Question

Beishan Technologies' end-of-year free cash flow (FCF) is expected to be $70 million, and free cash flow is expected to grow at a constant

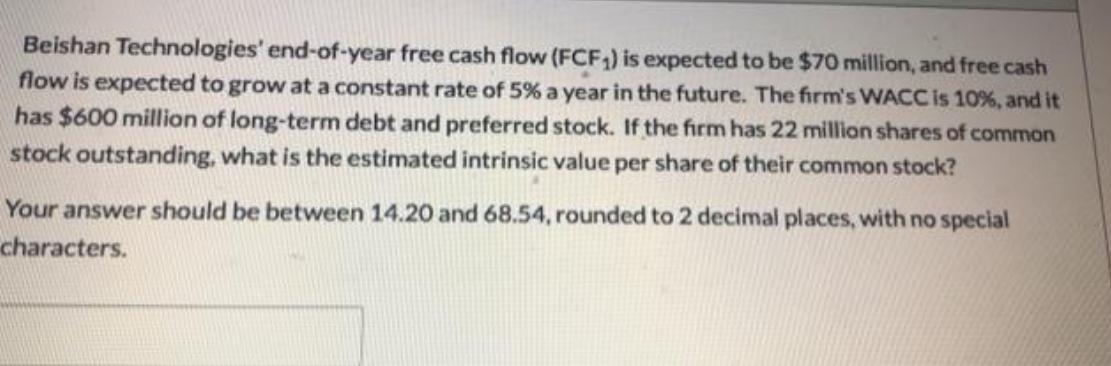

Beishan Technologies' end-of-year free cash flow (FCF) is expected to be $70 million, and free cash flow is expected to grow at a constant rate of 5% a year in the future. The firm's WACC is 10%, and it has $600 million of long-term debt and preferred stock. If the firm has 22 million shares of common stock outstanding, what is the estimated intrinsic value per share of their common stock? Your answer should be between 14.20 and 68.54, rounded to 2 decimal places, with no special characters.

Step by Step Solution

3.54 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

The given question asks to estimate the intrinsic value per share of common stock for Beishan Techno...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Management Theory and Practice

Authors: Eugene F. Brigham, Michael C. Ehrhardt

15th edition

130563229X, 978-1305632301, 1305632303, 978-0357685877, 978-1305886902, 1305886909, 978-1305632295

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App