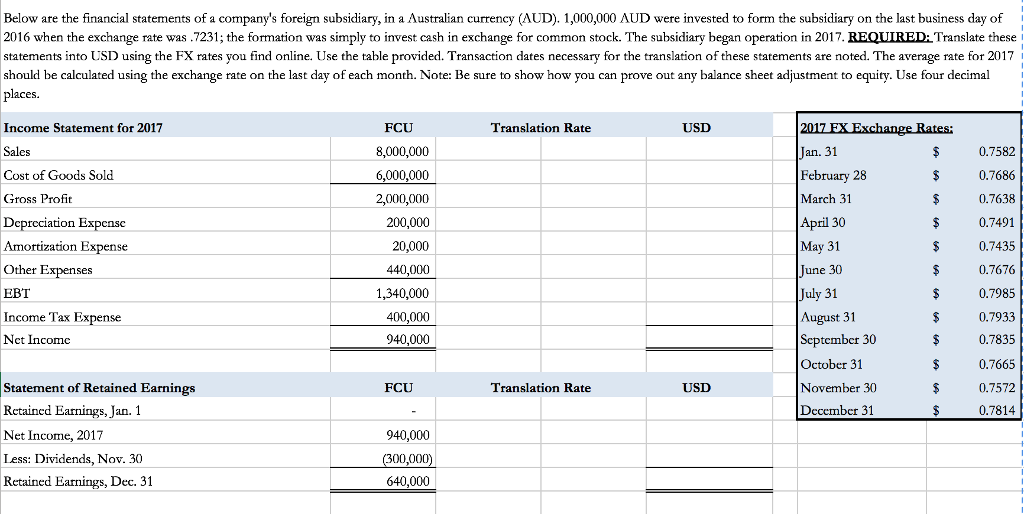

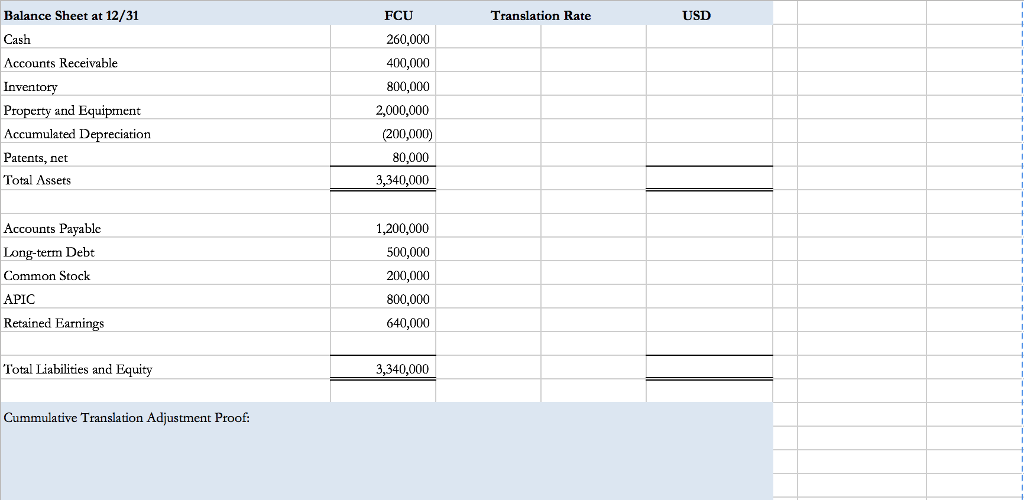

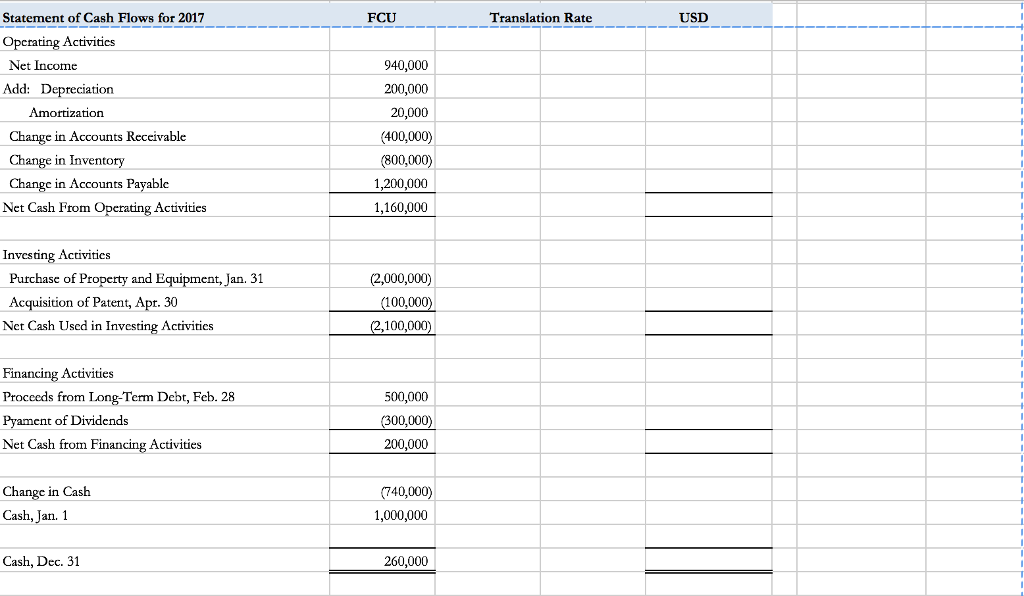

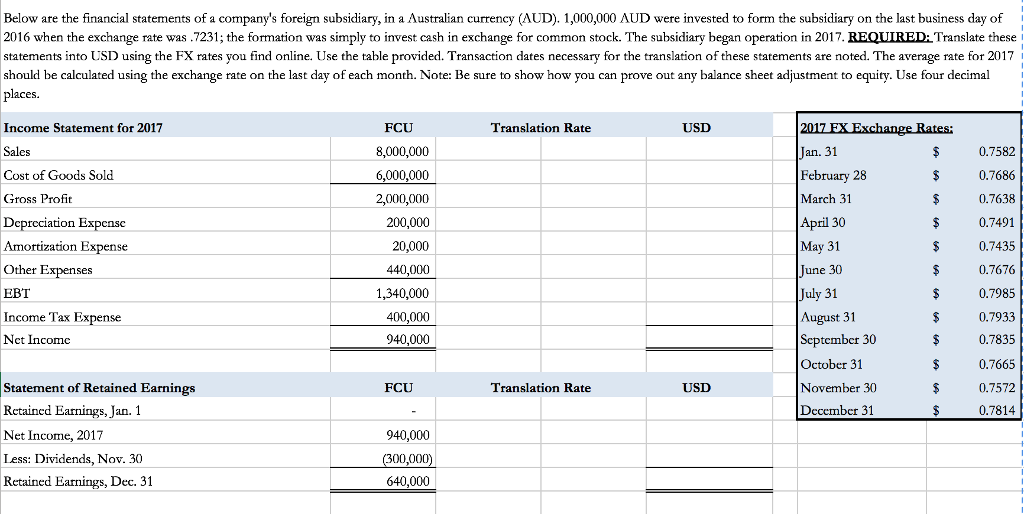

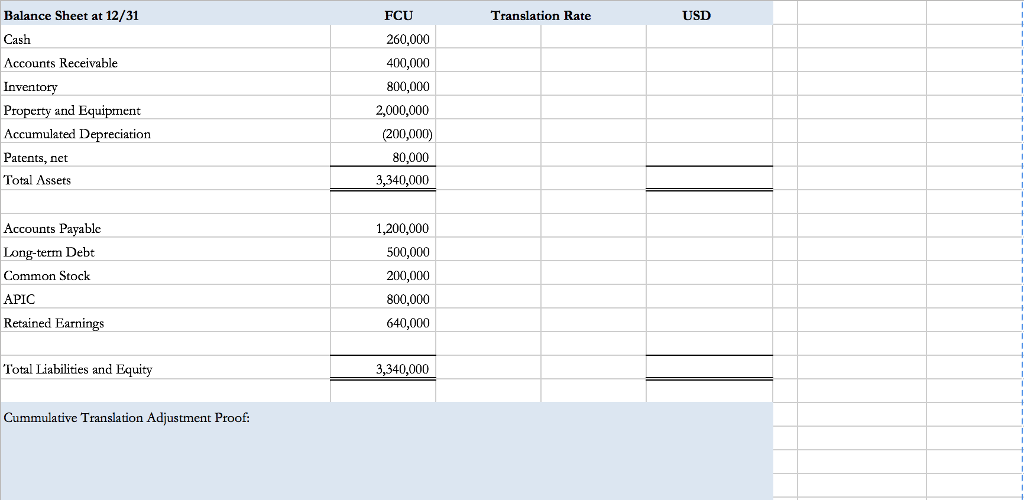

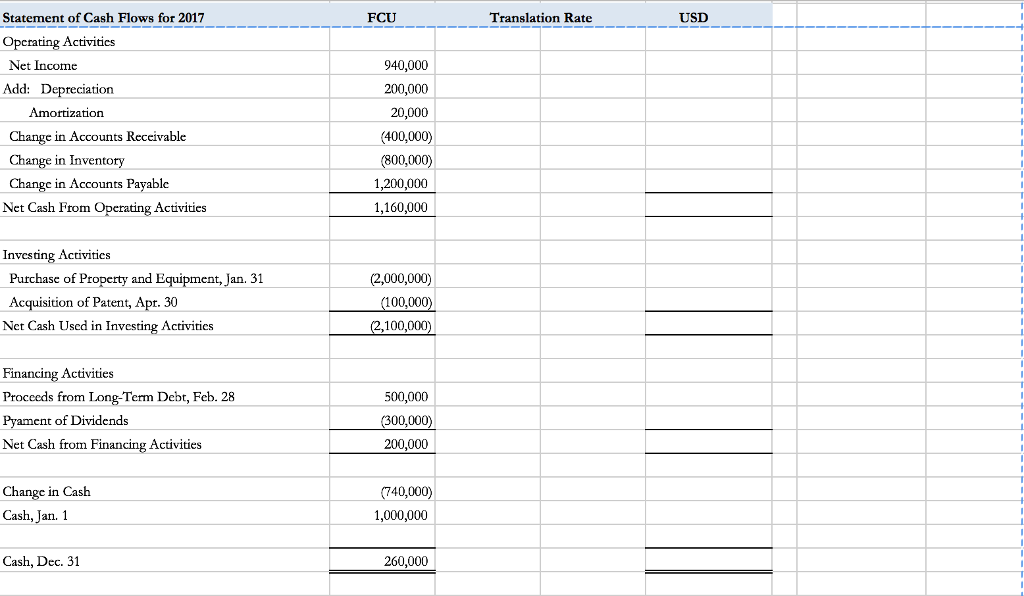

Below are the financial statements of a company's foreign subsidiary, in a Australian currency (AUD). 1,000,000 AUD were invested to form the subsidiary on the last business day of I 2016 when the exchange rate was .7231; the formation was simply to invest cash in exchange for common stock. The subsidiary began operation in 2017. REQUIRED:Translate thesei statements into USD using the FX rates you find online. Use the table provided. Transaction dates necessary for the translation of these statements are noted. The average rate for 2017 i should be calculated using the exchange rate on the last day of each month. Note: Be sure to show how you can prove out any balance sheet adjustment to equity. Use four decimal places. Translation Rate USD Income Statement for 2017 Sales Cost of Goods Sold Gross Profit Depreciation Expcnsc Amortization Expense Other Expenses EBT Income Tax Expense Net Incomc FCU 8,000,000 6,000,000 2,000,000 200,000 20,000 440,000 1,340,000 400,000 940,000 0.7582 0.7686 0.7638 0.7491 0.7435 0.7676 0.7985 0.7933 0.7835 0.7665 0.7572 0.7814 an. February 28 March 31 April 30 May 31 une July 31 August 31 Scptember 30 October 31 November 30 Decembcr 31 Statement of Retained Earnings Retained Earnings, Jan. 1 Net Income, 2017 Less: Dividends, Nov. 30 Retained Earnings, Dec. 31 FCU Translation Rate USD 940,000 640,000 Below are the financial statements of a company's foreign subsidiary, in a Australian currency (AUD). 1,000,000 AUD were invested to form the subsidiary on the last business day of I 2016 when the exchange rate was .7231; the formation was simply to invest cash in exchange for common stock. The subsidiary began operation in 2017. REQUIRED:Translate thesei statements into USD using the FX rates you find online. Use the table provided. Transaction dates necessary for the translation of these statements are noted. The average rate for 2017 i should be calculated using the exchange rate on the last day of each month. Note: Be sure to show how you can prove out any balance sheet adjustment to equity. Use four decimal places. Translation Rate USD Income Statement for 2017 Sales Cost of Goods Sold Gross Profit Depreciation Expcnsc Amortization Expense Other Expenses EBT Income Tax Expense Net Incomc FCU 8,000,000 6,000,000 2,000,000 200,000 20,000 440,000 1,340,000 400,000 940,000 0.7582 0.7686 0.7638 0.7491 0.7435 0.7676 0.7985 0.7933 0.7835 0.7665 0.7572 0.7814 an. February 28 March 31 April 30 May 31 une July 31 August 31 Scptember 30 October 31 November 30 Decembcr 31 Statement of Retained Earnings Retained Earnings, Jan. 1 Net Income, 2017 Less: Dividends, Nov. 30 Retained Earnings, Dec. 31 FCU Translation Rate USD 940,000 640,000