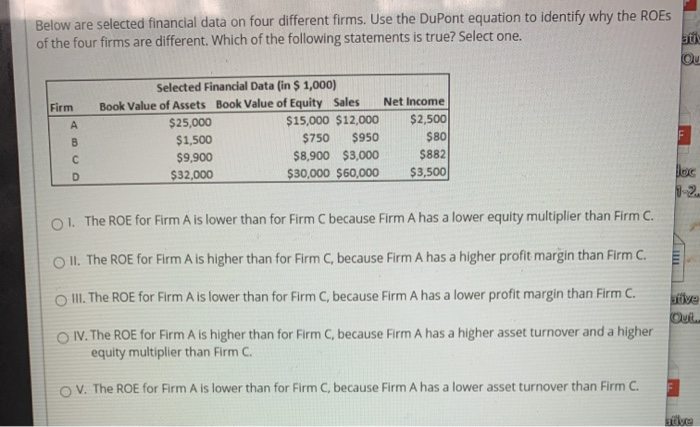

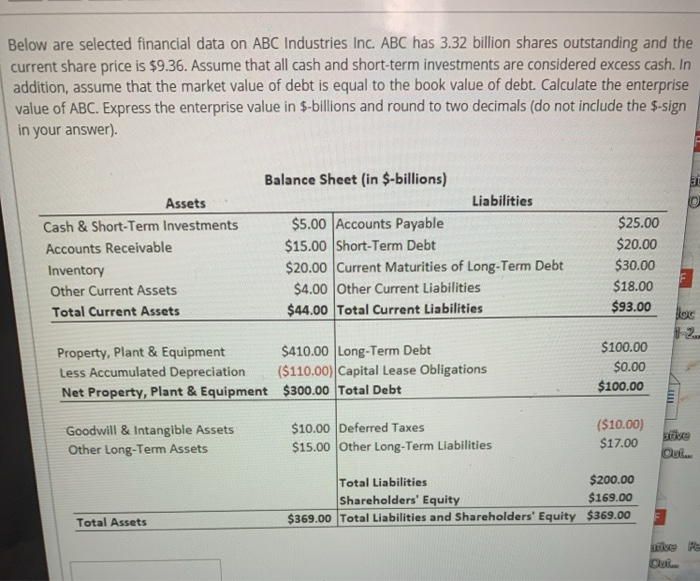

Below are selected financial data on four different firms. Use the DuPont equation to identify why the ROES of the four firms are different. Which of the following statements is true? Select one. at Firm B D Selected Financial Data (in $1,000) Book Value of Assets Book Value of Equity Sales Net Income $25,000 $15,000 $12,000 $2,500 $1,500 $750 $950 $9,900 $8,900 $3,000 $882 $32,000 $30,000 $60,000 $3,500 $80 lloc 1-2 01. The ROE for Firm A is lower than for Firm C because Firm A has a lower equity multiplier than Firm C. O II. The ROE for Firm A is higher than for Firm C, because Firm A has a higher profit margin than Firm C. ative Out o II. The ROE for Firm A is lower than for Firm C, because Firm A has a lower profit margin than Firm C. O IV. The ROE for Firm A is higher than for Firm C, because Firm A has a higher asset turnover and a higher equity multiplier than Firm C. OV. The ROE for Firm A is lower than for Firm C, because Firm A has a lower asset turnover than Firm C. Below are selected financial data on ABC Industries Inc. ABC has 3.32 billion shares outstanding and the current share price is $9.36. Assume that all cash and short-term investments are considered excess cash. In addition, assume that the market value of debt is equal to the book value of debt. Calculate the enterprise value of ABC. Express the enterprise value in $-billions and round to two decimals (do not include the $-sign in your answer). Assets Cash & Short-Term Investments Accounts Receivable Inventory Other Current Assets Total Current Assets Balance Sheet (in $-billions) Liabilities $5.00 Accounts Payable $15.00 Short-Term Debt $20.00 Current Maturities of Long-Term Debt $4.00 Other Current Liabilities $44.00 Total Current Liabilities $25.00 $20.00 $30.00 $18.00 $93.00 1-2. Property, Plant & Equipment $410.00 Long-Term Debt Less Accumulated Depreciation ($110.00) Capital Lease Obligations Net Property, Plant & Equipment $300.00 Total Debt $100.00 $0.00 $100.00 Goodwill & Intangible Assets Other Long-Term Assets $10.00 Deferred Taxes $15.00 Other Long-Term Liabilities ($10.00) $17.00 Out Total Liabilities $200.00 Shareholders' Equity $169.00 $369.00 Total Liabilities and Shareholders' Equity $369.00 Total Assets ative Re Out