Answered step by step

Verified Expert Solution

Question

1 Approved Answer

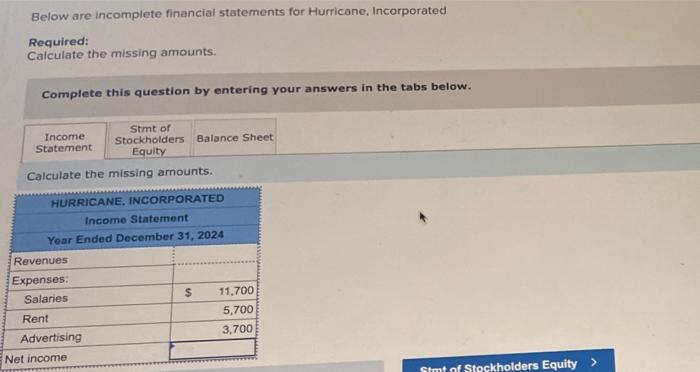

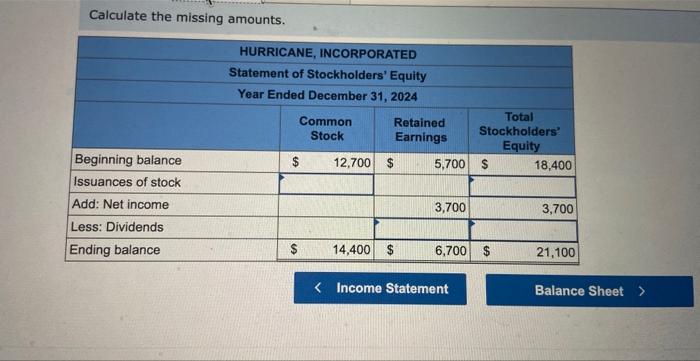

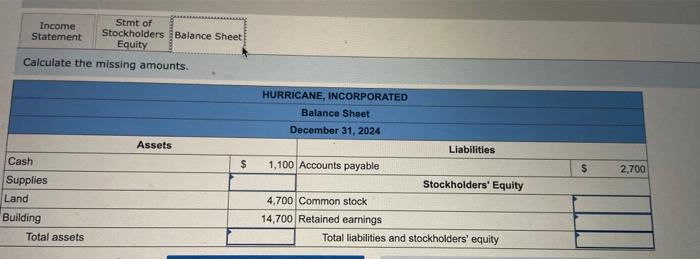

Below are incomplete financial statements for Hurricane, Incorporated Required: Calculate the missing amounts. Complete this question by entering your answers in the tabs below.

Below are incomplete financial statements for Hurricane, Incorporated Required: Calculate the missing amounts. Complete this question by entering your answers in the tabs below. Income Statement Stmt of Stockholders Balance Sheet Equity Calculate the missing amounts. HURRICANE, INCORPORATED Income Statement Year Ended December 31, 2024 Revenues Expenses: Salaries Rent Advertising Net income $ 11,700 5,700 3,700 Stmt of Stockholders Equity > Calculate the missing amounts. HURRICANE, INCORPORATED Statement of Stockholders' Equity Year Ended December 31, 2024 Beginning balance Issuances of stock Add: Net income Common Retained Total Stockholders' Stock Earnings Equity $ 12,700 $ 5,700 $ 18,400 3,700 3,700 Less: Dividends Ending balance $ 14,400 $ 6,700 $ 21,100 < Income Statement Balance Sheet > Stmt of Income Statement Stockholders Balance Sheet Equity Calculate the missing amounts. Cash Supplies Land Building Total assets HURRICANE, INCORPORATED Balance Sheet December 31, 2024 Assets Liabilities $ 1,100 Accounts payable $ 2,700 Stockholders' Equity 4,700 Common stock 14,700 Retained earnings Total liabilities and stockholders' equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Introduction Hurricane Incorporated a growing agency is focused on retaining financial transparency and effective control of its economic statements As part of their annual financial reporting for the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started