Belmont paid $360,000 cash and issued 600,000 common shares for all of the outstanding shares common shares of Lyons on January 1, 2018. On

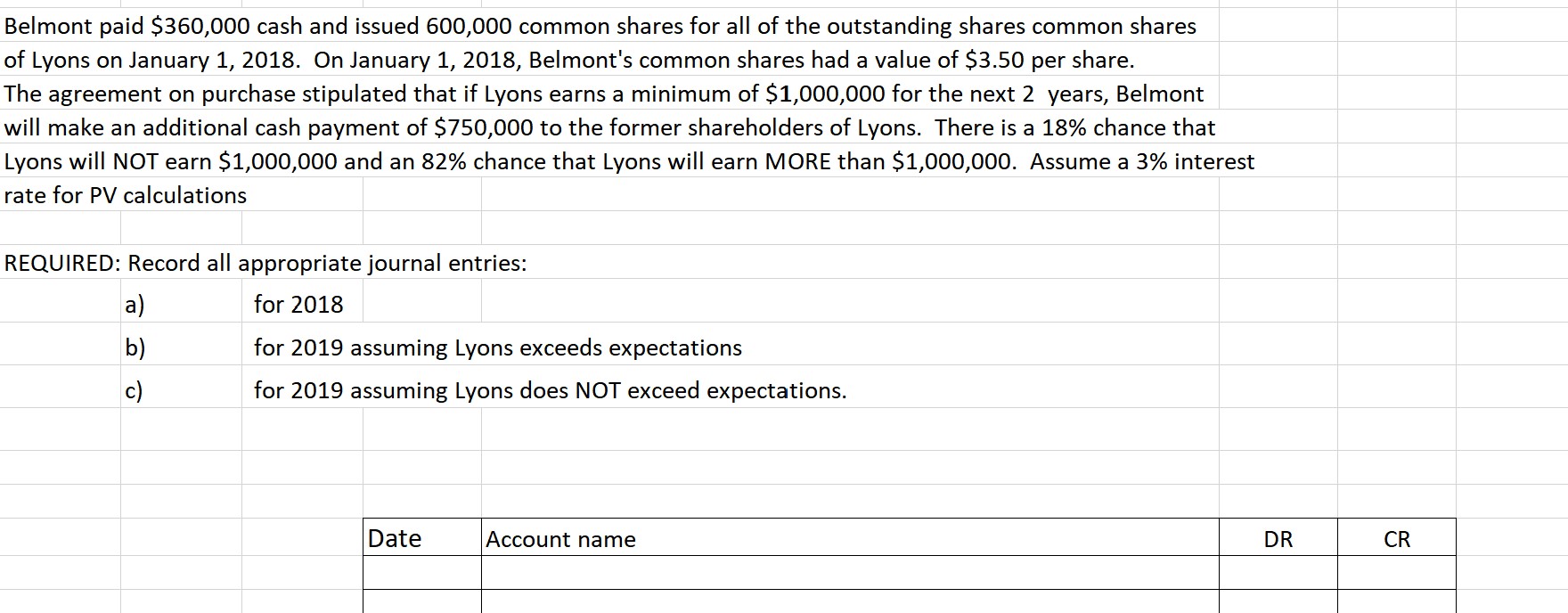

Belmont paid $360,000 cash and issued 600,000 common shares for all of the outstanding shares common shares of Lyons on January 1, 2018. On January 1, 2018, Belmont's common shares had a value of $3.50 per share. The agreement on purchase stipulated that if Lyons earns a minimum of $1,000,000 for the next 2 years, Belmont will make an additional cash payment of $750,000 to the former shareholders of Lyons. There is a 18% chance that Lyons will NOT earn $1,000,000 and an 82% chance that Lyons will earn MORE than $1,000,000. Assume a 3% interest rate for PV calculations REQUIRED: Record all appropriate journal entries: a) for 2018 b) for 2019 assuming Lyons exceeds expectations c) for 2019 assuming Lyons does NOT exceed expectations. Date Account name DR CR

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a For 2018 January 1 2018 Goodwill Common Stock Belmont Additional Paid in Capital Cash 540000 6...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started