Answered step by step

Verified Expert Solution

Question

1 Approved Answer

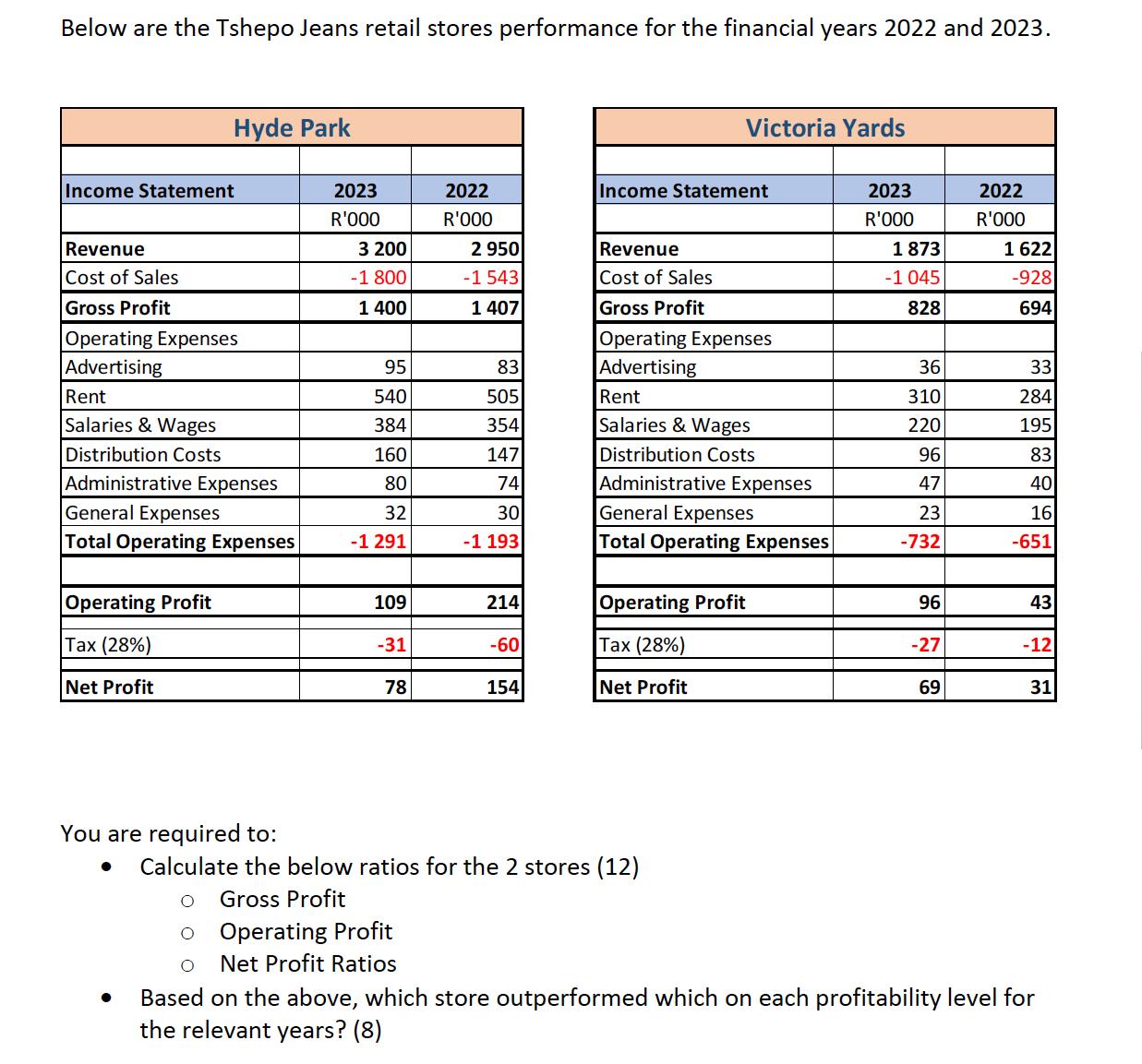

Below are the Tshepo Jeans retail stores performance for the financial years 2022 and 2023. Income Statement Revenue Cost of Sales Gross Profit Operating

Below are the Tshepo Jeans retail stores performance for the financial years 2022 and 2023. Income Statement Revenue Cost of Sales Gross Profit Operating Expenses Advertising Hyde Park Rent Salaries & Wages Distribution Costs Administrative Expenses General Expenses Total Operating Expenses Operating Profit Tax (28%) Net Profit You are required to: 2023 R'000 3 200 -1 800 1 400 95 540 384 160 80 32 -1 291 109 -31 78 2022 R'000 2 950 -1 543 1 407 83 505 354 147 74 30 -1 193 214 -60 154 Income Statement Revenue Cost of Sales Gross Profit Victoria Yards Operating Expenses Advertising Rent Salaries & Wages Distribution Costs Administrative Expenses General Expenses Total Operating Expenses Operating Profit Tax (28%) Net Profit Calculate the below ratios for the 2 stores (12) Gross Profit 2023 R'000 1 873 -1 045 828 36 310 220 96 47 23 -732 96 -27 69 2022 R'000 1 622 -928 694 33 284 195 83 40 16 -651 43 -12 31 Operating Profit O Net Profit Ratios Based on the above, which store outperformed which on each profitability level for the relevant years? (8)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets calculate the ratios for both stores and then determine which store outperformed the other on e...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started