Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Below are ratios for some of the firms that have appeared in this book, for their 2020 fiscal year: Firms Coca-Cola Nike Reebok Hewlett-Packard Dell,

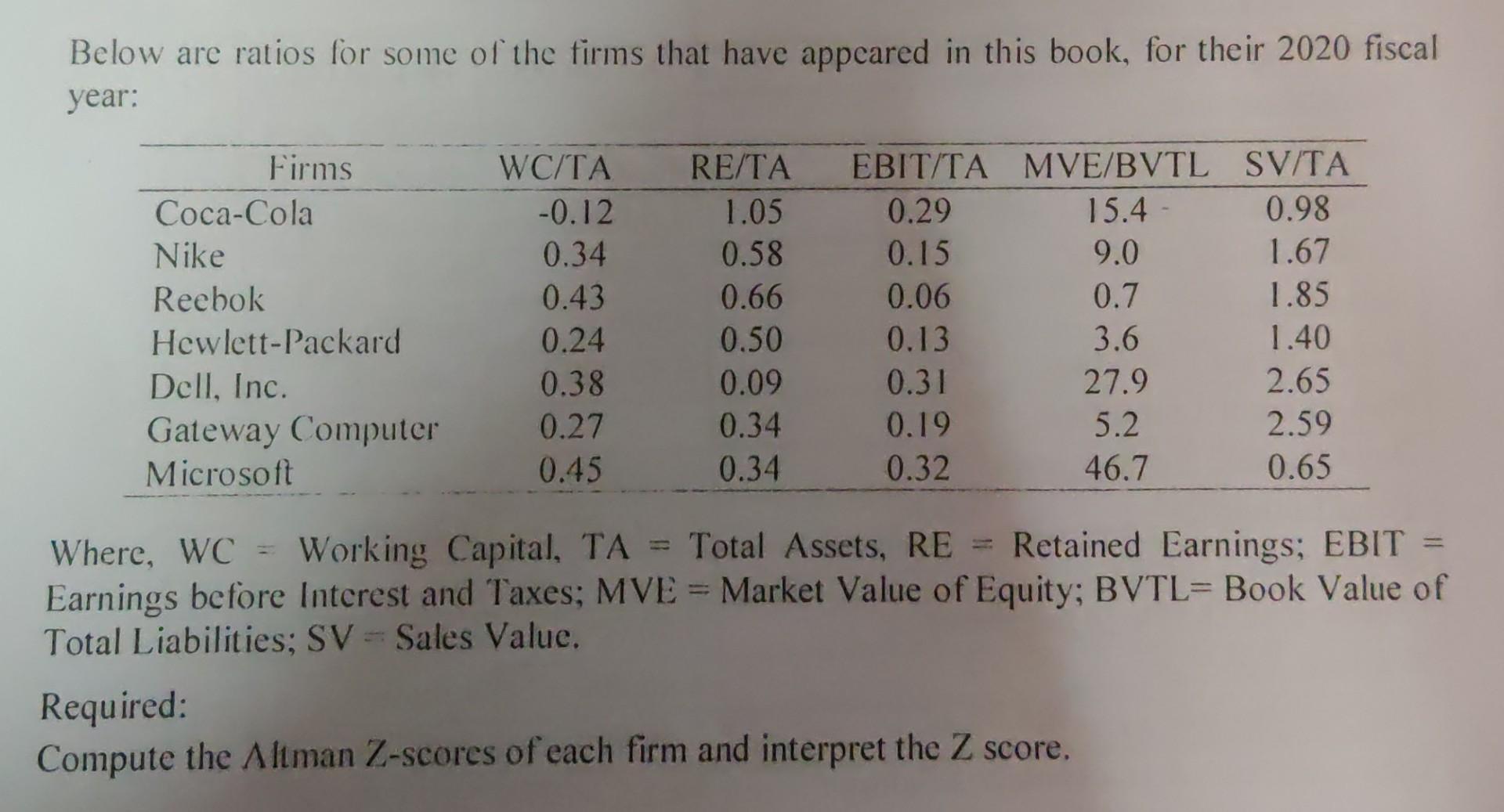

Below are ratios for some of the firms that have appeared in this book, for their 2020 fiscal year: Firms Coca-Cola Nike Reebok Hewlett-Packard Dell, Inc. Gateway Computer Microsoft WC/TA -0.12 0.34 0.43 0.24 0.38 0.27 0.45 RE/TA 1.05 0.58 0.66 0.50 0.09 0.34 0.34 EBIT/TA MVE/BVTL SV/TA / 0.29 15.4 - 0.98 0.15 9.0 1.67 0.06 0.7 1.85 0.13 3.6 1.40 0.31 27.9 2.65 0.19 5.2 2.59 0.32 46.7 0.65 Where, WC = Working Capital, TA = Total Assets, RE = Retained Earnings; EBIT Earnings before Interest and Taxes; MVE = Market Value of Equity; BVTL=Book Value of Total Liabilities; SV - Sales Value. Required: Compute the Altman Z-scores of each firm and interpret the Z score

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started