Answered step by step

Verified Expert Solution

Question

1 Approved Answer

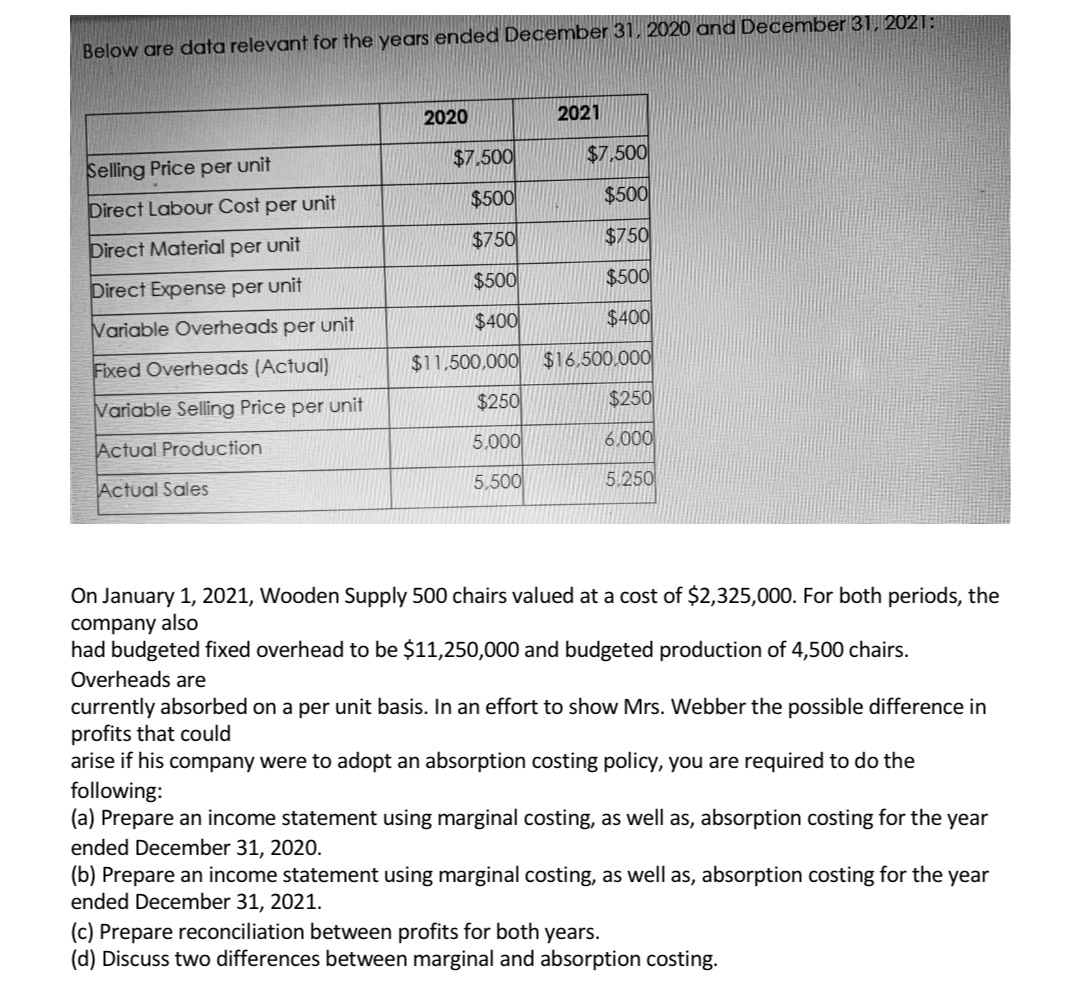

Below are data relevant for the years ended December 31, 2020 and December 31, 2021: 2020 2021 Selling Price per unit $7,500 $7,500 Direct

Below are data relevant for the years ended December 31, 2020 and December 31, 2021: 2020 2021 Selling Price per unit $7,500 $7,500 Direct Labour Cost per unit $500 $500 Direct Material per unit $750 $750 Direct Expense per unit $500 $500 Variable Overheads per unit $400 $400 Fixed Overheads (Actual) $11,500,000 $16,500,000 Variable Selling Price per unit $250 $250 Actual Production 5,000 6,000 Actual Sales 5,500 5.250 On January 1, 2021, Wooden Supply 500 chairs valued at a cost of $2,325,000. For both periods, the company also had budgeted fixed overhead to be $11,250,000 and budgeted production of 4,500 chairs. Overheads are currently absorbed on a per unit basis. In an effort to show Mrs. Webber the possible difference in profits that could arise if his company were to adopt an absorption costing policy, you are required to do the following: (a) Prepare an income statement using marginal costing, as well as, absorption costing for the year ended December 31, 2020. (b) Prepare an income statement using marginal costing, as well as, absorption costing for the year ended December 31, 2021. (c) Prepare reconciliation between profits for both years. (d) Discuss two differences between marginal and absorption costing.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Income Statement for the year ended December 31 2020 Marginal Costing Sales 5500 units 7500 412500...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started