Question

Below are option quotes on Oct 12th for Nov expiration crude oil futures. For now, you can treat these options as if they are on

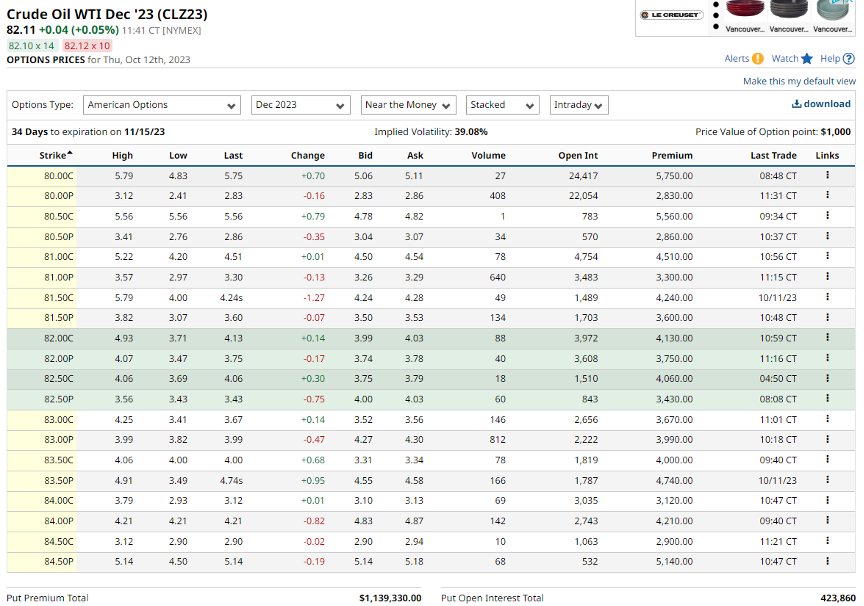

Below are option quotes on Oct 12th for Nov expiration crude oil futures. For now, you can treat these options as if they are on crude oil. How can an oil producer construct a selling price range between $80/barrel and $84? What is the net cost (or net premium) for doing so? How can a refinery construct a purchase price range between $80.5/barrel and $84.5/ barrel? What is the net cost (or net premium) for doing so? Indicate clearly what options you buy and what options you sell. When computing net cost, use ask price if you want to buy the option, use bid price if you want to sell the option.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started