Answered step by step

Verified Expert Solution

Question

1 Approved Answer

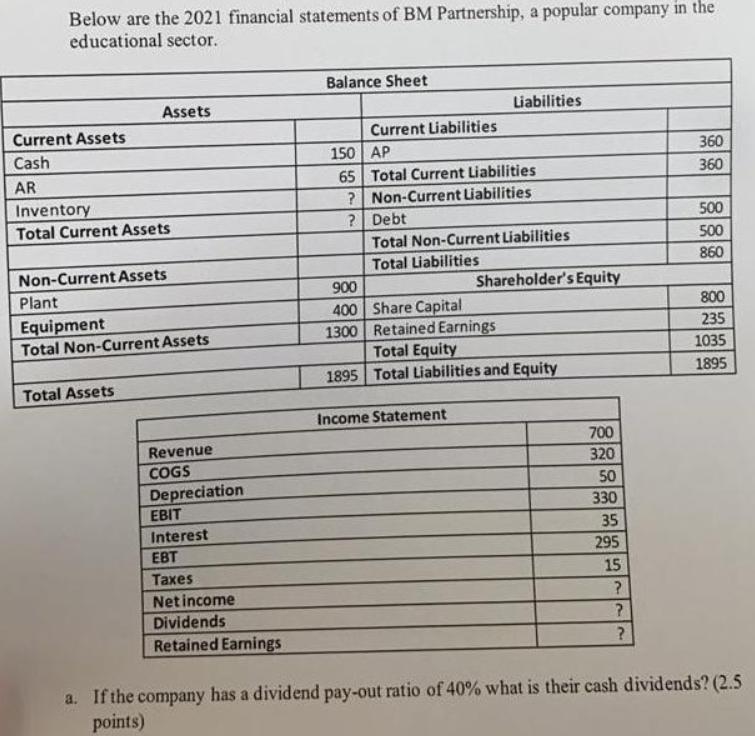

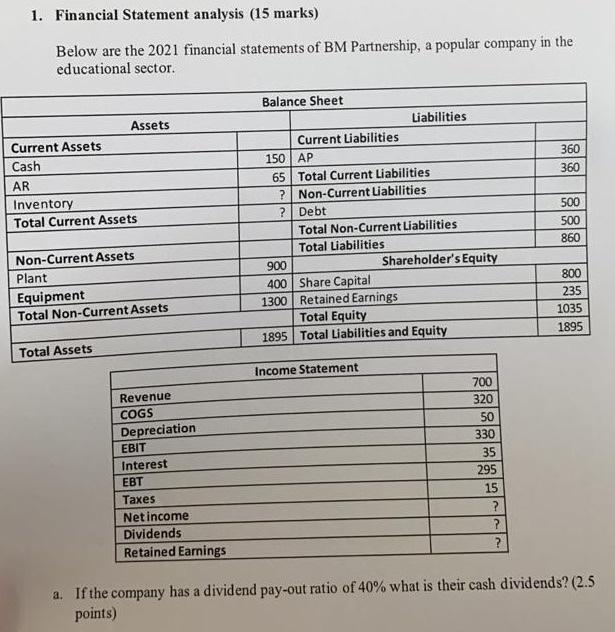

Below are the 2021 financial statements of BM Partnership, a popular company in the educational sector. Balance Sheet Assets Liabilities Current Liabilities 150 AP

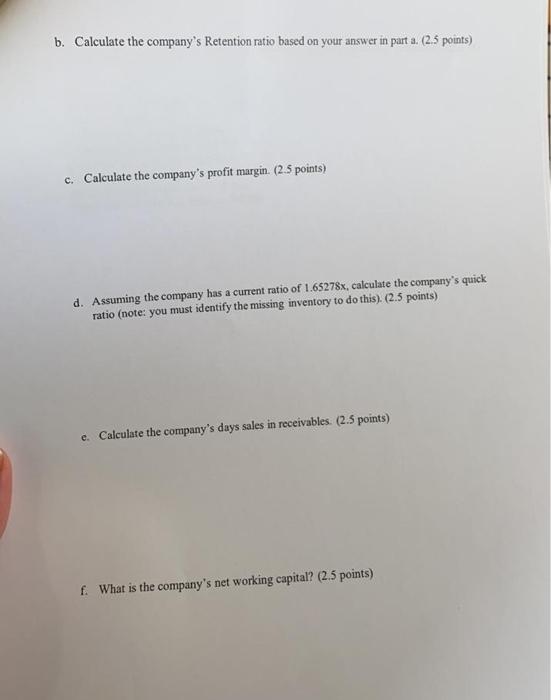

Below are the 2021 financial statements of BM Partnership, a popular company in the educational sector. Balance Sheet Assets Liabilities Current Liabilities 150 AP 65 Total Current Liabilities ? Non-Current Liabilities ? Debt Current Assets Cash 360 360 AR Inventory 500 Total Current Assets Total Non-Current Liabilities 500 Total Liabilities 860 Non-Current Assets 900 Shareholder's Equity Plant 400 Share Capital 1300 Retained Earnings Total Equity 1895 Total Liabilities and Equity 800 Equipment 235 Total Non-Current Assets 1035 1895 Total Assets Income Statement 700 Revenue COGS 320 50 Depreciation EBIT 330 35 295 Interest EBT Taxes 15 Netincome Dividends Retained Earnings a. If the company has a dividend pay-out ratio of 40% what is their cash dividends? (2.5 points) 1. Financial Statement analysis (15 marks) Below are the 2021 financial statements of BM Partnership, a popular company in the educational sector. Balance Sheet Assets Liabilities Current Assets Current Liabilities Cash 150 | AP 65 Total Current Liabilities ? Non-Current Liabilities 360 AR 360 Inventory Total Current Assets Debt 500 Total Non-Current Liabilities 500 Non-Current Assets Total Liabilities 860 900 Shareholder's Equity Plant 400 Share Capital 1300 | Retained Earnings Total Equity 1895 Total Liabilities and Equity 800 Equipment Total Non-Current Assets 235 1035 1895 Total Assets Income Statement 700 Revenue 320 COGS 50 Depreciation EBIT 330 Interest 35 EBT 295 es 15 Net income Dividends Retained Earnings a. If the company has a dividend pay-out ratio of 40% what is their cash dividends? (2.5 points) b. Calculate the company's Retention ratio based on your answer in part a. (2.5 points) c. Calculate the company's profit margin. (2.5 points) d. Assuming the company has a current ratio of 1.65278x, calculate the company's quick ratio (note: you must identify the missing inventory to do this). (2.5 points) e. Calculate the company's days sales in receivables. (2.5 points) f. What is the company's net working capital? (2.5 points) Below are the 2021 financial statements of BM Partnership, a popular company in the educational sector. Balance Sheet Assets Liabilities Current Liabilities 150 AP 65 Total Current Liabilities ? Non-Current Liabilities ? Debt Current Assets Cash 360 360 AR Inventory 500 Total Current Assets Total Non-Current Liabilities 500 Total Liabilities 860 Non-Current Assets 900 Shareholder's Equity Plant 400 Share Capital 1300 Retained Earnings Total Equity 1895 Total Liabilities and Equity 800 Equipment 235 Total Non-Current Assets 1035 1895 Total Assets Income Statement 700 Revenue COGS 320 50 Depreciation EBIT 330 35 295 Interest EBT Taxes 15 Netincome Dividends Retained Earnings a. If the company has a dividend pay-out ratio of 40% what is their cash dividends? (2.5 points) 1. Financial Statement analysis (15 marks) Below are the 2021 financial statements of BM Partnership, a popular company in the educational sector. Balance Sheet Assets Liabilities Current Assets Current Liabilities Cash 150 | AP 65 Total Current Liabilities ? Non-Current Liabilities 360 AR 360 Inventory Total Current Assets Debt 500 Total Non-Current Liabilities 500 Non-Current Assets Total Liabilities 860 900 Shareholder's Equity Plant 400 Share Capital 1300 | Retained Earnings Total Equity 1895 Total Liabilities and Equity 800 Equipment Total Non-Current Assets 235 1035 1895 Total Assets Income Statement 700 Revenue 320 COGS 50 Depreciation EBIT 330 Interest 35 EBT 295 es 15 Net income Dividends Retained Earnings a. If the company has a dividend pay-out ratio of 40% what is their cash dividends? (2.5 points) b. Calculate the company's Retention ratio based on your answer in part a. (2.5 points) c. Calculate the company's profit margin. (2.5 points) d. Assuming the company has a current ratio of 1.65278x, calculate the company's quick ratio (note: you must identify the missing inventory to do this). (2.5 points) e. Calculate the company's days sales in receivables. (2.5 points) f. What is the company's net working capital? (2.5 points) Below are the 2021 financial statements of BM Partnership, a popular company in the educational sector. Balance Sheet Assets Liabilities Current Liabilities 150 AP 65 Total Current Liabilities ? Non-Current Liabilities ? Debt Current Assets Cash 360 360 AR Inventory 500 Total Current Assets Total Non-Current Liabilities 500 Total Liabilities 860 Non-Current Assets 900 Shareholder's Equity Plant 400 Share Capital 1300 Retained Earnings Total Equity 1895 Total Liabilities and Equity 800 Equipment 235 Total Non-Current Assets 1035 1895 Total Assets Income Statement 700 Revenue COGS 320 50 Depreciation EBIT 330 35 295 Interest EBT Taxes 15 Netincome Dividends Retained Earnings a. If the company has a dividend pay-out ratio of 40% what is their cash dividends? (2.5 points) 1. Financial Statement analysis (15 marks) Below are the 2021 financial statements of BM Partnership, a popular company in the educational sector. Balance Sheet Assets Liabilities Current Assets Current Liabilities Cash 150 | AP 65 Total Current Liabilities ? Non-Current Liabilities 360 AR 360 Inventory Total Current Assets Debt 500 Total Non-Current Liabilities 500 Non-Current Assets Total Liabilities 860 900 Shareholder's Equity Plant 400 Share Capital 1300 | Retained Earnings Total Equity 1895 Total Liabilities and Equity 800 Equipment Total Non-Current Assets 235 1035 1895 Total Assets Income Statement 700 Revenue 320 COGS 50 Depreciation EBIT 330 Interest 35 EBT 295 es 15 Net income Dividends Retained Earnings a. If the company has a dividend pay-out ratio of 40% what is their cash dividends? (2.5 points) b. Calculate the company's Retention ratio based on your answer in part a. (2.5 points) c. Calculate the company's profit margin. (2.5 points) d. Assuming the company has a current ratio of 1.65278x, calculate the company's quick ratio (note: you must identify the missing inventory to do this). (2.5 points) e. Calculate the company's days sales in receivables. (2.5 points) f. What is the company's net working capital? (2.5 points) Below are the 2021 financial statements of BM Partnership, a popular company in the educational sector. Balance Sheet Assets Liabilities Current Liabilities 150 AP 65 Total Current Liabilities ? Non-Current Liabilities ? Debt Current Assets Cash 360 360 AR Inventory 500 Total Current Assets Total Non-Current Liabilities 500 Total Liabilities 860 Non-Current Assets 900 Shareholder's Equity Plant 400 Share Capital 1300 Retained Earnings Total Equity 1895 Total Liabilities and Equity 800 Equipment 235 Total Non-Current Assets 1035 1895 Total Assets Income Statement 700 Revenue COGS 320 50 Depreciation EBIT 330 35 295 Interest EBT Taxes 15 Netincome Dividends Retained Earnings a. If the company has a dividend pay-out ratio of 40% what is their cash dividends? (2.5 points) 1. Financial Statement analysis (15 marks) Below are the 2021 financial statements of BM Partnership, a popular company in the educational sector. Balance Sheet Assets Liabilities Current Assets Current Liabilities Cash 150 | AP 65 Total Current Liabilities ? Non-Current Liabilities 360 AR 360 Inventory Total Current Assets Debt 500 Total Non-Current Liabilities 500 Non-Current Assets Total Liabilities 860 900 Shareholder's Equity Plant 400 Share Capital 1300 | Retained Earnings Total Equity 1895 Total Liabilities and Equity 800 Equipment Total Non-Current Assets 235 1035 1895 Total Assets Income Statement 700 Revenue 320 COGS 50 Depreciation EBIT 330 Interest 35 EBT 295 es 15 Net income Dividends Retained Earnings a. If the company has a dividend pay-out ratio of 40% what is their cash dividends? (2.5 points) b. Calculate the company's Retention ratio based on your answer in part a. (2.5 points) c. Calculate the company's profit margin. (2.5 points) d. Assuming the company has a current ratio of 1.65278x, calculate the company's quick ratio (note: you must identify the missing inventory to do this). (2.5 points) e. Calculate the company's days sales in receivables. (2.5 points) f. What is the company's net working capital? (2.5 points)

Step by Step Solution

★★★★★

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Answers A 112 B 60 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started