Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Below are the transactions that took place in the two companies, PT A and PT XYZ. 1-Mar-21 PT XYZ purchases $20,000 of inventory on

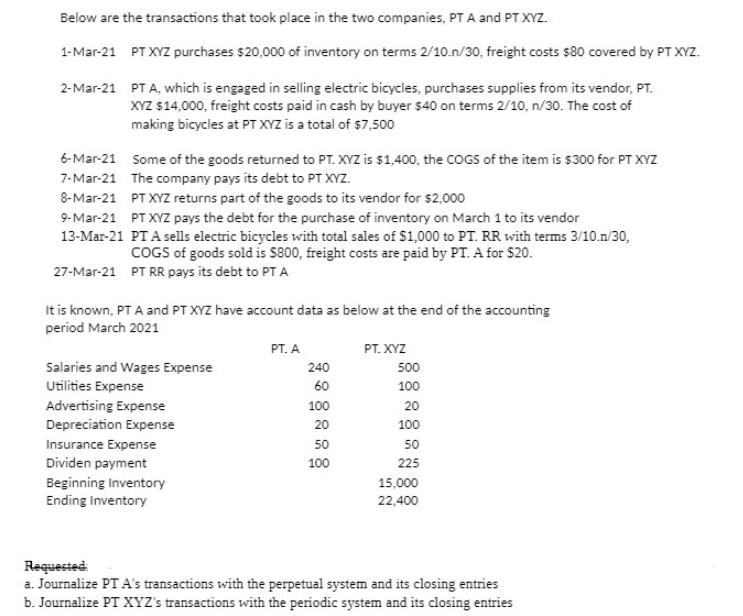

Below are the transactions that took place in the two companies, PT A and PT XYZ. 1-Mar-21 PT XYZ purchases $20,000 of inventory on terms 2/10.n/30, freight costs $80 covered by PT XYZ. 2-Mar-21 PT A, which is engaged in selling electric bicycles, purchases supplies from its vendor, PT. XYZ $14,000, freight costs paid in cash by buyer $40 on terms 2/10, n/30. The cost of making bicycles at PT XYZ is a total of $7,500 6-Mar-21 Some of the goods returned to PT. XYZ is $1,400, the COGS of the item is $300 for PT XYZ 7-Mar-21 The company pays its debt to PT XYZ. 8-Mar-21 PT XYZ returns part of the goods to its vendor for $2,000 9-Mar-21 PT XYZ pays the debt for the purchase of inventory on March 1 to its vendor 13-Mar-21 PT A sells electric bicycles with total sales of $1,000 to PT. RR with terms 3/10.n/30, COGS of goods sold is $800, freight costs are paid by PT. A for $20. 27-Mar-21 PT RR pays its debt to PT A It is known, PT A and PT XYZ have account data as below at the end of the accounting period March 2021 Salaries and Wages Expense Utilities Expense Advertising Expense Depreciation Expense Insurance Expense Dividen payment Beginning Inventory Ending Inventory PT. A 240 60 100 20 50 100 PT.XYZ 500 100 20 100 50 225 15,000 22,400 Requested: a. Journalize PT A's transactions with the perpetual system and its closing entries b. Journalize PT XYZ's transactions with the periodic system and its closing entries

Step by Step Solution

★★★★★

3.40 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

a Journal entry of PT As transactions with the perpetual system and its closing entries are as follows Date 1Mar21 Debit Inventory Ac 20000 Credit Accounts Payable XYZ 20000 Freight costs covered by P...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started