Answered step by step

Verified Expert Solution

Question

1 Approved Answer

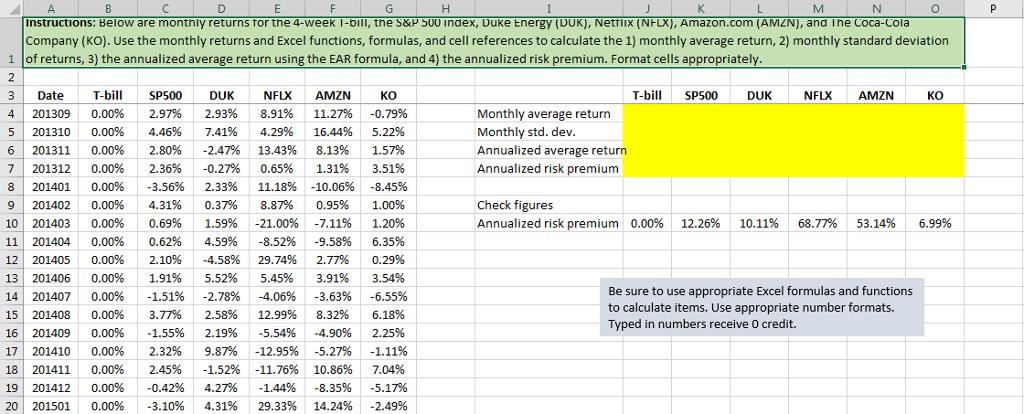

Below are monthly returns for the 4-week T-bill, the S&P 500 index, Duke Energy (DUK), Netflix (NFLX), Amazon.com (AMZN), and The Coca-Cola Company (KO). Use

Below are monthly returns for the 4-week T-bill, the S&P 500 index, Duke Energy (DUK), Netflix (NFLX), Amazon.com (AMZN), and The Coca-Cola Company (KO). Use the monthly returns and Excel functions, formulas, and cell references to calculate the 1) monthly average return, 2) monthly standard deviation of returns, 3) the annualized average return using the EAR formula, and 4) the annualized risk premium. Format cells appropriately.

What formulas to use in order to get the Annualized risk premium.

A B D E F M P Instructions: Below are monthly returns for the 4-week I-bill, the S&P 500 index, Duke Energy (DUK), Netflix (NFLX), Amazon.com (AMZN), and Ihe Coca-Cola Company (KO). Use the monthly returns and Excel functions, formulas, and cell references to calculate the 1) monthly average return, 2) monthly standard deviation 1 of returns, 3) the annualized average return using the EAR formula, and 4) the annualized risk premium. Format cells appropriately. 2 3 Date T-bill SP500 DUK NFLX AMZN T-bill SP500 DUK NFLX AMZN 201309 Monthly average return Monthly std. dev. Annualized average return 4 0.00% 2.97% 2.93% 8.91% 11.27% -0.79% 5 201310 6 201311 7 201312 8 201401 9 201402 10 201403 0.00% 4.46% 7.41% 4.29% 16.44% 5.22% 0.00% 2.80% -2.47% 13.43% 8.13% 1.57% 0.00% 2.36% -0.27% 0.65% 1.31% 3.51% Annualized risk premium 0.00% -3.56% 2.33% 11.18% -10.06% -8.45% 0.00% 4.31% 0.37% 8.87% 0.95% 1.00% Check figures 0.00% 0.69% 1.59% -21.00% -7.11% 1.20% Annualized risk premium 0.00% 12.26% 10.11% 68.77% 53.14% 6.99% 11 201404 12 201405 13 201406 14 201407 15 201408 16 201409 17 201410 18 201411 0.00% 0.62% 4.59% -8.52% -9.58% 6.35% 0.00% 2.10% -4.58% 29.74% 2.77% 0.29% 0.00% 1.91% 5.52% 5.45% 3.91% 3.54% Be sure to use appropriate Excel formulas and functions to calculate items. Use appropriate number formats. Typed in numbers receive O credit. 0.00% -1.51% -2.78% -4.06% -3.63% -6.55% 0.00% 3.77% 2.58% 12.99% 8.32% 6.18% 0.00% -1.55% 2.19% -5.54% -4.90% 2.25% 0.00% 2.32% 9.87% -12.95% -5.27% -1.11% 0.00% 2.45% -1.52% -11.76% 10.86% 7.04% 19 201412 0.00% -0.42% 4.27% -1.44% -8.35% -5.17% 20 201501 0.00% -3.10% 4.31% 29.33% 14.24% -2.49%

Step by Step Solution

★★★★★

3.47 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

Mnthly verge return fr Tbill vergeB4B20 Mnthly std dev fr TbillSTDE...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started