Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Belinda Oliver, a Canadian, acquired a property in Hong Kong for $5 million in April 2016. As she only spends a few weeks in

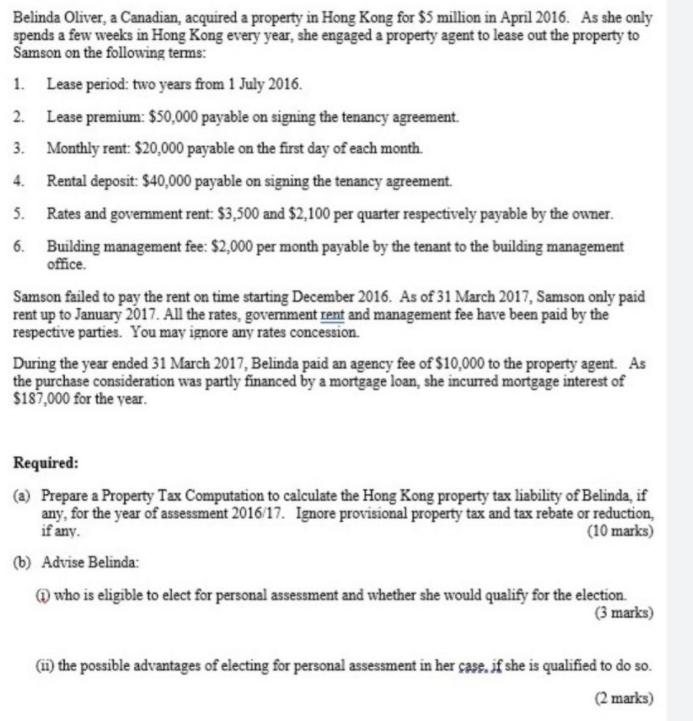

Belinda Oliver, a Canadian, acquired a property in Hong Kong for $5 million in April 2016. As she only spends a few weeks in Hong Kong every year, she engaged a property agent to lease out the property to Samson on the following terms: 1. Lease period: two years from 1 July 2016. 2. Lease premium: $50,000 payable on signing the tenancy agreement. 3. Monthly rent: $20,000 payable on the first day of each month. 4. Rental deposit: $40,000 payable on signing the tenancy agreement. 5. Rates and govemment rent: $3,500 and $2,100 per quarter respectively payable by the owner. 6. Building management fee: $2,000 per month payable by the tenant to the building management office. Samson failed to pay the rent on time starting December 2016. As of 31 March 2017, Samson only paid rent up to January 2017. All the rates, govemment rent and management fee have been paid by the respective parties. You may ignore any rates concession. During the year ended 31 March 2017, Belinda paid an agency fee of $10,000 to the property agent. As the purchase consideration was partly financed by a mortgage loan, she incurred mortgage interest of $187,000 for the year. Required: (2) Prepare a Property Tax Computation to calculate the Hong Kong property tax liability of Belinda, if any, for the year of assessment 2016/17. Ignore provisional property tax and tax rebate or reduction, if any. (10 marks) (b) Advise Belinda: @who is eligible to elect for personal assessment and whether she would qualify for the election. (3 marks) (i) the possible advantages of electing for personal assessment in her ase. if she is qualified to do so. (2 marks) Belinda Oliver, a Canadian, acquired a property in Hong Kong for $5 million in April 2016. As she only spends a few weeks in Hong Kong every year, she engaged a property agent to lease out the property to Samson on the following terms: 1. Lease period: two years from 1 July 2016. 2. Lease premium: $50,000 payable on signing the tenancy agreement. 3. Monthly rent: $20,000 payable on the first day of each month. 4. Rental deposit: $40,000 payable on signing the tenancy agreement. 5. Rates and govemment rent: $3,500 and $2,100 per quarter respectively payable by the owner. 6. Building management fee: $2,000 per month payable by the tenant to the building management office. Samson failed to pay the rent on time starting December 2016. As of 31 March 2017, Samson only paid rent up to January 2017. All the rates, govemment rent and management fee have been paid by the respective parties. You may ignore any rates concession. During the year ended 31 March 2017, Belinda paid an agency fee of $10,000 to the property agent. As the purchase consideration was partly financed by a mortgage loan, she incurred mortgage interest of $187,000 for the year. Required: (2) Prepare a Property Tax Computation to calculate the Hong Kong property tax liability of Belinda, if any, for the year of assessment 2016/17. Ignore provisional property tax and tax rebate or reduction, if any. (10 marks) (b) Advise Belinda: @who is eligible to elect for personal assessment and whether she would qualify for the election. (3 marks) (i) the possible advantages of electing for personal assessment in her ase. if she is qualified to do so. (2 marks) Belinda Oliver, a Canadian, acquired a property in Hong Kong for $5 million in April 2016. As she only spends a few weeks in Hong Kong every year, she engaged a property agent to lease out the property to Samson on the following terms: 1. Lease period: two years from 1 July 2016. 2. Lease premium: $50,000 payable on signing the tenancy agreement. 3. Monthly rent: $20,000 payable on the first day of each month. 4. Rental deposit: $40,000 payable on signing the tenancy agreement. 5. Rates and govemment rent: $3,500 and $2,100 per quarter respectively payable by the owner. 6. Building management fee: $2,000 per month payable by the tenant to the building management office. Samson failed to pay the rent on time starting December 2016. As of 31 March 2017, Samson only paid rent up to January 2017. All the rates, govemment rent and management fee have been paid by the respective parties. You may ignore any rates concession. During the year ended 31 March 2017, Belinda paid an agency fee of $10,000 to the property agent. As the purchase consideration was partly financed by a mortgage loan, she incurred mortgage interest of $187,000 for the year. Required: (2) Prepare a Property Tax Computation to calculate the Hong Kong property tax liability of Belinda, if any, for the year of assessment 2016/17. Ignore provisional property tax and tax rebate or reduction, if any. (10 marks) (b) Advise Belinda: @who is eligible to elect for personal assessment and whether she would qualify for the election. (3 marks) (i) the possible advantages of electing for personal assessment in her ase. if she is qualified to do so. (2 marks) Belinda Oliver, a Canadian, acquired a property in Hong Kong for $5 million in April 2016. As she only spends a few weeks in Hong Kong every year, she engaged a property agent to lease out the property to Samson on the following terms: 1. Lease period: two years from 1 July 2016. 2. Lease premium: $50,000 payable on signing the tenancy agreement. 3. Monthly rent: $20,000 payable on the first day of each month. 4. Rental deposit: $40,000 payable on signing the tenancy agreement. 5. Rates and govemment rent: $3,500 and $2,100 per quarter respectively payable by the owner. 6. Building management fee: $2,000 per month payable by the tenant to the building management office. Samson failed to pay the rent on time starting December 2016. As of 31 March 2017, Samson only paid rent up to January 2017. All the rates, govemment rent and management fee have been paid by the respective parties. You may ignore any rates concession. During the year ended 31 March 2017, Belinda paid an agency fee of $10,000 to the property agent. As the purchase consideration was partly financed by a mortgage loan, she incurred mortgage interest of $187,000 for the year. Required: (2) Prepare a Property Tax Computation to calculate the Hong Kong property tax liability of Belinda, if any, for the year of assessment 2016/17. Ignore provisional property tax and tax rebate or reduction, if any. (10 marks) (b) Advise Belinda: @who is eligible to elect for personal assessment and whether she would qualify for the election. (3 marks) (i) the possible advantages of electing for personal assessment in her ase. if she is qualified to do so. (2 marks) Belinda Oliver, a Canadian, acquired a property in Hong Kong for $5 million in April 2016. As she only spends a few weeks in Hong Kong every year, she engaged a property agent to lease out the property to Samson on the following terms: 1. Lease period: two years from 1 July 2016. 2. Lease premium: $50,000 payable on signing the tenancy agreement. 3. Monthly rent: $20,000 payable on the first day of each month. 4. Rental deposit: $40,000 payable on signing the tenancy agreement. 5. Rates and govemment rent: $3,500 and $2,100 per quarter respectively payable by the owner. 6. Building management fee: $2,000 per month payable by the tenant to the building management office. Samson failed to pay the rent on time starting December 2016. As of 31 March 2017, Samson only paid rent up to January 2017. All the rates, govemment rent and management fee have been paid by the respective parties. You may ignore any rates concession. During the year ended 31 March 2017, Belinda paid an agency fee of $10,000 to the property agent. As the purchase consideration was partly financed by a mortgage loan, she incurred mortgage interest of $187,000 for the year. Required: (2) Prepare a Property Tax Computation to calculate the Hong Kong property tax liability of Belinda, if any, for the year of assessment 2016/17. Ignore provisional property tax and tax rebate or reduction, if any. (10 marks) (b) Advise Belinda: @who is eligible to elect for personal assessment and whether she would qualify for the election. (3 marks) (i) the possible advantages of electing for personal assessment in her ase. if she is qualified to do so. (2 marks) Belinda Oliver, a Canadian, acquired a property in Hong Kong for $5 million in April 2016. As she only spends a few weeks in Hong Kong every year, she engaged a property agent to lease out the property to Samson on the following terms: 1. Lease period: two years from 1 July 2016. 2. Lease premium: $50,000 payable on signing the tenancy agreement. 3. Monthly rent: $20,000 payable on the first day of each month. 4. Rental deposit: $40,000 payable on signing the tenancy agreement. 5. Rates and govemment rent: $3,500 and $2,100 per quarter respectively payable by the owner. 6. Building management fee: $2,000 per month payable by the tenant to the building management office. Samson failed to pay the rent on time starting December 2016. As of 31 March 2017, Samson only paid rent up to January 2017. All the rates, govemment rent and management fee have been paid by the respective parties. You may ignore any rates concession. During the year ended 31 March 2017, Belinda paid an agency fee of $10,000 to the property agent. As the purchase consideration was partly financed by a mortgage loan, she incurred mortgage interest of $187,000 for the year. Required: (2) Prepare a Property Tax Computation to calculate the Hong Kong property tax liability of Belinda, if any, for the year of assessment 2016/17. Ignore provisional property tax and tax rebate or reduction, if any. (10 marks) (b) Advise Belinda: @who is eligible to elect for personal assessment and whether she would qualify for the election. (3 marks) (i) the possible advantages of electing for personal assessment in her ase. if she is qualified to do so. (2 marks)

Step by Step Solution

★★★★★

3.39 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Response to quiz a Hong Kongs property tax liability for the assessment year 201617 Propertys base value is 5 million Until January the rent will be p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started