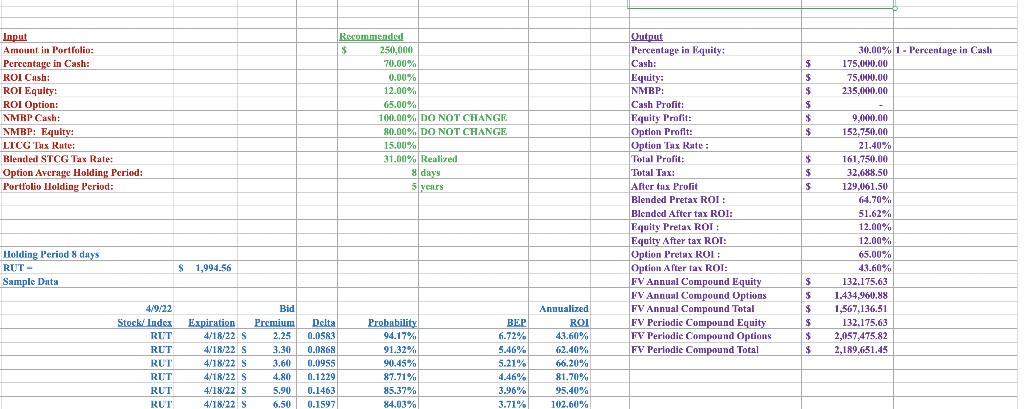

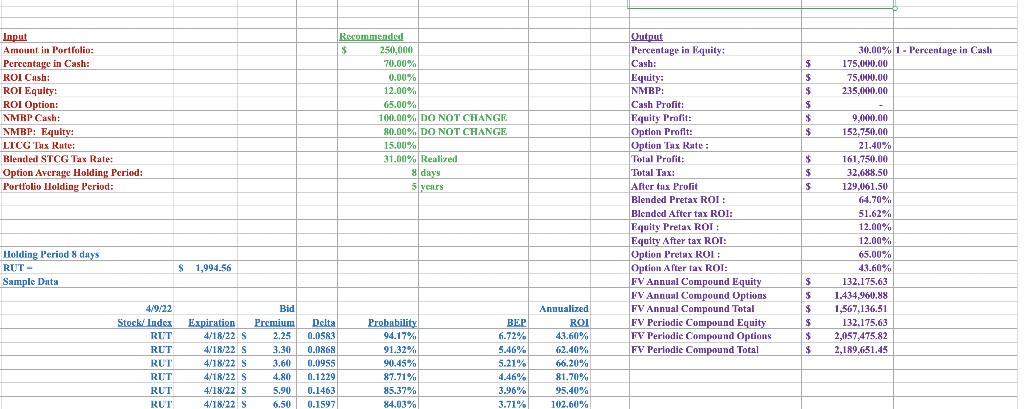

Behavioral Economics and Finance applied to Derivatives A. Explain how Mental Accounting/ Prospect Theory/ Loss Aversion can be used to predict the behavior of high income option investors when they earn a lot of money ($1M) and have a high tax bill ($300,000). B. A variation of Economic Game Theory is Behavioral Economic Game Theory (BEGT). Based on BEGT, explain the economic irrationality yet possible psychological rationality of trading complex derivatives that the untrained investor knows little about. In other words, why does someone trade options not knowing Greeks or Bitcoin/ cryptocurrency, or futures, or trade on margin not knowing what it is all about. 4 C. Discuss the relationship between Overconfidence and Financial Literacy in the area of Derivative Trading. If a person has a low Financial Literacy in the area of Derivatives yet ignores that and invests real money because he/ she is overconfident, why does this happen? $ $ 30.00% 1 - Percentage in Cash 175.000.00 75,000.00 235.000.00 Input Amount in Portfolio: Percentage in Cash: ROI Cash: ROI Equity: ROI Option: NMRP Cash: : NMBP: Equity: LTCG Tax Rate: Blended STCG Tax Rate: Option Average Holding Period: Portfolio Holding Period: Recommended $ $ 250,000 70.00% 0.00% 12.00% 65.00% 100.00% DO NOT CHANGE 80.00% DO NOT CHANGE 15.00% 31.00% Realized 8 days 5 years $ $ $ $ $ $ $ Output Percentage in Equity Cash: Equity: NMBP: Cash Profit Equity Profit Option Profit: Option Tax Rate : Total Profit: Total Tax: After tax Profit Blended Pretax ROI : Blended After tax ROI: Equity Pretax ROT Equity After tax ROT: Option Pretax ROI Option After tax ROT: FV Annual Compound Equity FV Annual Compound Options FV Annual Compound Total FV Periodic Compound Equity FV Perlodie Compound Options FV Periodie Compound Total 9,000.00 152.750.00 21.40% 161,750,00 32.688.50 129,061.50 64.70% 51.62% 12.00% 12.00% 65.00% 43.60% % 132.175.63 1,434,960.88 1,567,136.51 132.175.63 2,057,475.82 2,189.651.45 Holding Period 8 days RUT- Sample Data $ 1,994.56 $ $ $ $ $ 4/9/22 Stock/ Index RUT RUT RUT RUT RUT RUT Expiration 4/18/22 S 4/18/22 S 4/18/22 S 4/18/22 S 4/18/22 s 4/18/22 Bid Premium Delta 2.25 0.05R3 3.30 0.0868 3.60 0.0955 4.80 0.1229 5.90 0.1463 6.50 0.15971 Probability 94.17% 91.32% 90.45% 87.71% 85.37% 84.03% BEP 6.72% 5.46% 5.21% 4.46% 3.96% 3.71% Annualized ROI 43.60% 62.40% 66.20% 81.70% 95.40% 102.60% Behavioral Economics and Finance applied to Derivatives A. Explain how Mental Accounting/ Prospect Theory/ Loss Aversion can be used to predict the behavior of high income option investors when they earn a lot of money ($1M) and have a high tax bill ($300,000). B. A variation of Economic Game Theory is Behavioral Economic Game Theory (BEGT). Based on BEGT, explain the economic irrationality yet possible psychological rationality of trading complex derivatives that the untrained investor knows little about. In other words, why does someone trade options not knowing Greeks or Bitcoin/ cryptocurrency, or futures, or trade on margin not knowing what it is all about. 4 C. Discuss the relationship between Overconfidence and Financial Literacy in the area of Derivative Trading. If a person has a low Financial Literacy in the area of Derivatives yet ignores that and invests real money because he/ she is overconfident, why does this happen? $ $ 30.00% 1 - Percentage in Cash 175.000.00 75,000.00 235.000.00 Input Amount in Portfolio: Percentage in Cash: ROI Cash: ROI Equity: ROI Option: NMRP Cash: : NMBP: Equity: LTCG Tax Rate: Blended STCG Tax Rate: Option Average Holding Period: Portfolio Holding Period: Recommended $ $ 250,000 70.00% 0.00% 12.00% 65.00% 100.00% DO NOT CHANGE 80.00% DO NOT CHANGE 15.00% 31.00% Realized 8 days 5 years $ $ $ $ $ $ $ Output Percentage in Equity Cash: Equity: NMBP: Cash Profit Equity Profit Option Profit: Option Tax Rate : Total Profit: Total Tax: After tax Profit Blended Pretax ROI : Blended After tax ROI: Equity Pretax ROT Equity After tax ROT: Option Pretax ROI Option After tax ROT: FV Annual Compound Equity FV Annual Compound Options FV Annual Compound Total FV Periodic Compound Equity FV Perlodie Compound Options FV Periodie Compound Total 9,000.00 152.750.00 21.40% 161,750,00 32.688.50 129,061.50 64.70% 51.62% 12.00% 12.00% 65.00% 43.60% % 132.175.63 1,434,960.88 1,567,136.51 132.175.63 2,057,475.82 2,189.651.45 Holding Period 8 days RUT- Sample Data $ 1,994.56 $ $ $ $ $ 4/9/22 Stock/ Index RUT RUT RUT RUT RUT RUT Expiration 4/18/22 S 4/18/22 S 4/18/22 S 4/18/22 S 4/18/22 s 4/18/22 Bid Premium Delta 2.25 0.05R3 3.30 0.0868 3.60 0.0955 4.80 0.1229 5.90 0.1463 6.50 0.15971 Probability 94.17% 91.32% 90.45% 87.71% 85.37% 84.03% BEP 6.72% 5.46% 5.21% 4.46% 3.96% 3.71% Annualized ROI 43.60% 62.40% 66.20% 81.70% 95.40% 102.60%