Answered step by step

Verified Expert Solution

Question

1 Approved Answer

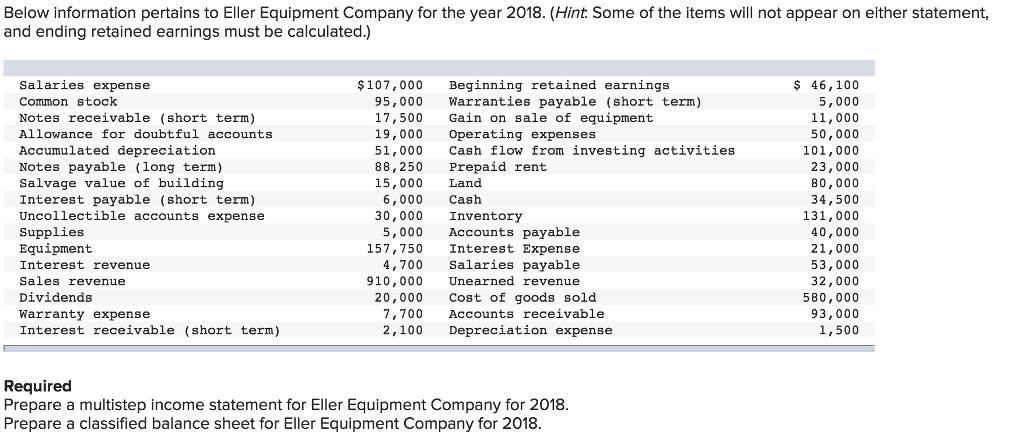

Below information pertains to Eller Equipment Company for the year 2018. (Hint. Some of the items will not appear on either statement, and ending

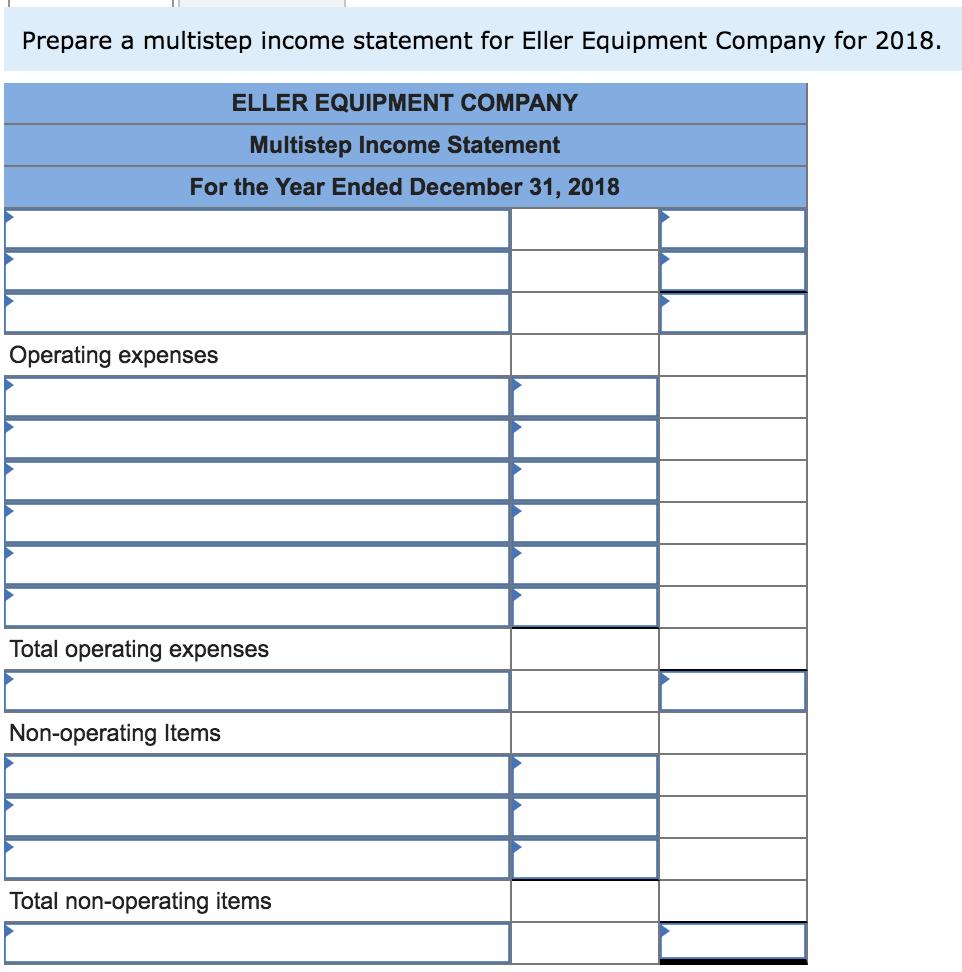

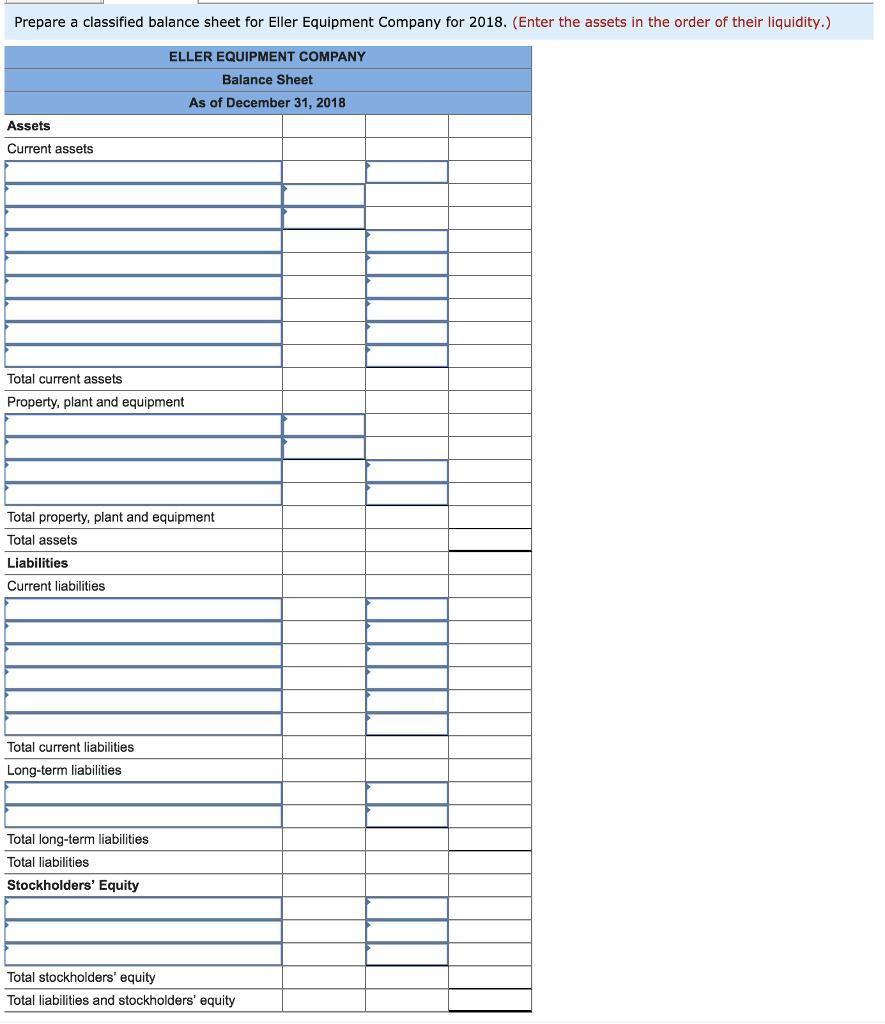

Below information pertains to Eller Equipment Company for the year 2018. (Hint. Some of the items will not appear on either statement, and ending retained earnings must be calculated.) $107,000 $ 46,100 Salaries expense Common stock 95,000 Beginning retained earnings Warranties payable (short term) Gain on sale of equipment 17,500 5,000 11,000 50,000 19,000 Operating expenses Notes receivable (short term) Allowance for doubtful accounts Accumulated depreciation Notes payable (long term) Salvage value of building 51,000 Cash flow from investing activities 101,000 88,250 Prepaid rent 23,000 15,000 Land 6,000 Cash Interest payable (short term) Uncollectible accounts expense Supplies 80,000 34,500 131,000 40,000 30,000 Inventory 5,000 Accounts payable Equipment 157,750 Interest Expense 21,000 Interest revenue 4,700 53,000 32,000 Sales revenue Dividends 910,000 20,000 Salaries payable Unearned revenue Cost of goods sold Accounts receivable Depreciation expense. 580,000 Warranty expense 7,700 93,000 1,500 Interest receivable (short term). 2,100 Required Prepare a multistep income statement for Eller Equipment Company for 2018. Prepare a classified balance sheet for Eller Equipment Company for 2018. Prepare a multistep income statement for Eller Equipment Company for 2018. ELLER EQUIPMENT COMPANY Multistep Income Statement For the Year Ended December 31, 2018 Operating expenses Total operating expenses Non-operating Items Total non-operating items Prepare a classified balance sheet for Eller Equipment Company for 2018. (Enter the assets in the order of their liquidity.) ELLER EQUIPMENT COMPANY Balance Sheet As of December 31, 2018 Assets Current assets Total current assets Property, plant and equipment Total property, plant and equipment Total assets Liabilities Current liabilities Total current liabilities. Long-term liabilities Total long-term liabilities Total liabilities Stockholders' Equity Total stockholders' equity Total liabilities and stockholders' equity

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

ELLER EQUIPMENT COMPANY Multiple Step Income Statement For the year ended December 312018 Items Amou...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started