Answered step by step

Verified Expert Solution

Question

1 Approved Answer

BeGone manufactures spray cans of insect repellent. On August 1, the company had 11,760 units in the beginning WIP Inventory that were 100 percent

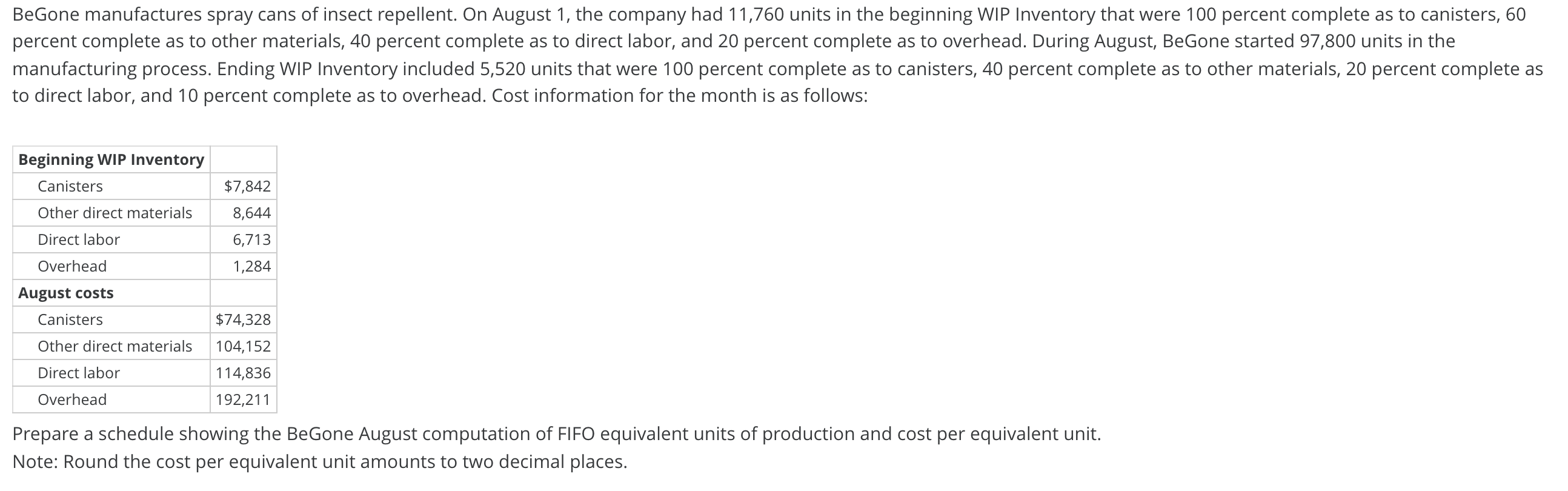

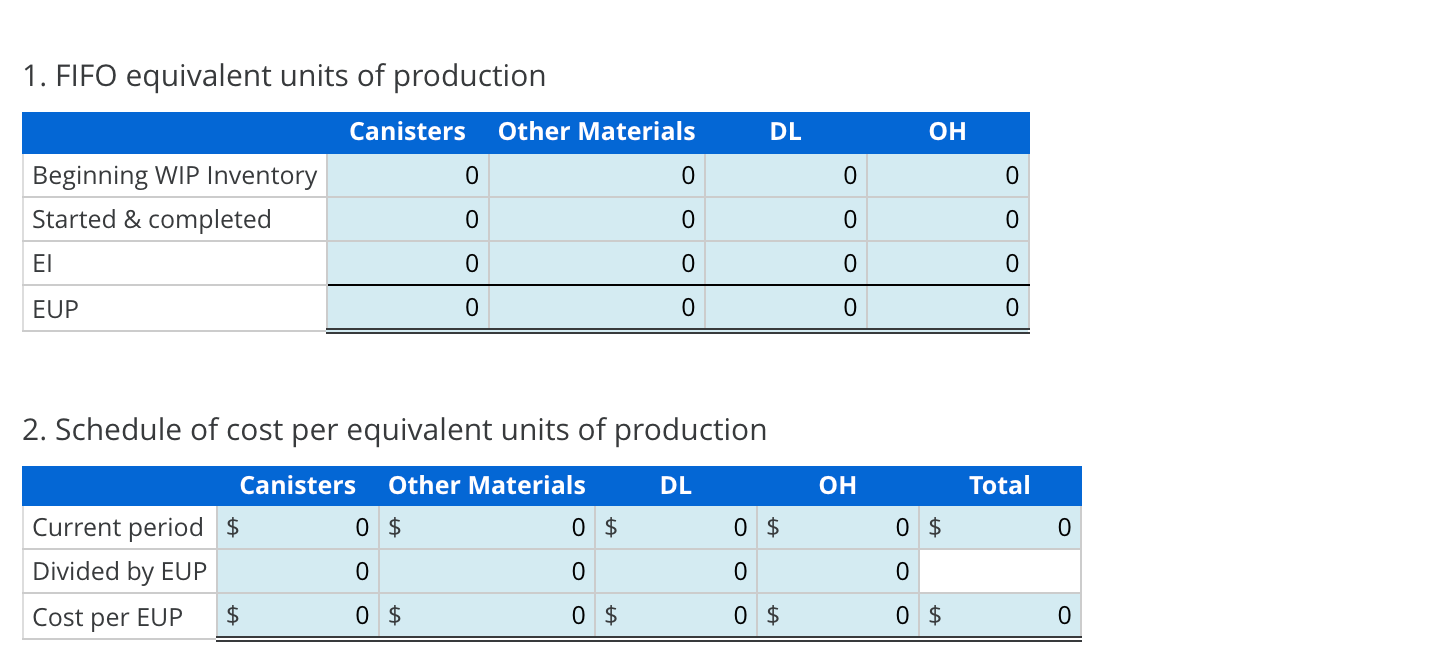

BeGone manufactures spray cans of insect repellent. On August 1, the company had 11,760 units in the beginning WIP Inventory that were 100 percent complete as to canisters, 60 percent complete as to other materials, 40 percent complete as to direct labor, and 20 percent complete as to overhead. During August, BeGone started 97,800 units in the manufacturing process. Ending WIP Inventory included 5,520 units that were 100 percent complete as to canisters, 40 percent complete as to other materials, 20 percent complete as to direct labor, and 10 percent complete as to overhead. Cost information for the month is as follows: Beginning WIP Inventory Canisters Other direct materials Direct labor Overhead August costs Canisters Other direct materials Direct labor Overhead $7,842 8,644 6,713 1,284 $74,328 104,152 114,836 192,211 Prepare a schedule showing the BeGone August computation of FIFO equivalent units of production and cost per equivalent unit. Note: Round the cost per equivalent unit amounts to two decimal places. 1. FIFO equivalent units of production Beginning WIP Inventory Started & completed EI EUP Canisters Other Materials Current period $ Divided by EUP Cost per EUP $ 0 0 0 0 2. Schedule of cost per equivalent units of production DL Canisters Other Materials 0 $ 0 0 $ 0 0 0 0 0 $ 0 0 $ DL 0 $ 0 0 $ 0 0 0 0 OH OH 0 $ 0 0 $ 0 0 0 0 Total 0 0

Step by Step Solution

★★★★★

3.50 Rating (173 Votes )

There are 3 Steps involved in it

Step: 1

1 FIFO equivalent unit of production Canister Other mater...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started