Answered step by step

Verified Expert Solution

Question

1 Approved Answer

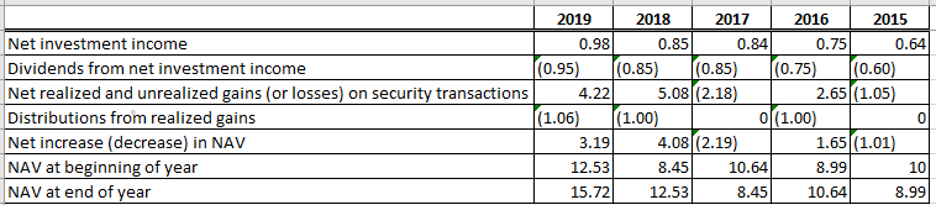

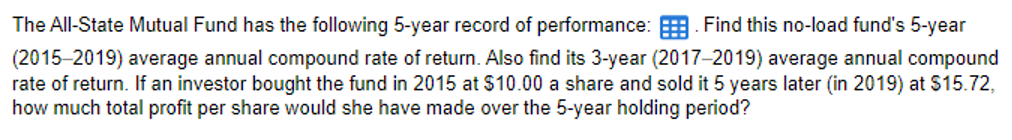

begin{tabular}{|l|r|r|r|r|r|r|} hline & multicolumn{1}{|c|}{2019} & multicolumn{1}{c|}{2018} & multicolumn{1}{c|}{2017} & multicolumn{1}{c|}{2016} & multicolumn{2}{c|}{2015} hline hline Net investment income & 0.98 & 0.85 & 0.84 &

\begin{tabular}{|l|r|r|r|r|r|r|} \hline & \multicolumn{1}{|c|}{2019} & \multicolumn{1}{c|}{2018} & \multicolumn{1}{c|}{2017} & \multicolumn{1}{c|}{2016} & \multicolumn{2}{c|}{2015} \\ \hline \hline Net investment income & 0.98 & 0.85 & 0.84 & 0.75 & \multicolumn{2}{|c|}{0.64} \\ \hline Dividends from net investment income & (0.95) & (0.85) & (0.85) & (0.75) & (0.60) \\ \hline Net realized and unrealized gains (or losses) on security transactions & 4.22 & 5.08 & (2.18) & 2.65 & (1.05) \\ \hline Distributions from realized gains & (1.06) & (1.00) & 0 & (1.00) & 0 \\ \hline Net increase (decrease) in NAV & 3.19 & 4.08 & (2.19) & 1.65 & (1.01) \\ \hline NAV at beginning of year & 12.53 & 8.45 & 10.64 & 8.99 & 10 \\ \hline NAV at end of year & 15.72 & 12.53 & 8.45 & 10.64 & 8.99 \\ \hline \end{tabular} The All-State Mutual Fund has the following 5-year record of performance: Find this no-load fund's 5-year (2015-2019) average annual compound rate of return. Also find its 3-year (2017-2019) average annual compound rate of return. If an investor bought the fund in 2015 at $10.00 a share and sold it 5 years later (in 2019) at $15.72, how much total profit per share would she have made over the 5-year holding period

\begin{tabular}{|l|r|r|r|r|r|r|} \hline & \multicolumn{1}{|c|}{2019} & \multicolumn{1}{c|}{2018} & \multicolumn{1}{c|}{2017} & \multicolumn{1}{c|}{2016} & \multicolumn{2}{c|}{2015} \\ \hline \hline Net investment income & 0.98 & 0.85 & 0.84 & 0.75 & \multicolumn{2}{|c|}{0.64} \\ \hline Dividends from net investment income & (0.95) & (0.85) & (0.85) & (0.75) & (0.60) \\ \hline Net realized and unrealized gains (or losses) on security transactions & 4.22 & 5.08 & (2.18) & 2.65 & (1.05) \\ \hline Distributions from realized gains & (1.06) & (1.00) & 0 & (1.00) & 0 \\ \hline Net increase (decrease) in NAV & 3.19 & 4.08 & (2.19) & 1.65 & (1.01) \\ \hline NAV at beginning of year & 12.53 & 8.45 & 10.64 & 8.99 & 10 \\ \hline NAV at end of year & 15.72 & 12.53 & 8.45 & 10.64 & 8.99 \\ \hline \end{tabular} The All-State Mutual Fund has the following 5-year record of performance: Find this no-load fund's 5-year (2015-2019) average annual compound rate of return. Also find its 3-year (2017-2019) average annual compound rate of return. If an investor bought the fund in 2015 at $10.00 a share and sold it 5 years later (in 2019) at $15.72, how much total profit per share would she have made over the 5-year holding period Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started