Question

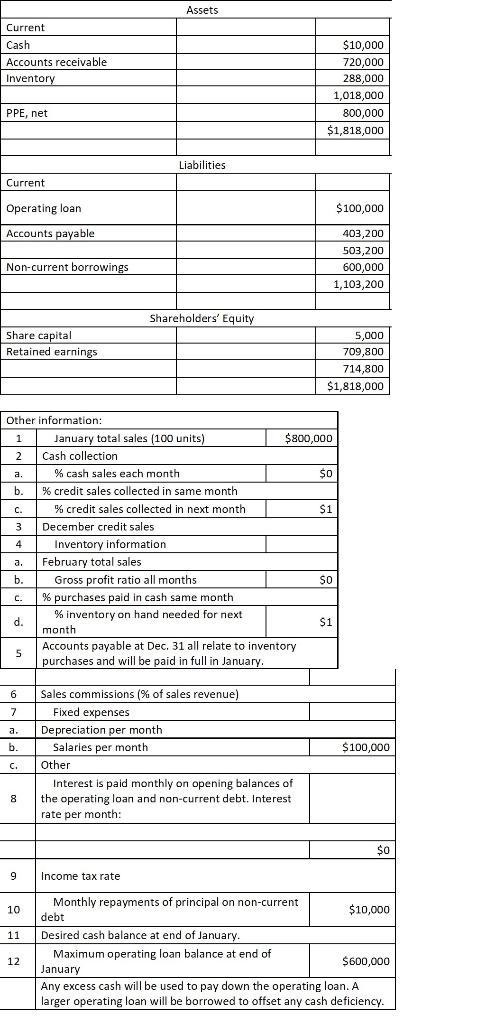

Bellerose Used Cars Ltd. is planning its cash needs for the month of January, 2023. The statement of financial position showed the following at December

Bellerose Used Cars Ltd. is planning its cash needs for the month of January, 2023. The statement of financial position showed the following at December 31, 2022.

Required:

a. (12 marks) Using the budget worksheet on the following page, record the above information. Assume that all 2022 income taxes have been paid prior to January 1, 2023.

b. (6 marks) Prepare a budgeted statement of financial position at January 31, 2023 and a budgeted income statement, budgeted statement of changes in equity, and budgeted statement of cash flows for the month ended January 31, 2023. Show all calculations. For SCF purposes, assume the operating loan is not part of cash and cash equivalents.

ASSSETS | = | LIABILITIES | + | S/H EQUITY | |||||||||||||||||

Trans. | Cash | + | Acc. Rec. | + | Invent. | + | PPE | = | Op. Loan | + | Acc. Pay. | + | L/T Debt | + | Share Capital | + | Ret. Earn. | Desc. | |||

Cf. | 10,000 | 720 ,000 | 288,000 | 800,000 | 100,000 | 403,200 | 600,000 | 5,000 | 709,800 | ||||||||||||

Totals | |||||||||||||||||||||

Current Cash Accounts receivable. Inventory PPE, net Current Operating loan Accounts payable Non-current borrowings Share capital Retained earnings Other information: 1 2 a. b. C. 3 4 a. b. C. d. 5 6 7 a. b. C. 8 9 10 11 12 Assets Liabilities January total sales (100 units) Shareholders' Equity Cash collection % cash sales each month % credit sales collected in same month % credit sales collected in next month December credit sales Inventory information February total sales Gross profit ratio all months % purchases paid in cash same month % inventory on hand needed for next month Other Accounts payable at Dec. 31 all relate to inventory purchases and will be paid in full in January. Sales commissions (% of sales revenue) Fixed expenses Depreciation per month. Salaries per month. Income tax rate Interest is paid monthly on opening balances of the operating loan and non-current debt. Interest rate per month: $800,000 $10,000 720,000 288,000 1,018,000 800,000 $1,818,000 Monthly repayments of principal on non-current debt Desired cash balance at end of January. Maximum operating loan balance at end of 5,000 709,800 714,800 $1,818,000 $100,000 403,200 503,200 600,000 1,103,200 $0 $1 SO $1 $100,000 $0 $10,000 $600,000 January Any excess cash will be used to pay down the operating loan. A larger operating loan will be borrowed to offset any cash deficiency.

Step by Step Solution

3.49 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

a Fill out the budget worksheet provided with the given information b Use the budgeted information t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started