Answered step by step

Verified Expert Solution

Question

1 Approved Answer

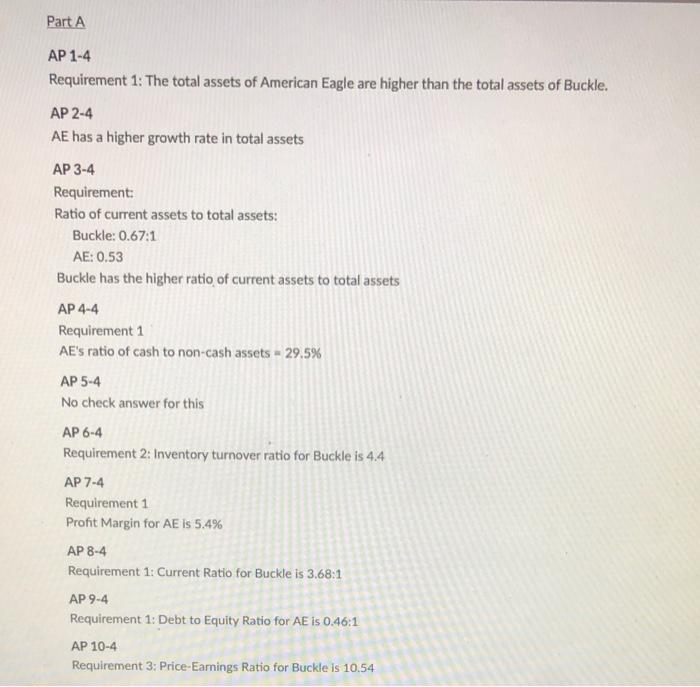

below are the calculations for part A Part B You are the junior investment advisor of BuckEagle, Inc., a local investment company that has been

below are the calculations for part A

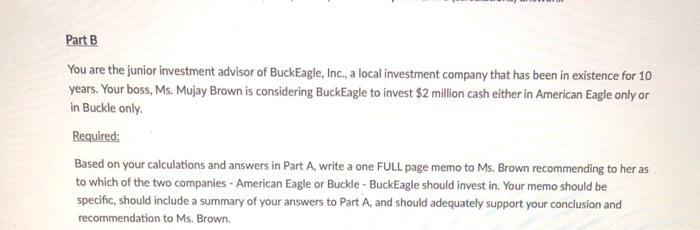

Part B You are the junior investment advisor of BuckEagle, Inc., a local investment company that has been in existence for 10 years. Your boss, Ms. Mujay Brown is considering BuckEagle to invest $2 million cash either in American Eagle only in Buckle only. Required: Based on your calculations and answers in Part A, write a one FULL page memo to Ms. Brown recommending to her as to which of the two companies - American Eagle or Buckle - BuckEagle should invest in. Your memo should be specific, should include a summary of your answers to Part A, and should adequately support your conclusion and recommendation to Ms. Brown.

Step by Step Solution

★★★★★

3.54 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Part A Part B MEMORANDUM To Ms Mujay Brown CEO of BuckEagle Inc From Your Name Junior Investment Advisor Date Date Subject Recommendation for Investme...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started