Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Behavioral Finance Problem 5. 3Com Corporation was a digital electronics manufacture that sold computer network systems and services. At the end of 1999,3Com decided to

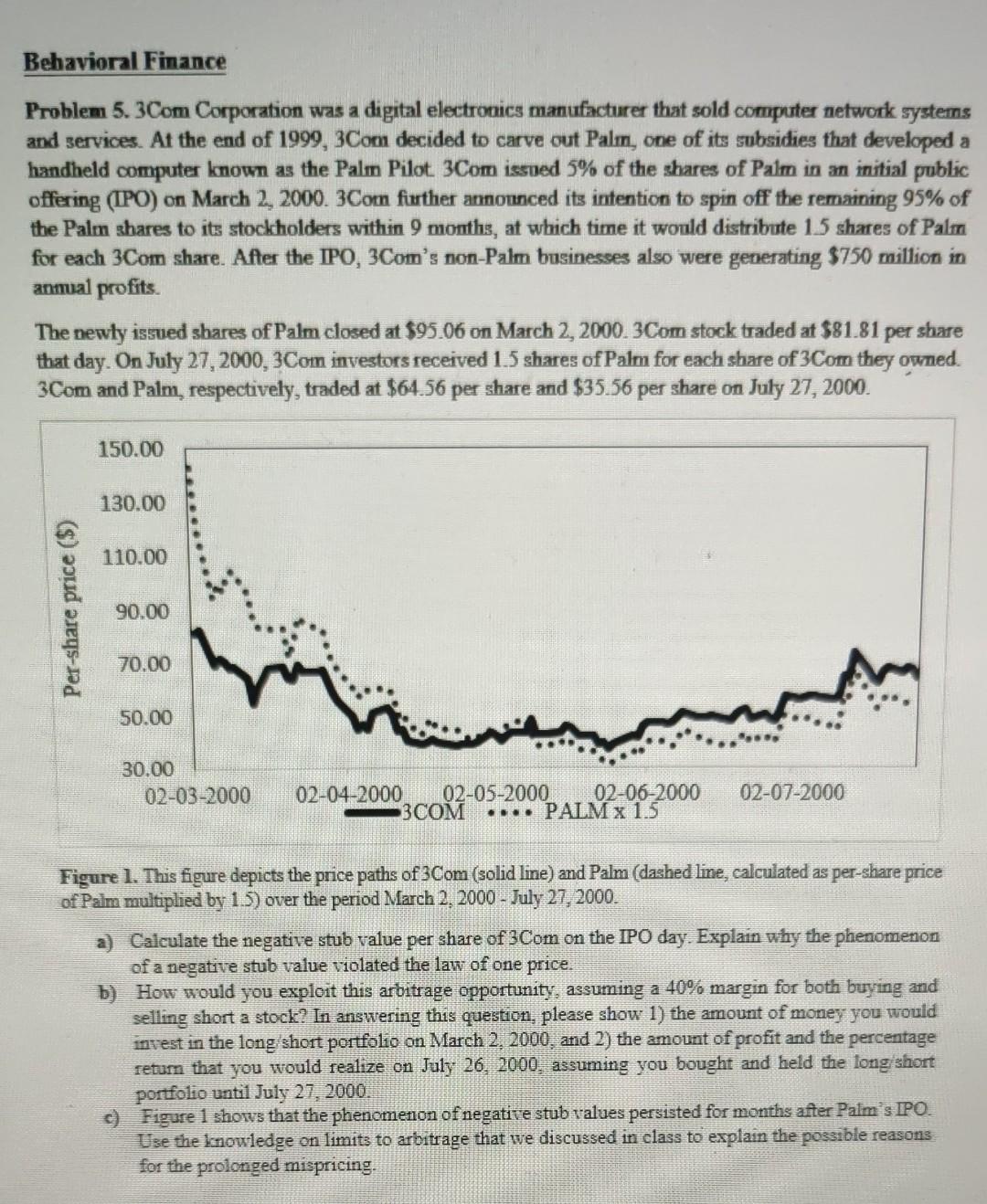

Behavioral Finance Problem 5. 3Com Corporation was a digital electronics manufacture that sold computer network systems and services. At the end of 1999,3Com decided to carve out Palm, one of its subsidies that developed a handheld computer known as the Palm Pilot. 3 Com issued 5% of the shares of Palm in an initial problic offering (IPO) on March 2, 2000. 3Com further announced its intention to spin off the remaining 95% of the Palm ahares to its stockholders within 9 months, at which time it would distribute 15 shares of Palm for each 3Com share. After the IPO, 3Com's non-Palm businesses also were generating $750 million in anmual profits. The newly issued shares of Palm closed at $95.06 on March 2, 2000. 3Com stock traded at $81.81 per share that day. On July 27,2000,3 Com investors received 1.5 shares of Palm for each share of 3 Com they owned. 3Com and Palm, respectively, traded at $64.56 per share and $35.56 per share on July 27,2000. Figure 1. This figure depicts the price paths of 3Com (solid line) and Palm (dashed line, calculated as per-share price of Palm multiplied by 1.5) over the period March 2, 2000 - July 27, 2000 . a) Calculate the negative stub value per share of 3Com on the IPO day. Explain why the phenomenon of a negative stub value violated the law of one price. b) How would you exploit this arbitrage opportunity, assuming a 40% margin for both buying and selling short a stock? In answering this question, please show 1) the amount of money you would invest in the long short portfolio on March 2, 2000, and 2) the amount of profit and the percentage retum that you would realize on July 26,2000 , assuming you bought and held the long/short portfolio until July 27,2000 . c) Figure 1 shows that the phenomenon of negative stub values persisted for months after Palm's IPO. Use the knowledge on limits to arbitrage that we discussed in class to explain the possible reasons for the prolonged mispricing. Behavioral Finance Problem 5. 3Com Corporation was a digital electronics manufacture that sold computer network systems and services. At the end of 1999,3Com decided to carve out Palm, one of its subsidies that developed a handheld computer known as the Palm Pilot. 3 Com issued 5% of the shares of Palm in an initial problic offering (IPO) on March 2, 2000. 3Com further announced its intention to spin off the remaining 95% of the Palm ahares to its stockholders within 9 months, at which time it would distribute 15 shares of Palm for each 3Com share. After the IPO, 3Com's non-Palm businesses also were generating $750 million in anmual profits. The newly issued shares of Palm closed at $95.06 on March 2, 2000. 3Com stock traded at $81.81 per share that day. On July 27,2000,3 Com investors received 1.5 shares of Palm for each share of 3 Com they owned. 3Com and Palm, respectively, traded at $64.56 per share and $35.56 per share on July 27,2000. Figure 1. This figure depicts the price paths of 3Com (solid line) and Palm (dashed line, calculated as per-share price of Palm multiplied by 1.5) over the period March 2, 2000 - July 27, 2000 . a) Calculate the negative stub value per share of 3Com on the IPO day. Explain why the phenomenon of a negative stub value violated the law of one price. b) How would you exploit this arbitrage opportunity, assuming a 40% margin for both buying and selling short a stock? In answering this question, please show 1) the amount of money you would invest in the long short portfolio on March 2, 2000, and 2) the amount of profit and the percentage retum that you would realize on July 26,2000 , assuming you bought and held the long/short portfolio until July 27,2000 . c) Figure 1 shows that the phenomenon of negative stub values persisted for months after Palm's IPO. Use the knowledge on limits to arbitrage that we discussed in class to explain the possible reasons for the prolonged mispricing

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started