Answered step by step

Verified Expert Solution

Question

1 Approved Answer

below in red is what I did wrong can you help me through it? On 1 June, Samuels & Co Advisors had balances in the

below in red is what I did wrong can you help me through it?

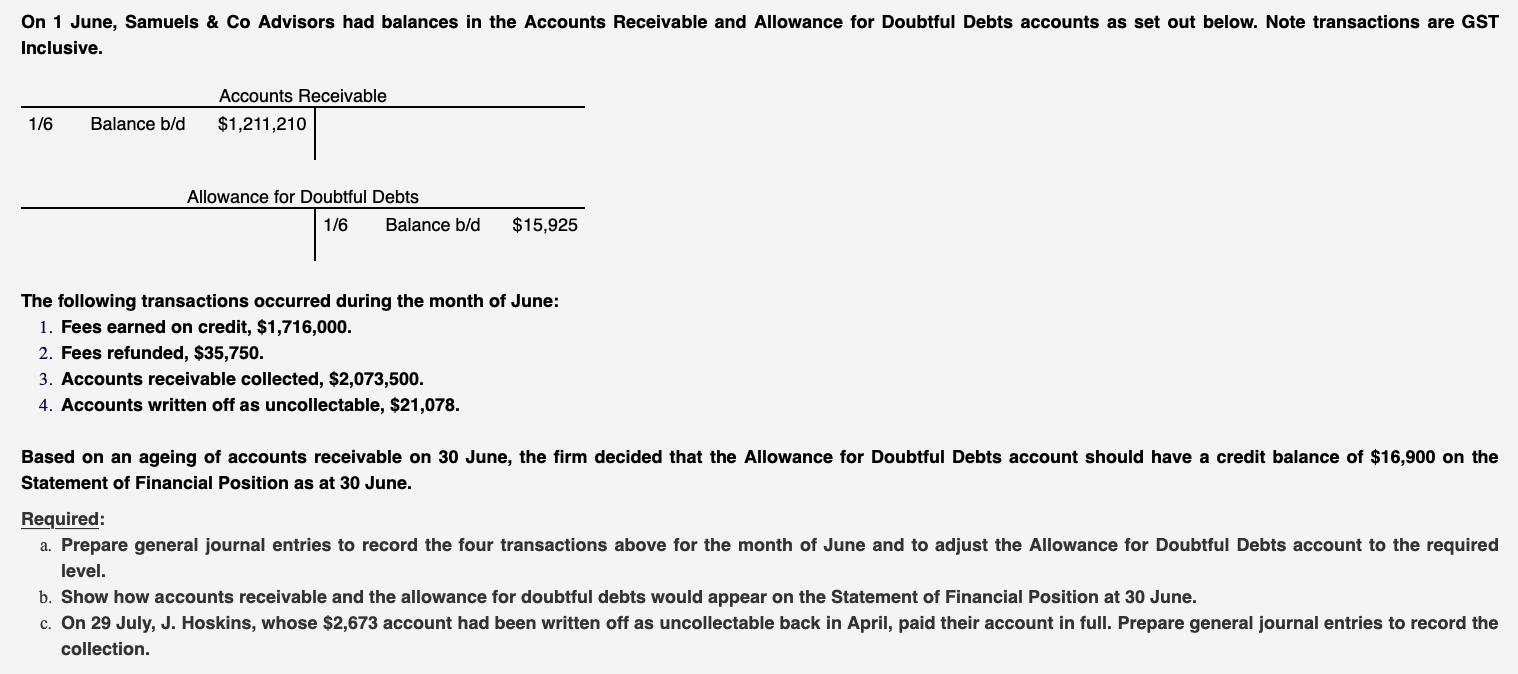

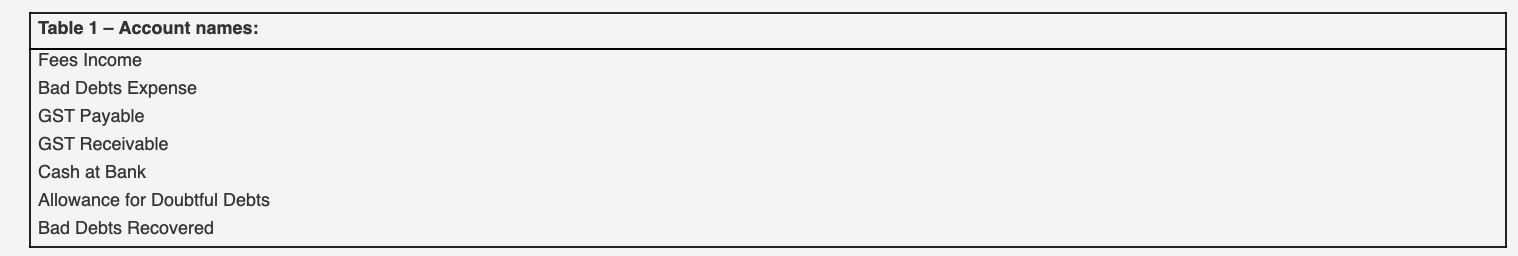

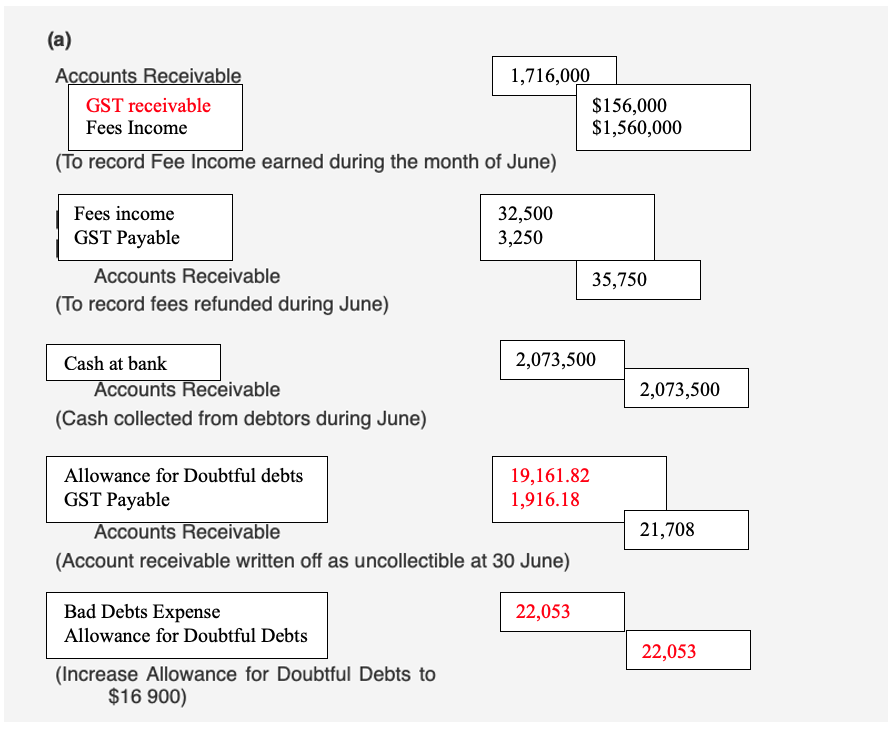

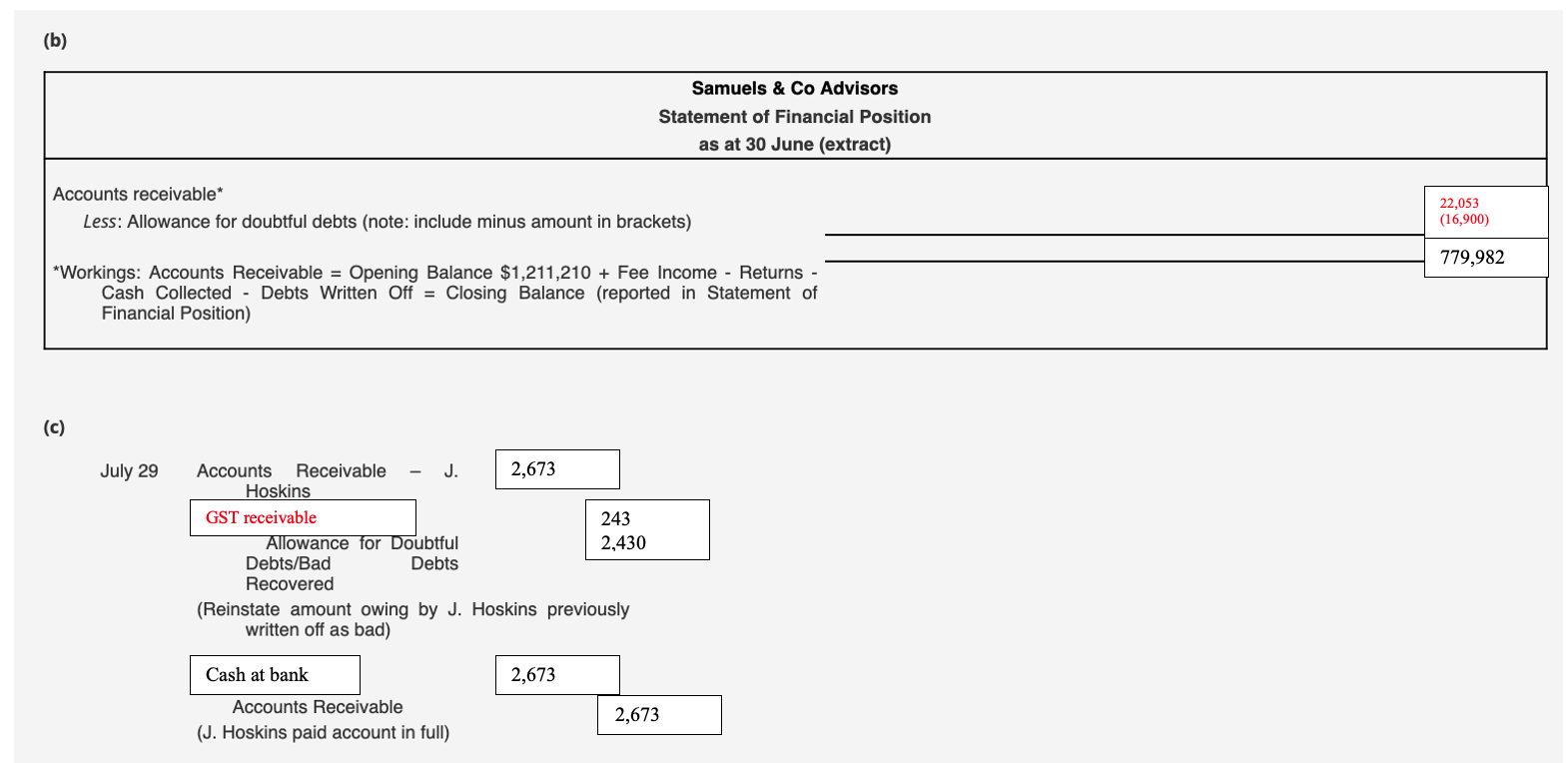

On 1 June, Samuels & Co Advisors had balances in the Accounts Receivable and Allowance for Doubtful Debts accounts as set out below. Note transactions are GST Inclusive. Accounts Receivable 1/6 Balance b/d $1,211,210 Allowance for Doubtful Debts 1/6 Balance b/d $15,925 The following transactions occurred during the month of June: 1. Fees earned on credit, $1,716,000. 2. Fees refunded, $35,750. 3. Accounts receivable collected, $2,073,500. 4. Accounts written off as uncollectable, $21,078. Based on an ageing of accounts receivable on 30 June, the firm decided that the Allowance for Doubtful Debts account should have a credit balance of $16,900 on the Statement of Financial Position as at 30 June. Required: a. Prepare general journal entries to record the four transactions above for the month of June and to adjust the Allowance for Doubtful Debts account to the required level. b. Show how accounts receivable and the allowance for doubtful debts would appear on the Statement of Financial Position at 30 June. c. On 29 July, J. Hoskins, whose $2,673 account had been written off as uncollectable back in April, paid their account in full. Prepare general journal entries to record the collection. Table 1 - Account names: Fees Income Bad Debts Expense GST Payable GST Receivable Cash at Bank Allowance for Doubtful Debts Bad Debts Recovered (a) Accounts Receivable 1,716,000 GST receivable Fees Income (To record Fee Income earned during the month of June) Fees income 32,500 GST Payable 3,250 Accounts Receivable (To record fees refunded during June) Cash at bank 2,073,500 Accounts Receivable (Cash collected from debtors during June) Allowance for Doubtful debts 19,161.82 GST Payable 1,916.18 Accounts Receivable (Account receivable written off as uncollectible at 30 June) Bad Debts Expense 22,053 Allowance for Doubtful Debts (Increase Allowance for Doubtful Debts to $16 900) $156,000 $1,560,000 35,750 2,073,500 21,708 22,053 (b) Samuels & Co Advisors Statement of Financial Position as at 30 June (extract) Accounts receivable* Less: Allowance for doubtful debts (note: include minus amount in brackets) *Workings: Accounts Receivable = Opening Balance $1,211,210 + Fee Income - Returns - Cash Collected - Debts Written Off = Closing Balance (reported in Statement of Financial Position) (c) July 29 J. 2,673 Accounts Receivable Hoskins GST receivable 243 2,430 Allowance for Doubtful Debts Debts/Bad Recovered (Reinstate amount owing by J. Hoskins previously written off as bad) Cash at bank 2,673 Accounts Receivable 2,673 (J. Hoskins paid account in full) 22,053 (16,900) 779,982

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started