Answered step by step

Verified Expert Solution

Question

1 Approved Answer

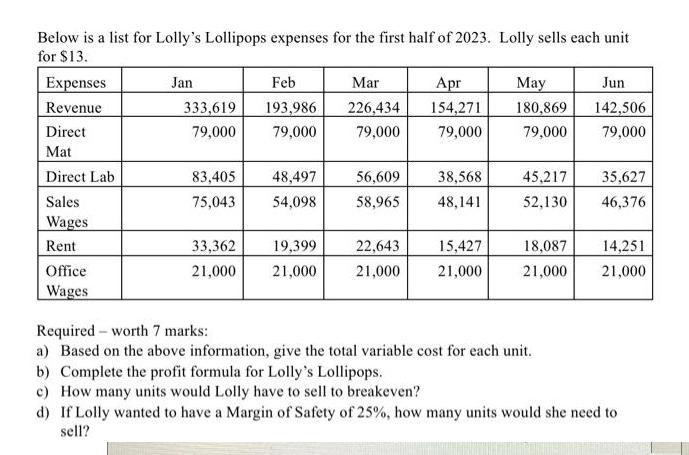

Below is a list for Lolly's Lollipops expenses for the first half of 2023. Lolly sells each unit for $13. Expenses Revenue Direct Mat

Below is a list for Lolly's Lollipops expenses for the first half of 2023. Lolly sells each unit for $13. Expenses Revenue Direct Mat Direct Lab Sales Wages Rent Office Wages Feb 333,619 193,986 79,000 79,000 Jan 83,405 75,043 48,497 54,098 33,362 19,399 21,000 21,000 Mar 226,434 79,000 56,609 58,965 22,643 21,000 Apr 154,271 79,000 38,568 48,141 15,427 21,000 May Jun 180,869 142,506 79,000 79,000 45,217 35,627 52,130 46,376 18,087 14,251 21,000 21,000 Required worth 7 marks: a) Based on the above information, give the total variable cost for each unit. b) Complete the profit formula for Lolly's Lollipops. c) How many units would Lolly have to sell to breakeven? d) If Lolly wanted to have a Margin of Safety of 25%, how many units would she need to sell?

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Certainly lets address each question a Total Variable Cost per Unit The total variable cost per unit ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started