & 8.00 & 0.00% & 0.00% & 0.00% \\ \hline Taxes & 950.00 & 0.00% & 0.00% & 0.00% \\ \hline Total operating revenues & 2,700.00 & 0.00% & 20.00% & 0.00% \\ \hline Total assets & 250.00 & 0.00% & 0.00% & 20.00% \\ \hline Equity capital & & & & \end{tabular} \begin{tabular}{|l|r|r|r|r|} \hline Intermediate Calcs Area: & & & & \\ \hline & Original & Alt (1) & Alt (2) & Alt (3) \\ \hline Net income before taxes and securities & & & & \\ transactions & 37.00 & 44.40 & 37.00 & 37.00 \\ \hline Taxes & 8.00 & 8.00 & 8.00 & 8.00 \\ Total operating revenues & 950.00 & 950.00 & 950.00 & 950.00 \\ \hline Total assets & 2,700.00 & 2,700.00 & 3,240.00 & 2,700.00 \\ \hline Equity capital & 250.00 & 250.00 & 250.00 & 300.00 \\ \hline \end{tabular} Output Area: OriginalAlt(1)Alt(2)Alt(3) Net income (after taxes) Tax management efficiency ratio Expense control efficiency ratio Asset management efficiency ratio Funds management efficiency ratio ROE % change Tax management efficiency ratio % change Expense control efficiency ratio % change Asset management efficiency ratio % change Funds management efficiency ratio % change ROE