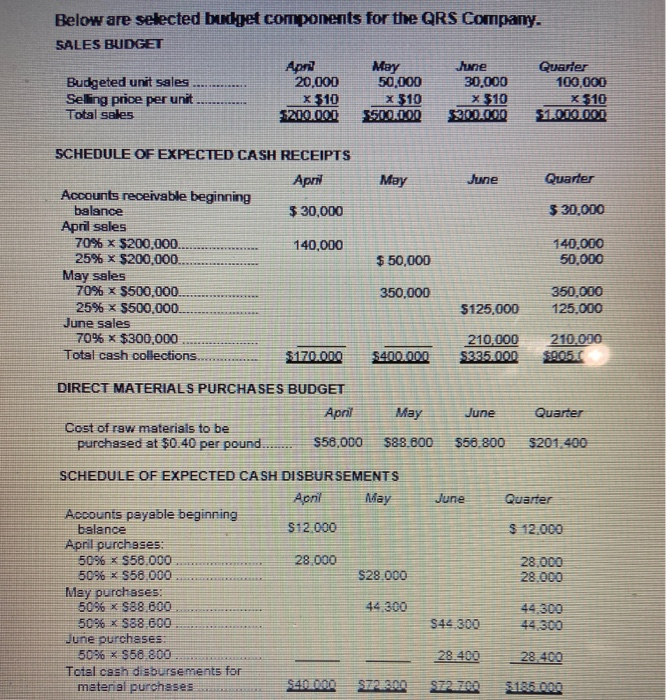

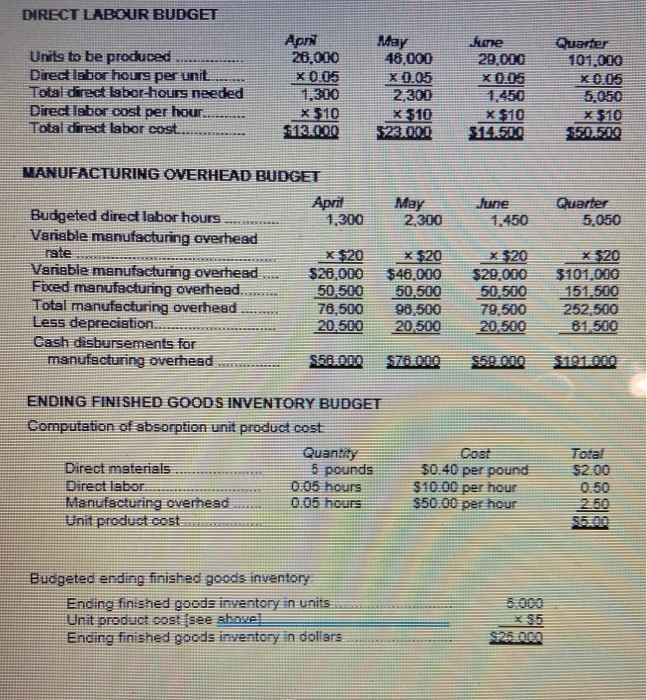

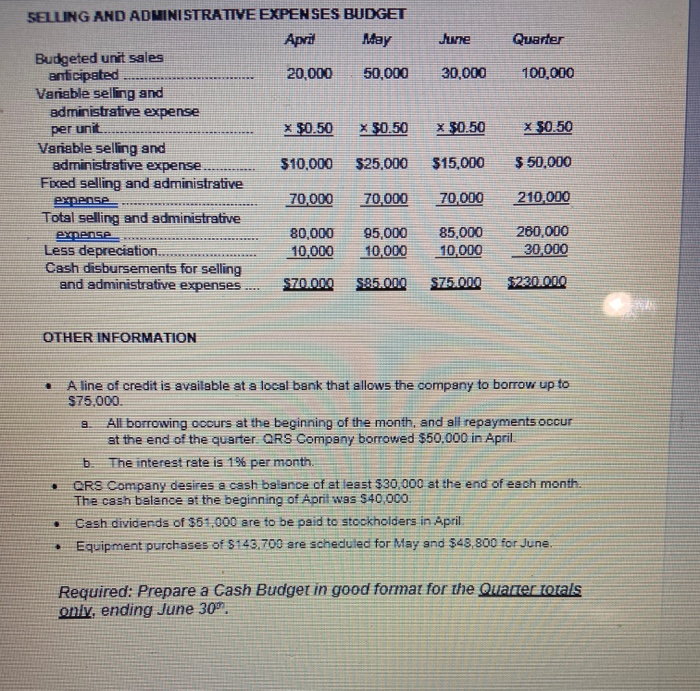

Below are selected budget components for the QRS Company. SALES BUDGET Apr May June Quarter Budgeted unit sales 20.000 50,000 30,000 100,000 Seling price per unit x 510 x 310 x 310 X 510 Total sales 5200,000 5500,000 300,000 May June Quarter $ 30,000 SCHEDULE OF EXPECTED CASH RECEIPTS April Accounts receivable beginning balance $ 30,000 April sales 70% x $200,000 140,000 25% x $200,000 May sales 70% x $500,000. 25% x $500.000 June sales 70% x $300,000 Total cash collections $170.000 140.000 50,000 $ 50,000 350,000 350.000 125,000 $125,000 210.000 $335.000 210,000 $9050 $400.000 DIRECT MATERIALS PURCHASES BUDGET April Cost of raw materials to be purchased at $0.40 per pound. $58.000 May June Quarter $88.800 $50.800 $201.400 June Quarter $ 12.000 SCHEDULE OF EXPECTED CASH DISBURSEMENTS Apni May Accounts payable beginning balance $12.000 April purchases: 50% x S58,000 28.000 509 * $58.000 $28.000 May purchases: 60% x 988.600 44 300 50% X $88,600 June purchases 50% * $50.800 Total cash disbursements for material purchases S200,00 28.000 28.000 44.300 $42.300 28.400 28.400 53185.000 DIRECT LABOUR BUDGET Apri 28.000 Units to be produced Direct labor hours per unit Total direct labor-hours needed Direct labor cost per hour. Total direct labor cost. 1.300 x $10 $12.000 May 48,000 X 0.05 2.300 x 510 5722.000 June 29,000 X0.05 1.450 x $10 31450.0 Quarter 101,000 X 0.05 5,050 X 510 550.500 May 2.300 June 1,450 Quarter 5,050 MANUFACTURING OVERHEAD BUDGET April Budgeted direct labor hours 1.300 Variable manufacturing overhead rate X $20 Variable manufacturing overhead $20,000 Fixed manufacturing overhead. 50.500 Total manufacturing overhead 78,500 Less depreciation... 20.500 Cash disbursements for manufacturing overhead $68.0.0.0 * $20 $46.000 50.500 96,500 20.500 X 520 $29.000 50.500 79.500 20.500 2520 3101.000 151.500 252,500 81 500 $78.000 ENDING FINISHED GOODS INVENTORY BUDGET Computation of absorption unit product cost Quantity Direct materials 5 pounds Direct labor 0.05 hours Manufacturing overhead 0.05 hours Unit product cost Cost $0.40 per pound $10.00 per hour $50.00 per hour Total $2.00 0.50 Budgeted ending finished goods inventory Encing finished goods inventory in units Unit product cost (see atawe! Ending finished goods inventory in dollars *55 May June Quarter 30,000 100,000 per unit x 30.50 X 50.50 SELUNG AND ADMINISTRATIVE EXPENSES BUDGET April Budgeted unit sales anticipated 20.000 50.000 Variable selling and administrative expense x $0.50 x 30.50 Vanable selling and administrative expense. $10.000 $25.000 Fixed selling and administrative expense 70,000 70,000 Total selling and administrative expense 80,000 95,000 Less depreciation....... 10,000 10,000 Cash disbursements for selling and administrative expenses $70.000 $85.00.0 $15,000 $ 50.000 70,000 210,000 85,000 10,000 260,000 30.000 $75.00.0 $220.000 OTHER INFORMATION A line of credit is available at a local bank that allows the company to borrow up to $75,000 9 All borrowing occurs at the beginning of the month, and all repayments occur at the end of the quarter. QRS Company borrowed $50,000 in April b The interest rate is 1% per month. QRS Company desires a cash balance of at least $30,000 at the end of each month. The cash balance et the beginning of April was $40,000 Cash dividends of $61,000 are to be paid to stockholders in April + Equipment purchases of $143.700 are scheduled for May and $48,800 for June. Required: Prepare a Cash Budget in good formar for the Quarter totals only, ending June 30