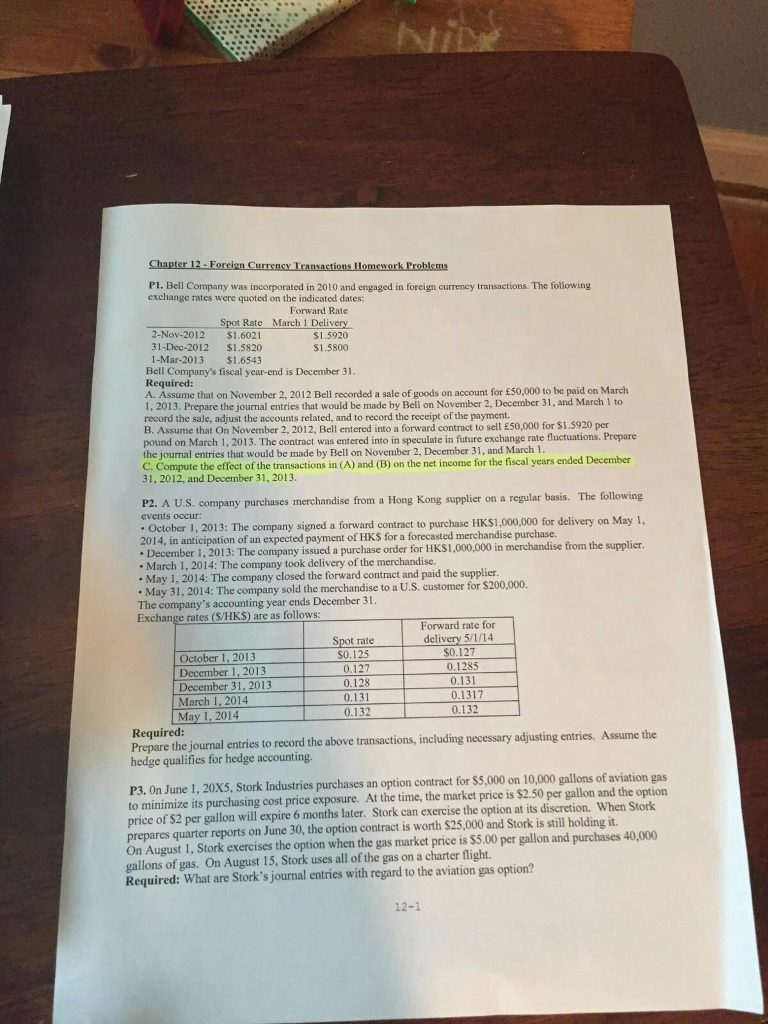

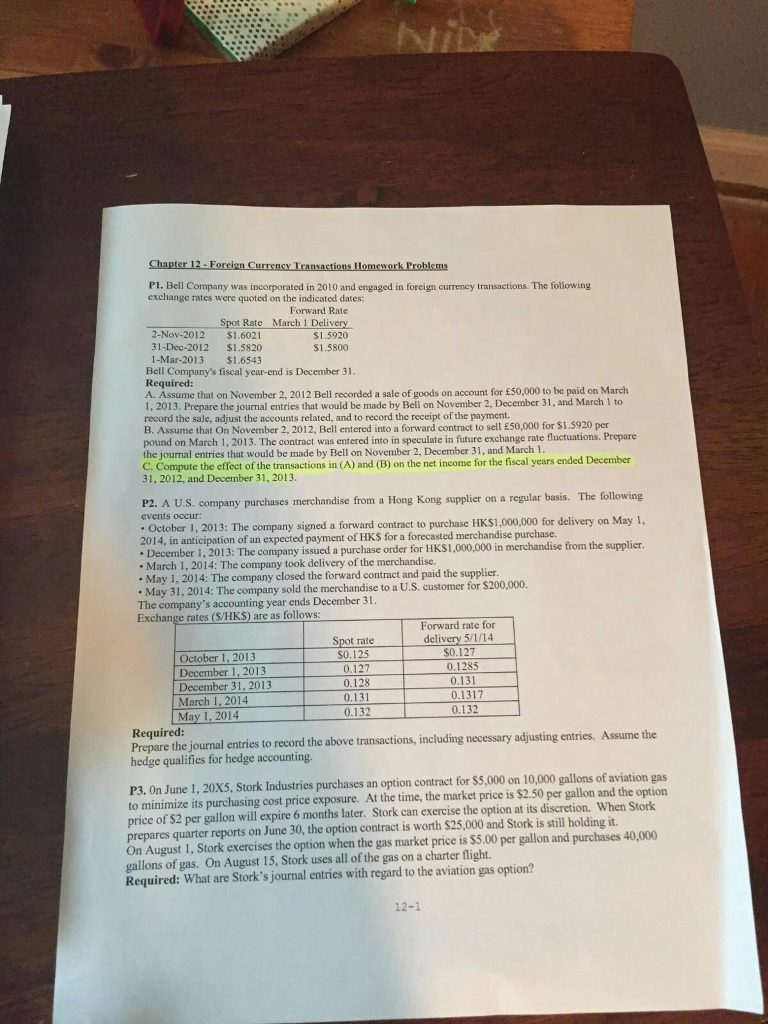

Bell Company was incorporated in 2010 and engaged in foreign currency transactions The following exchange rates were quoted on the indicated dates: A. Assume that on November 2, 2012 Bell recorded a sale of goods on account for 50.000 to be paid on March 1, 2013. Prepare the journal entries that would be made by Bell on November 2. December 31, and March 1 to record the sale, adjust the accounts related, and to record the receipt of the payment. B. Assume that On November 2.2012. Bell entered into a forward contract to sell 50.000 for $1, 5920 per pound on March 1, 2013. The contract was entered into in speculate in future exchange rate fluctuations. Prepare the journal entries that would be made by Bell on November 2, December 31, and March 1. C. Compute the effect of the transactions in (A) and (B) on the net income for the fiscal years ended December 31, 2012, and December 31, 2013. A U.S. company purchases merchandise from a Hong Kong supplier on a regular basis. The following events occur: October 1, 2013: The company signed a forward contract to purchase HK$1,000.,000 for delivery on May 1, 2014, in anticipation of an expected payment of HK $ for a forecasted merchandise purchase. December 1, 2013: The company issued a purchase order to HK $1,000,000 in merchandise from the supplier. March 1, 2014: The company took delivery of the merchandise. May 1, 2014: The company closed the forward contract and paid the supplier. May 31, 2014: The company sold the merchandise to a U.S. customer tor $200,000. The company's accounting year ends December 31. Required: Prepare the journal entries lo record the above transactions, including necessary adjusting entries. Assume the hedge qualifies for hedge accounting. On June 1, 20X5, Stork Industries purchases an option contract for $5,000 on 10,000 gallons of aviation gas to minimize it's purchasing cost price exposure At the time, the market price is $2.50 per gallon and the option price of $2 per gallon will expire 6 months later. Stork can exercise the option at its discretion. When Stork prepares quarter reports on June 30, the option contract is worth $25,000 and Stork is still holding it. On August 1. Stork exercises the option when the gas market price is $5.00 per gallon and purchases 40,000 gallons of gas. On August 15. Stork uses all of the gas on a charter flight. Required: What are Stork's journal entries with regard to the aviation gas option? Bell Company was incorporated in 2010 and engaged in foreign currency transactions The following exchange rates were quoted on the indicated dates: A. Assume that on November 2, 2012 Bell recorded a sale of goods on account for 50.000 to be paid on March 1, 2013. Prepare the journal entries that would be made by Bell on November 2. December 31, and March 1 to record the sale, adjust the accounts related, and to record the receipt of the payment. B. Assume that On November 2.2012. Bell entered into a forward contract to sell 50.000 for $1, 5920 per pound on March 1, 2013. The contract was entered into in speculate in future exchange rate fluctuations. Prepare the journal entries that would be made by Bell on November 2, December 31, and March 1. C. Compute the effect of the transactions in (A) and (B) on the net income for the fiscal years ended December 31, 2012, and December 31, 2013. A U.S. company purchases merchandise from a Hong Kong supplier on a regular basis. The following events occur: October 1, 2013: The company signed a forward contract to purchase HK$1,000.,000 for delivery on May 1, 2014, in anticipation of an expected payment of HK $ for a forecasted merchandise purchase. December 1, 2013: The company issued a purchase order to HK $1,000,000 in merchandise from the supplier. March 1, 2014: The company took delivery of the merchandise. May 1, 2014: The company closed the forward contract and paid the supplier. May 31, 2014: The company sold the merchandise to a U.S. customer tor $200,000. The company's accounting year ends December 31. Required: Prepare the journal entries lo record the above transactions, including necessary adjusting entries. Assume the hedge qualifies for hedge accounting. On June 1, 20X5, Stork Industries purchases an option contract for $5,000 on 10,000 gallons of aviation gas to minimize it's purchasing cost price exposure At the time, the market price is $2.50 per gallon and the option price of $2 per gallon will expire 6 months later. Stork can exercise the option at its discretion. When Stork prepares quarter reports on June 30, the option contract is worth $25,000 and Stork is still holding it. On August 1. Stork exercises the option when the gas market price is $5.00 per gallon and purchases 40,000 gallons of gas. On August 15. Stork uses all of the gas on a charter flight. Required: What are Stork's journal entries with regard to the aviation gas option