Question

Below are the initial assumptions regarding Berrian Technology's launch of a new digital communications device. Requirement Assuming that the cost per unit remains $ 7

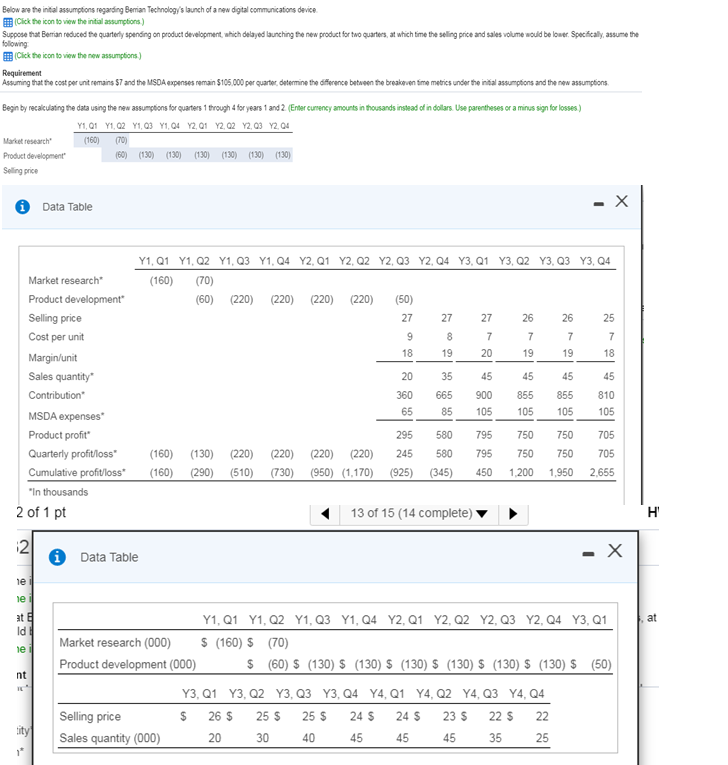

Below are the initial assumptions regarding

Berrian Technology's launch of a new digital communications device.

Requirement

Assuming that the cost per unit remains $ 7

and the MSDA expenses remain $105,000 per quarter, determine the difference between the breakeven time metrics under the initial assumptions and the new assumptions.

Begin by recalculating the data using the new assumptions for quarters 1 through 4 for years 1 and 2. (Enter currency amounts in thousands instead of in dollars. Use parentheses or a minus sign for losses.)

Begin by recalculating the data using the new assumptions for quarters 1 through 4 for years 1 and 2. (Enter currency amounts in thousands instead of in dollars. Use parentheses or a minus sign for losses.)

Below are the initial assumptions regarding Berrian Technology's launch of a new digital communications device Click the icon to view the initial assumptions) Suppose that Berrian reduced the quarterly spending on product development, which delayed launching the new product for two quarters at which time the selling price and sales volume would be lower Specifically, assume the following Click the icon to view the new assumptions) Requirement Assuming that the cost per unit remains $7 and the MSDA expenses remain $105.000 per quartier determine the difference between the break even time metrics under the initial assumptions and the new assumptions Begin by recalculating the data using the new assumptions for quarters through 4 for years 1 and 2 (Enter currency amounts in thousands instead of in dollars. Use parentheses or a minus sign for losses) 71,01 Y1,02 91,03 71,04 Y2Q1 7202 2,03 2,04 Market research (160) (70) Product development (80) (130) (130) (130) (130) (130) (130) Selling price 6 Data Table - X Market research Product development Selling price Cost per unit 2019 1919 Y1, Q1 Y1, Q2 Y1, Q3 Y1,04 Y2, Q1 Y2 Q2 Y2,Q3 Y2, Q4 Y3, Q1 Y3, Q2Y3, Q3Y3, 04 (160) (70) (60) (220) (220) (220) (220) (50) 27 27 27 26 26 25 9 8 7 7 7 7 19 20 45 360 665 900 855 855 65 85 105 105 106 105 295 580 795 750 750 705 (160) (130) (220) (220) (220) (220) 245 580 795 750 750 705 (160) (290) (510) (730) (950) (1,170) (925) (345) 450 1,200 1,950 2,655 Margin/unit Sales quantity Contribution MSDA expenses Product profit" Quarterly profit loss" Cumulative profit/loss* "In thousands 2 of 1 pt 45 13 of 15 (14 complete) H Data Table - X Y1, Q1 Y1, Q2 Y1, Q3 Y1, Q4Y2, Q1 Y2, Q2 Y2, 23 Y2, Q4 Y3, Q1 Market research (000) $ (160) $ (70) Product development (000) $ (60) $ (130) $ (130) $ (130) $ (130) $ (130) $ (130) $ (50) Y3, Q1 Y3, Q2 Y3, Q3Y3, Q4 Y4, Q1 Y4, Q2 Y4, Q3 Y4, Q4 Selling price $ 26 $ 255 256 245 246 23 5 225 22 Sales quantity (000) 20 30 40 45 45 45 35 25 Below are the initial assumptions regarding Berrian Technology's launch of a new digital communications device Click the icon to view the initial assumptions) Suppose that Berrian reduced the quarterly spending on product development, which delayed launching the new product for two quarters at which time the selling price and sales volume would be lower Specifically, assume the following Click the icon to view the new assumptions) Requirement Assuming that the cost per unit remains $7 and the MSDA expenses remain $105.000 per quartier determine the difference between the break even time metrics under the initial assumptions and the new assumptions Begin by recalculating the data using the new assumptions for quarters through 4 for years 1 and 2 (Enter currency amounts in thousands instead of in dollars. Use parentheses or a minus sign for losses) 71,01 Y1,02 91,03 71,04 Y2Q1 7202 2,03 2,04 Market research (160) (70) Product development (80) (130) (130) (130) (130) (130) (130) Selling price 6 Data Table - X Market research Product development Selling price Cost per unit 2019 1919 Y1, Q1 Y1, Q2 Y1, Q3 Y1,04 Y2, Q1 Y2 Q2 Y2,Q3 Y2, Q4 Y3, Q1 Y3, Q2Y3, Q3Y3, 04 (160) (70) (60) (220) (220) (220) (220) (50) 27 27 27 26 26 25 9 8 7 7 7 7 19 20 45 360 665 900 855 855 65 85 105 105 106 105 295 580 795 750 750 705 (160) (130) (220) (220) (220) (220) 245 580 795 750 750 705 (160) (290) (510) (730) (950) (1,170) (925) (345) 450 1,200 1,950 2,655 Margin/unit Sales quantity Contribution MSDA expenses Product profit" Quarterly profit loss" Cumulative profit/loss* "In thousands 2 of 1 pt 45 13 of 15 (14 complete) H Data Table - X Y1, Q1 Y1, Q2 Y1, Q3 Y1, Q4Y2, Q1 Y2, Q2 Y2, 23 Y2, Q4 Y3, Q1 Market research (000) $ (160) $ (70) Product development (000) $ (60) $ (130) $ (130) $ (130) $ (130) $ (130) $ (130) $ (50) Y3, Q1 Y3, Q2 Y3, Q3Y3, Q4 Y4, Q1 Y4, Q2 Y4, Q3 Y4, Q4 Selling price $ 26 $ 255 256 245 246 23 5 225 22 Sales quantity (000) 20 30 40 45 45 45 35 25

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started