Answered step by step

Verified Expert Solution

Question

1 Approved Answer

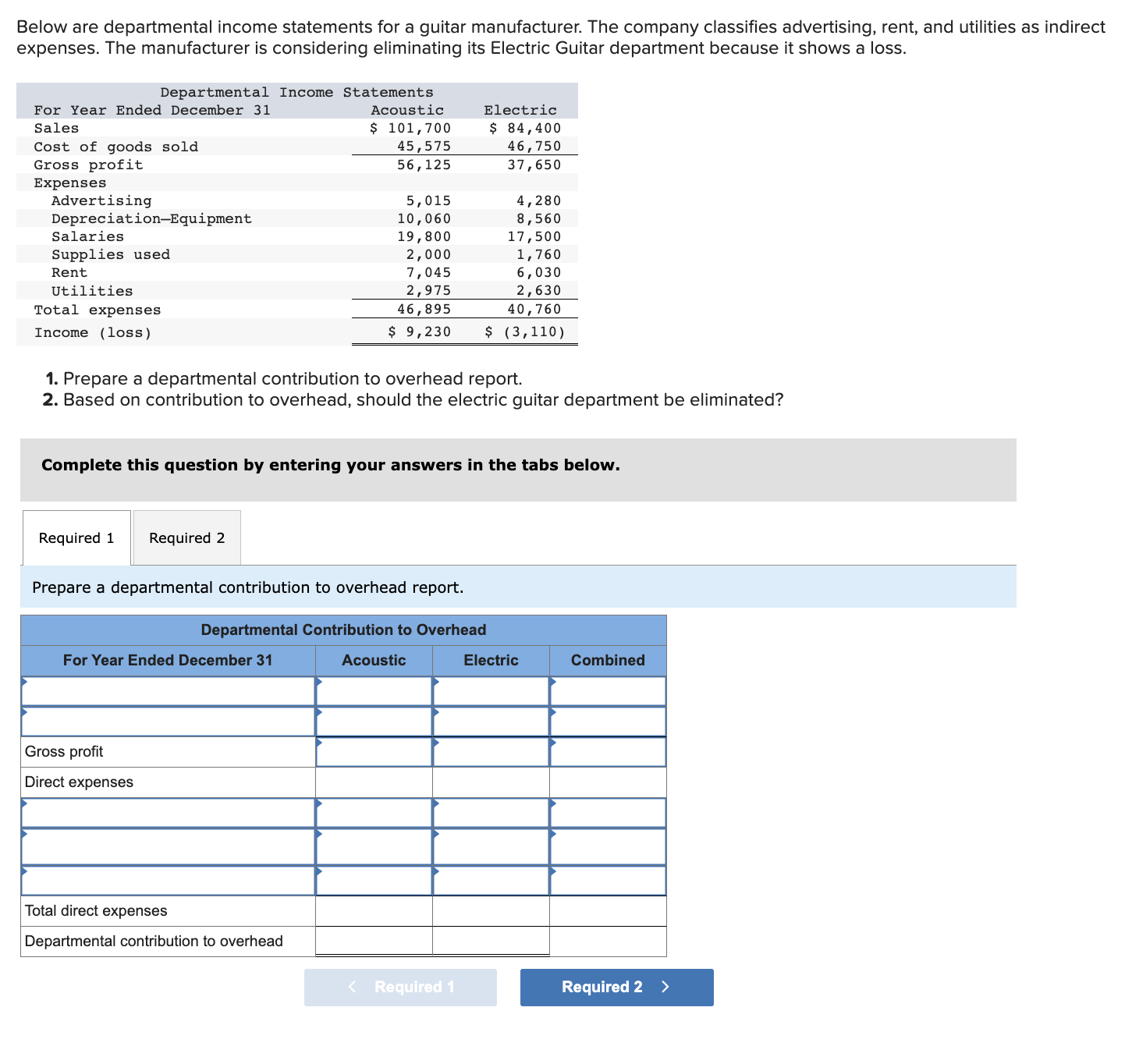

Below are departmental income statements for a guitar manufacturer. The company classifies advertising, rent, and utilities as indirect expenses. The manufacturer is considering eliminating

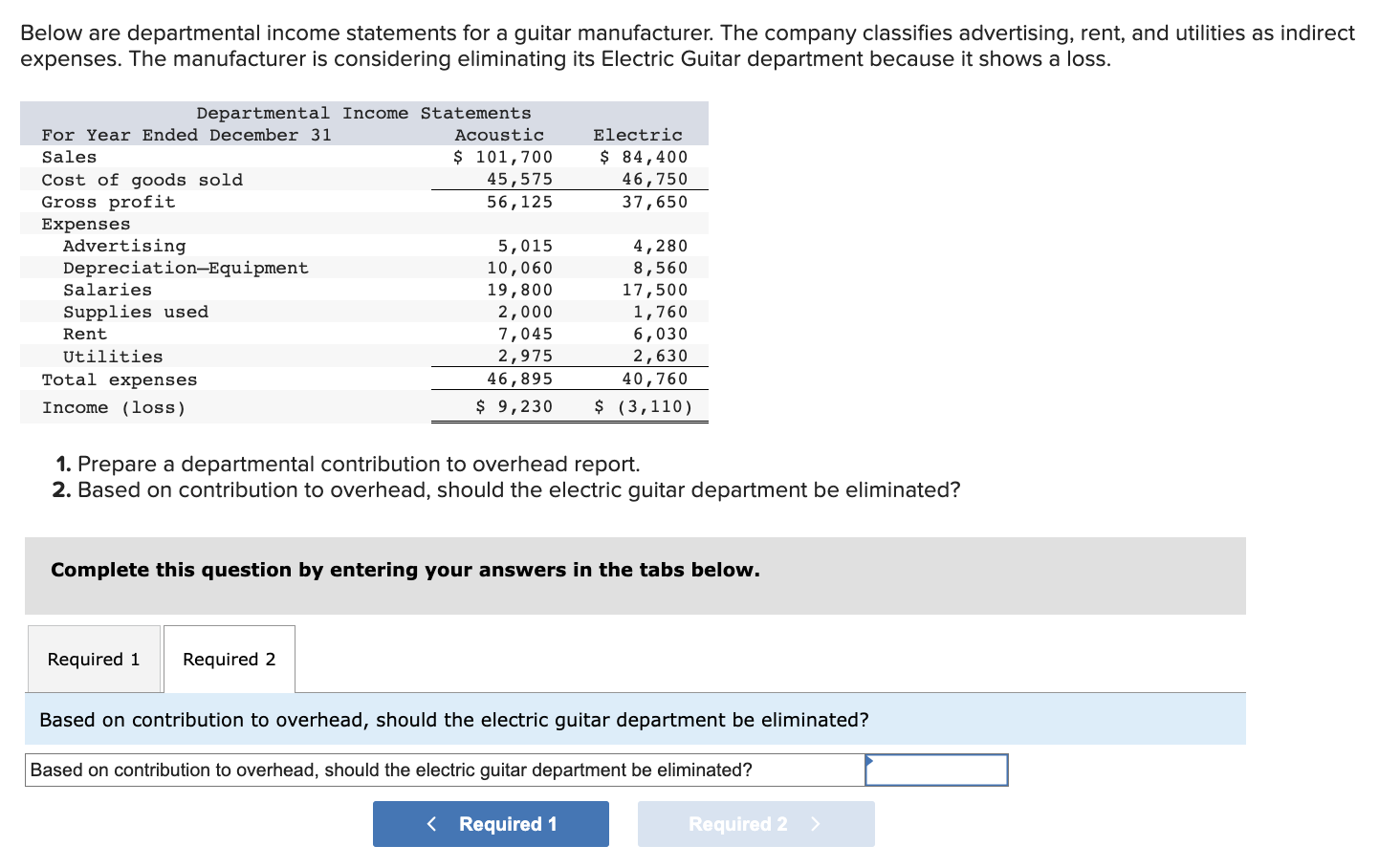

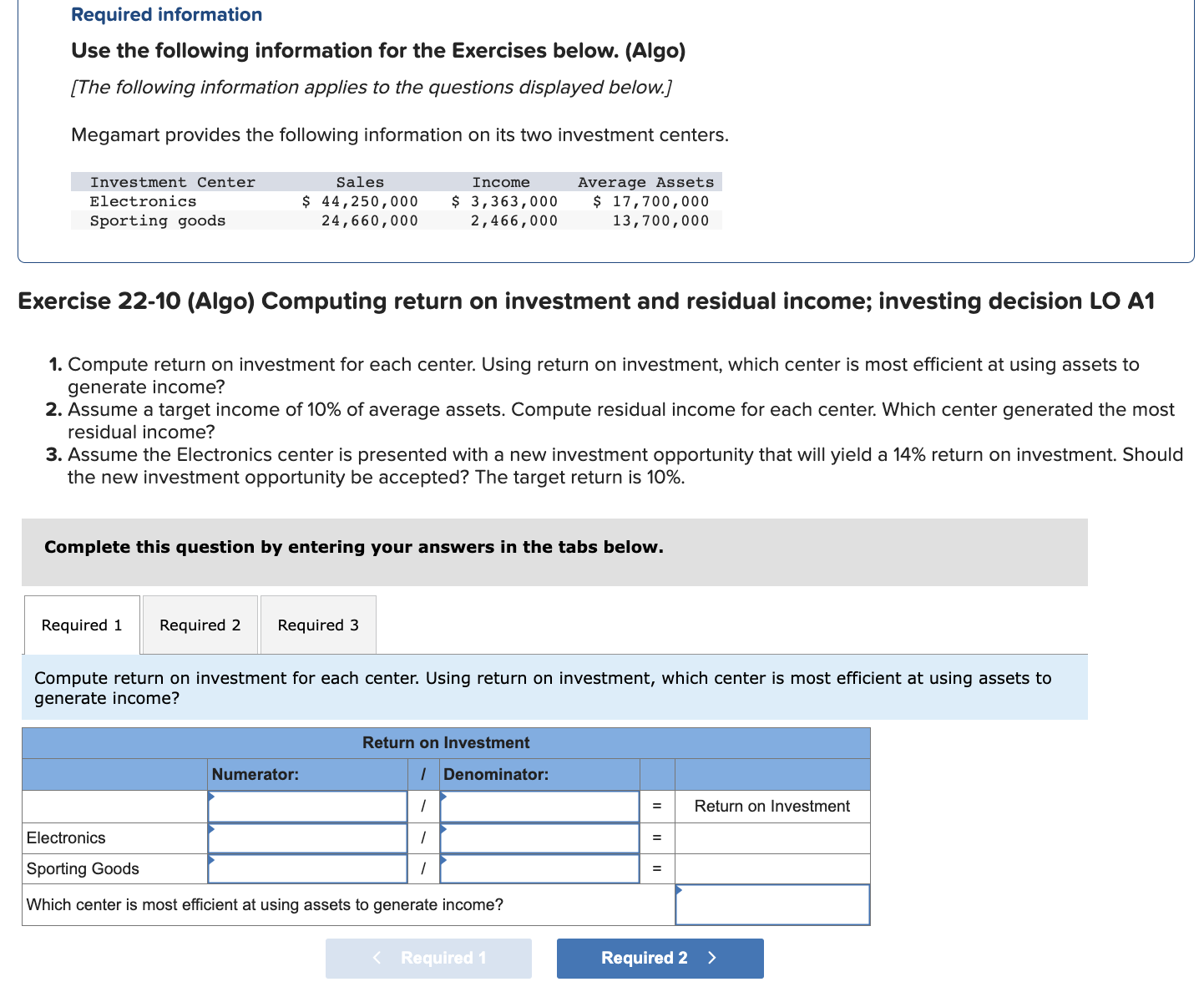

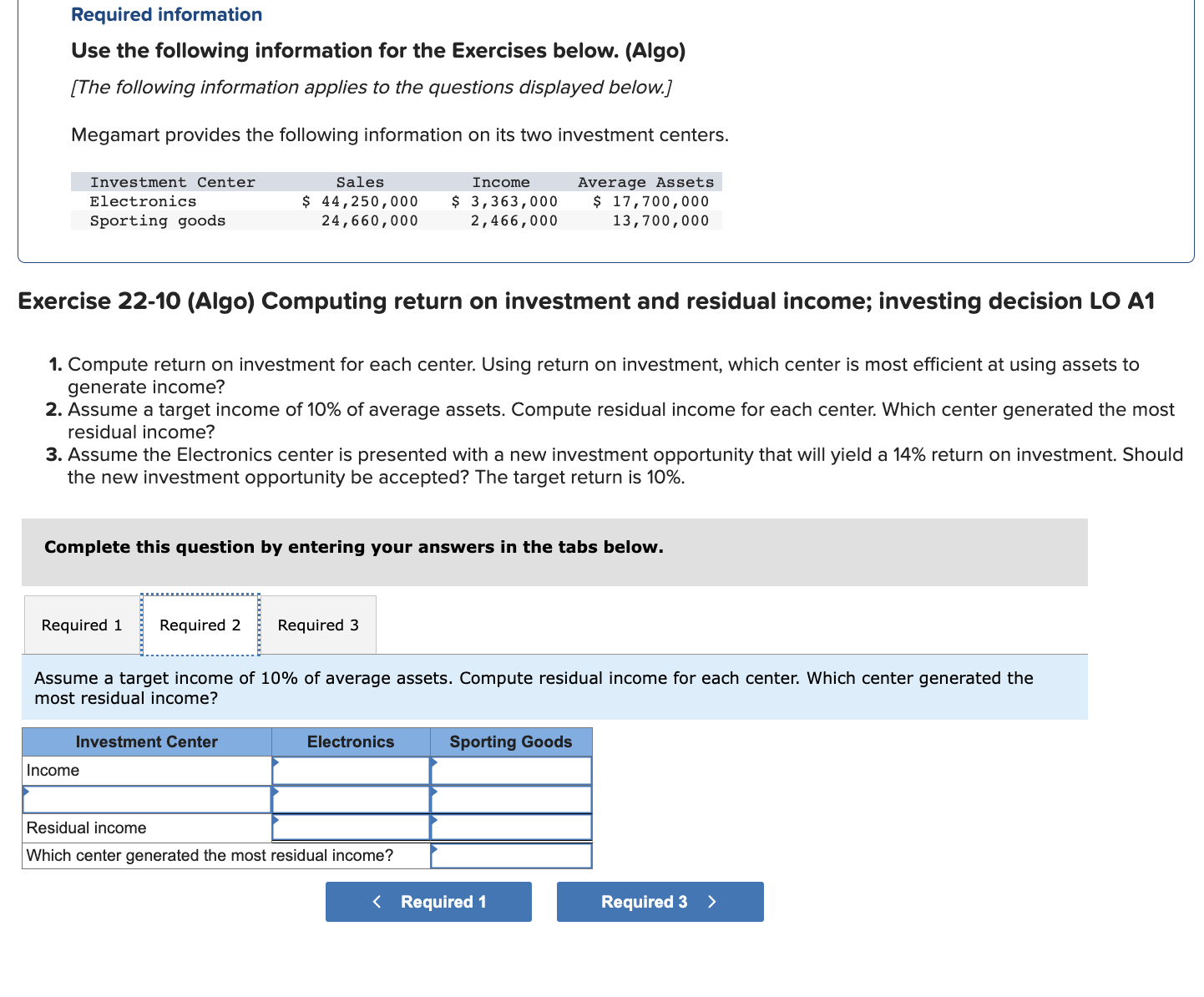

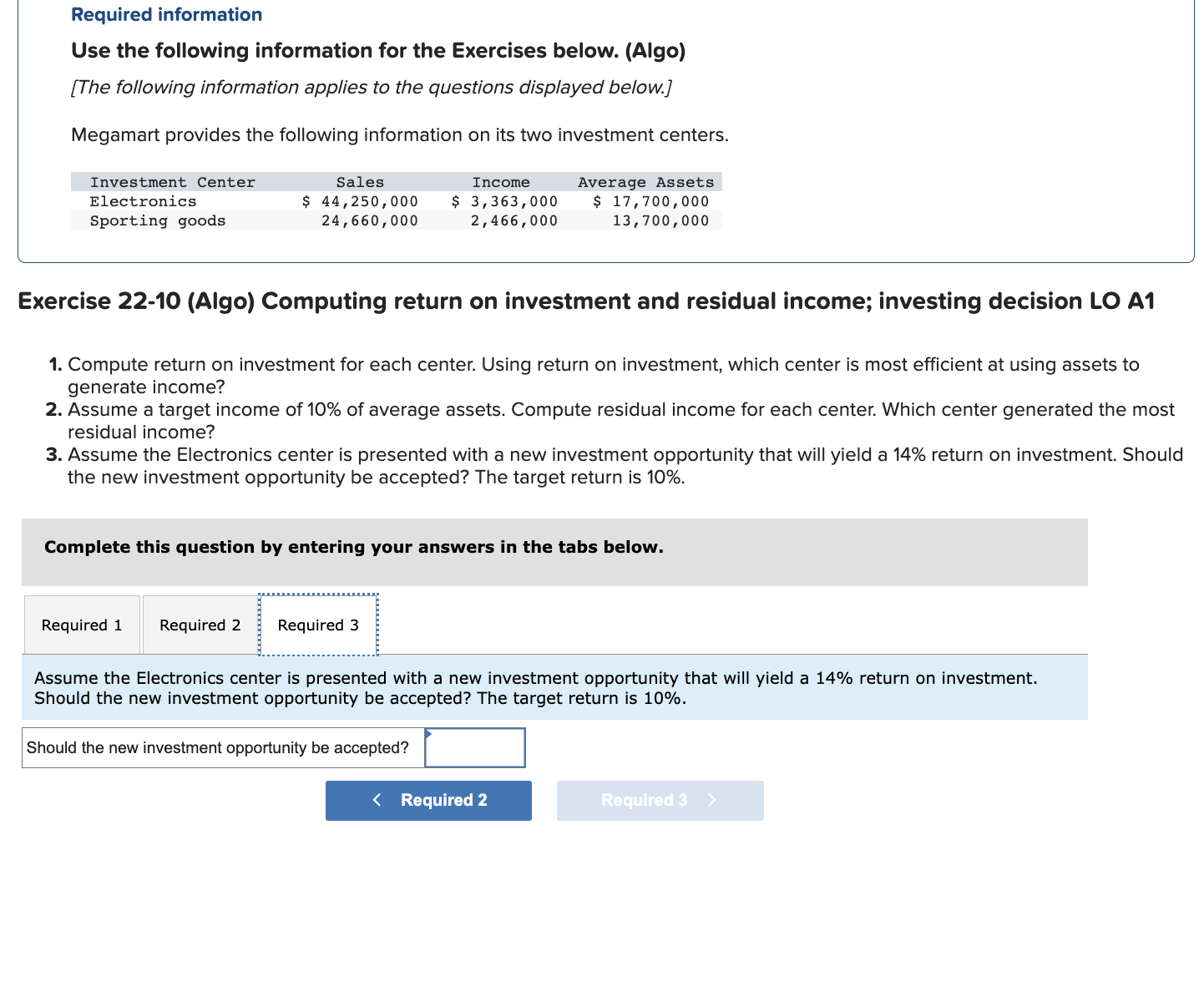

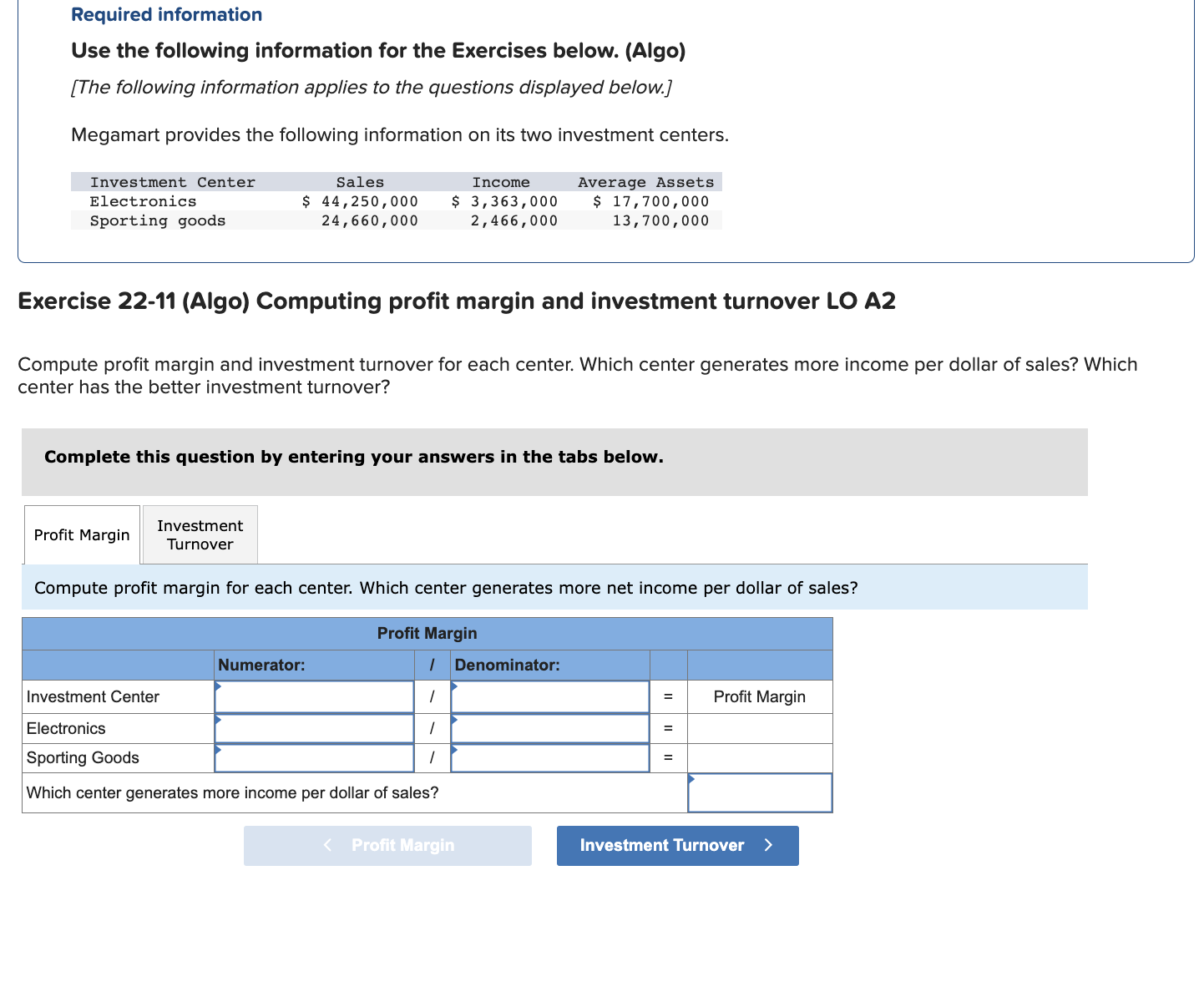

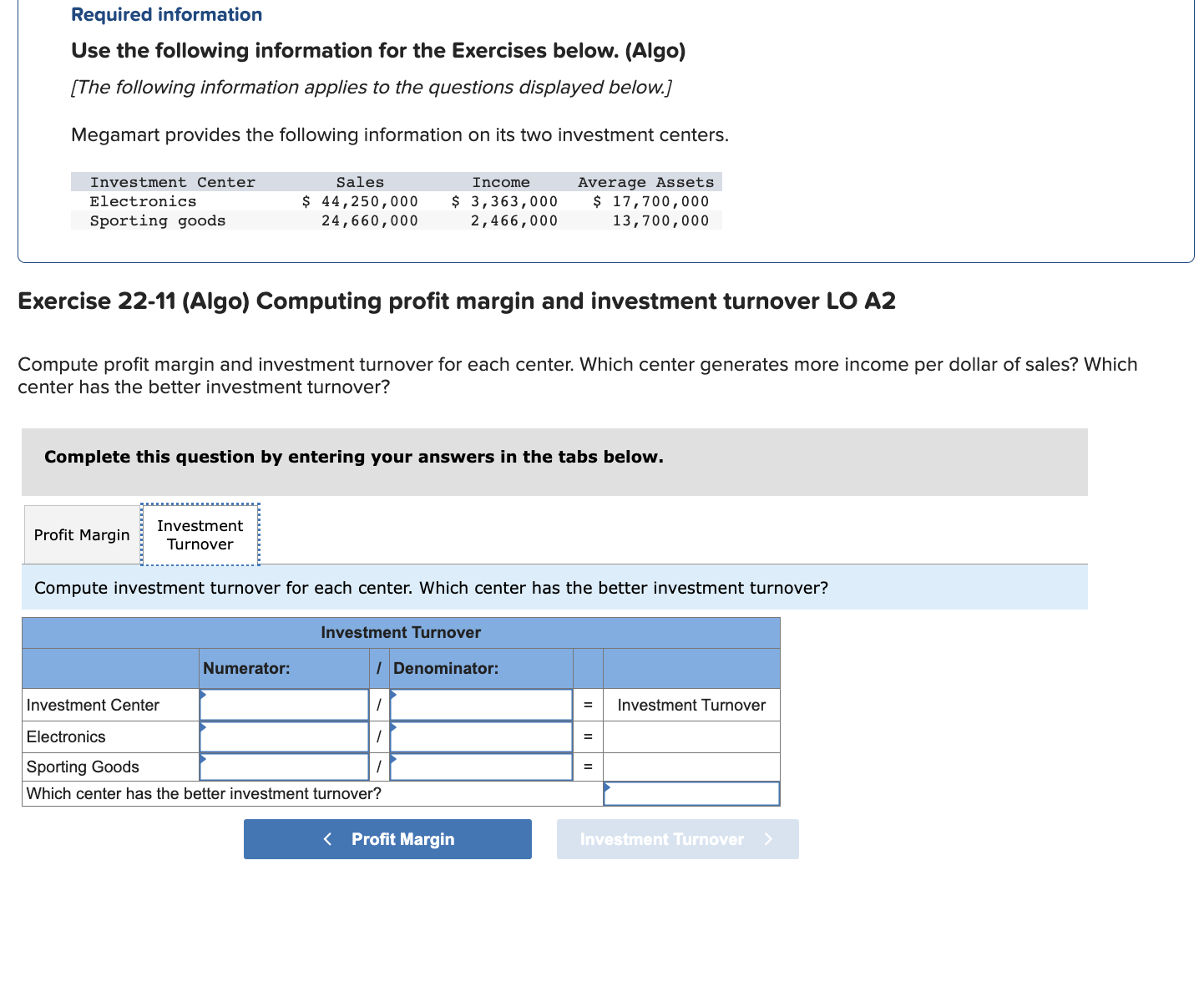

Below are departmental income statements for a guitar manufacturer. The company classifies advertising, rent, and utilities as indirect expenses. The manufacturer is considering eliminating its Electric Guitar department because it shows a loss. Departmental Income Statements For Year Ended December 31 Sales Cost of goods sold Gross profit Expenses Advertising Depreciation-Equipment Salaries Supplies used Rent Utilities Total expenses Income (loss) Electric Acoustic $ 101,700 45,575 $ 84,400 46,750 56,125 37,650 5,015 4,280 10,060 8,560 19,800 17,500 2,000 1,760 7,045 6,030 2,975 2,630 46,895 40,760 $ 9,230 $ (3,110) 1. Prepare a departmental contribution to overhead report. 2. Based on contribution to overhead, should the electric guitar department be eliminated? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare a departmental contribution to overhead report. Departmental Contribution to Overhead For Year Ended December 31 Gross profit Direct expenses Total direct expenses Departmental contribution to overhead Acoustic Electric Combined < Required 1 Required 2 > Below are departmental income statements for a guitar manufacturer. The company classifies advertising, rent, and utilities as indirect expenses. The manufacturer is considering eliminating its Electric Guitar department because it shows a loss. Departmental Income Statements For Year Ended December 31 Sales Cost of goods sold Gross profit Expenses Advertising Depreciation-Equipment Salaries Supplies used Rent Utilities Total expenses Income (loss) Electric Acoustic $ 101,700 45,575 $ 84,400 46,750 56,125 37,650 5,015 4,280 10,060 8,560 19,800 17,500 2,000 1,760 7,045 6,030 2,975 2,630 46,895 40,760 $ 9,230 $ (3,110) 1. Prepare a departmental contribution to overhead report. 2. Based on contribution to overhead, should the electric guitar department be eliminated? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Based on contribution to overhead, should the electric guitar department be eliminated? Based on contribution to overhead, should the electric guitar department be eliminated? < Required 1 Required 2 > Required information Use the following information for the Exercises below. (Algo) [The following information applies to the questions displayed below.] Megamart provides the following information on its two investment centers. Investment Center Electronics Sales Sporting goods $ 44,250,000 24,660,000 Income $ 3,363,000 2,466,000 Average Assets $ 17,700,000 13,700,000 Exercise 22-10 (Algo) Computing return on investment and residual income; investing decision LO A1 1. Compute return on investment for each center. Using return on investment, which center is most efficient at using assets to generate income? 2. Assume a target income of 10% of average assets. Compute residual income for each center. Which center generated the most residual income? 3. Assume the Electronics center is presented with a new investment opportunity that will yield a 14% return on investment. Should the new investment opportunity be accepted? The target return is 10%. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Compute return on investment for each center. Using return on investment, which center is most efficient at using assets to generate income? Return on Investment Numerator: / Denominator: 1 = Return on Investment Electronics Sporting Goods = I = Which center is most efficient at using assets to generate income? < Required 1 Required 2 > Required information Use the following information for the Exercises below. (Algo) [The following information applies to the questions displayed below.] Megamart provides the following information on its two investment centers. Investment Center Electronics Sales Sporting goods $ 44,250,000 24,660,000 Income $ 3,363,000 2,466,000 Average Assets $ 17,700,000 13,700,000 Exercise 22-10 (Algo) Computing return on investment and residual income; investing decision LO A1 1. Compute return on investment for each center. Using return on investment, which center is most efficient at using assets to generate income? 2. Assume a target income of 10% of average assets. Compute residual income for each center. Which center generated the most residual income? 3. Assume the Electronics center is presented with a new investment opportunity that will yield a 14% return on investment. Should the new investment opportunity be accepted? The target return is 10%. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Assume a target income of 10% of average assets. Compute residual income for each center. Which center generated the most residual income? Investment Center Income Electronics Residual income Which center generated the most residual income? Sporting Goods < Required 1 Required 3 > Required information Use the following information for the Exercises below. (Algo) [The following information applies to the questions displayed below.] Megamart provides the following information on its two investment centers. Investment Center Electronics Sales Sporting goods $ 44,250,000 24,660,000 Income $ 3,363,000 2,466,000 Average Assets $ 17,700,000 13,700,000 Exercise 22-10 (Algo) Computing return on investment and residual income; investing decision LO A1 1. Compute return on investment for each center. Using return on investment, which center is most efficient at using assets to generate income? 2. Assume a target income of 10% of average assets. Compute residual income for each center. Which center generated the most residual income? 3. Assume the Electronics center is presented with a new investment opportunity that will yield a 14% return on investment. Should the new investment opportunity be accepted? The target return is 10%. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Assume the Electronics center is presented with a new investment opportunity that will yield a 14% return on investment. Should the new investment opportunity be accepted? The target return is 10%. Should the new investment opportunity be accepted? < Required 2 Required 3 > Required information Use the following information for the Exercises below. (Algo) [The following information applies to the questions displayed below.] Megamart provides the following information on its two investment centers. Investment Center Sales Electronics Sporting goods $ 44,250,000 24,660,000 Income $ 3,363,000 2,466,000 Average Assets $ 17,700,000 13,700,000 Exercise 22-11 (Algo) Computing profit margin and investment turnover LO A2 Compute profit margin and investment turnover for each center. Which center generates more income per dollar of sales? Which center has the better investment turnover? Complete this question by entering your answers in the tabs below. Profit Margin Investment Turnover Compute profit margin for each center. Which center generates more net income per dollar of sales? Numerator: Profit Margin I Denominator: Investment Center / Profit Margin Electronics Sporting Goods 1 Which center generates more income per dollar of sales? < Profit Margin Investment Turnover > Required information Use the following information for the Exercises below. (Algo) [The following information applies to the questions displayed below.] Megamart provides the following information on its two investment centers. Investment Center Sales Electronics Sporting goods $ 44,250,000 24,660,000 Income $ 3,363,000 2,466,000 Average Assets $ 17,700,000 13,700,000 Exercise 22-11 (Algo) Computing profit margin and investment turnover LO A2 Compute profit margin and investment turnover for each center. Which center generates more income per dollar of sales? Which center has the better investment turnover? Complete this question by entering your answers in the tabs below. Profit Margin Investment Turnover Compute investment turnover for each center. Which center has the better investment turnover? Investment Turnover Numerator: / Denominator: Investment Center = Investment Turnover Electronics Sporting Goods Which center has the better investment turnover? < Profit Margin Investment Turnover >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Required 1 Departmental Contribution to Overhead DepartmentGross ProfitDirect ExpensesTotal ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started