Answered step by step

Verified Expert Solution

Question

1 Approved Answer

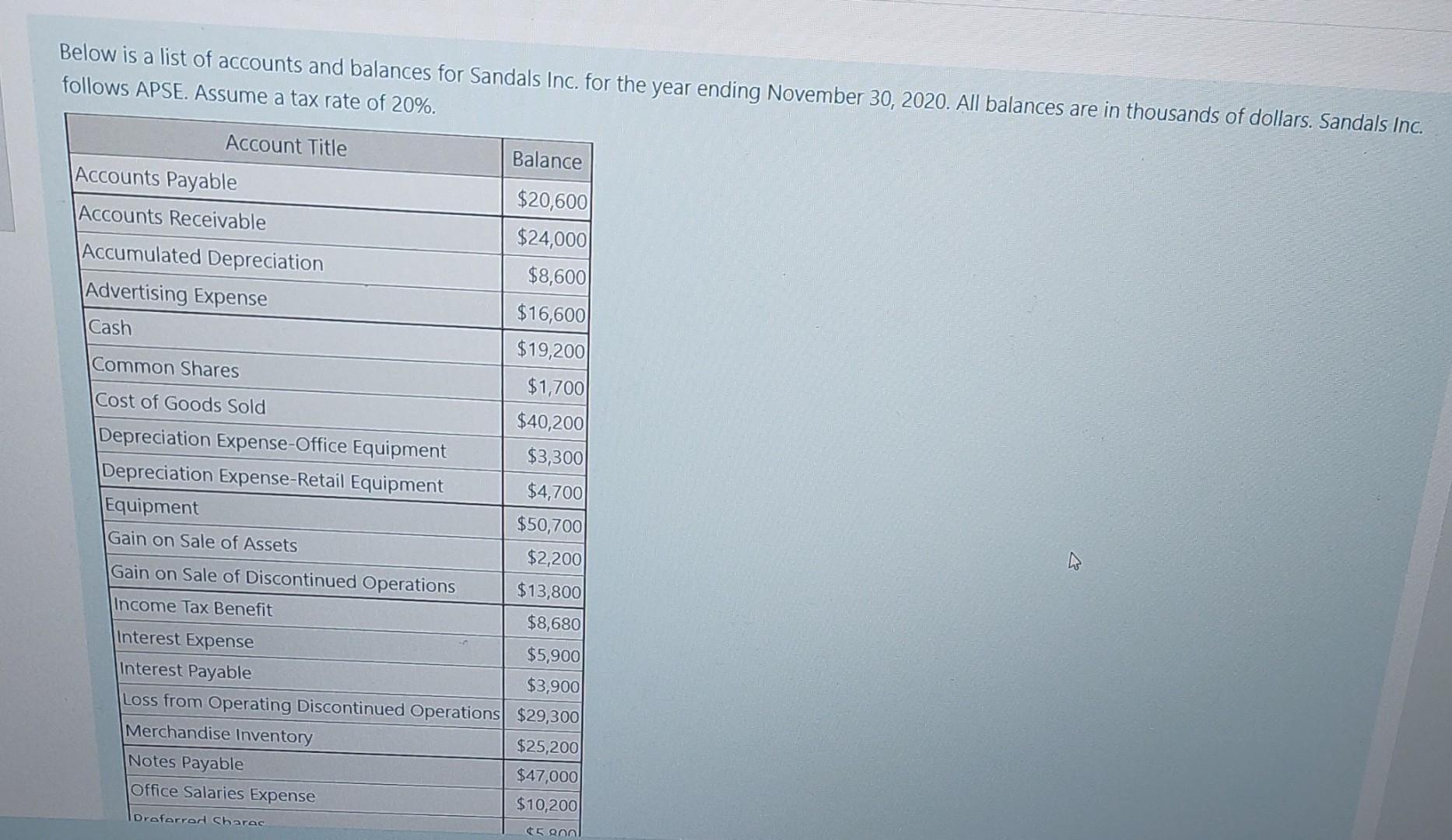

Below is a list of accounts and balances for Sandals Inc. for the year ending November 30, 2020. All balances are in thousands of

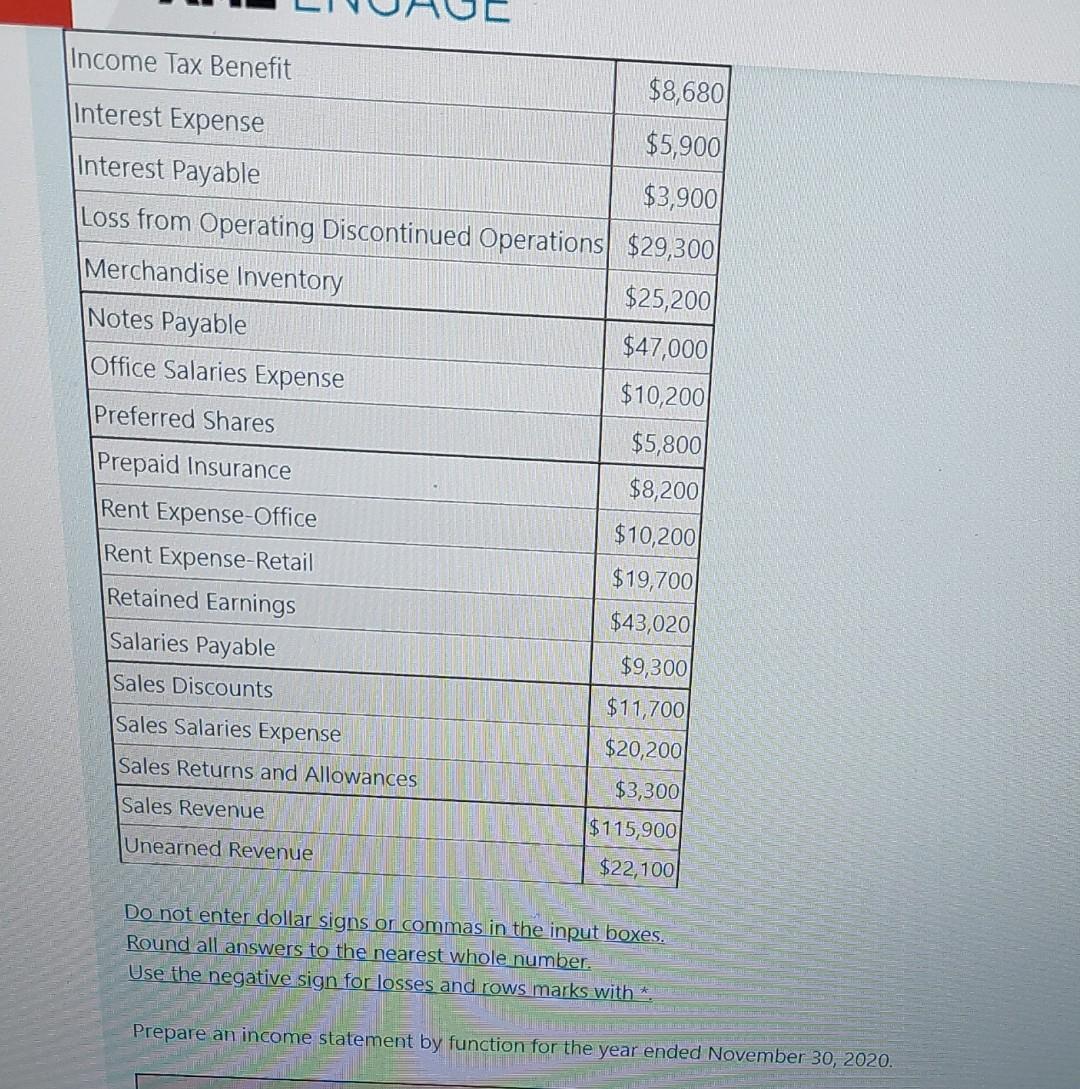

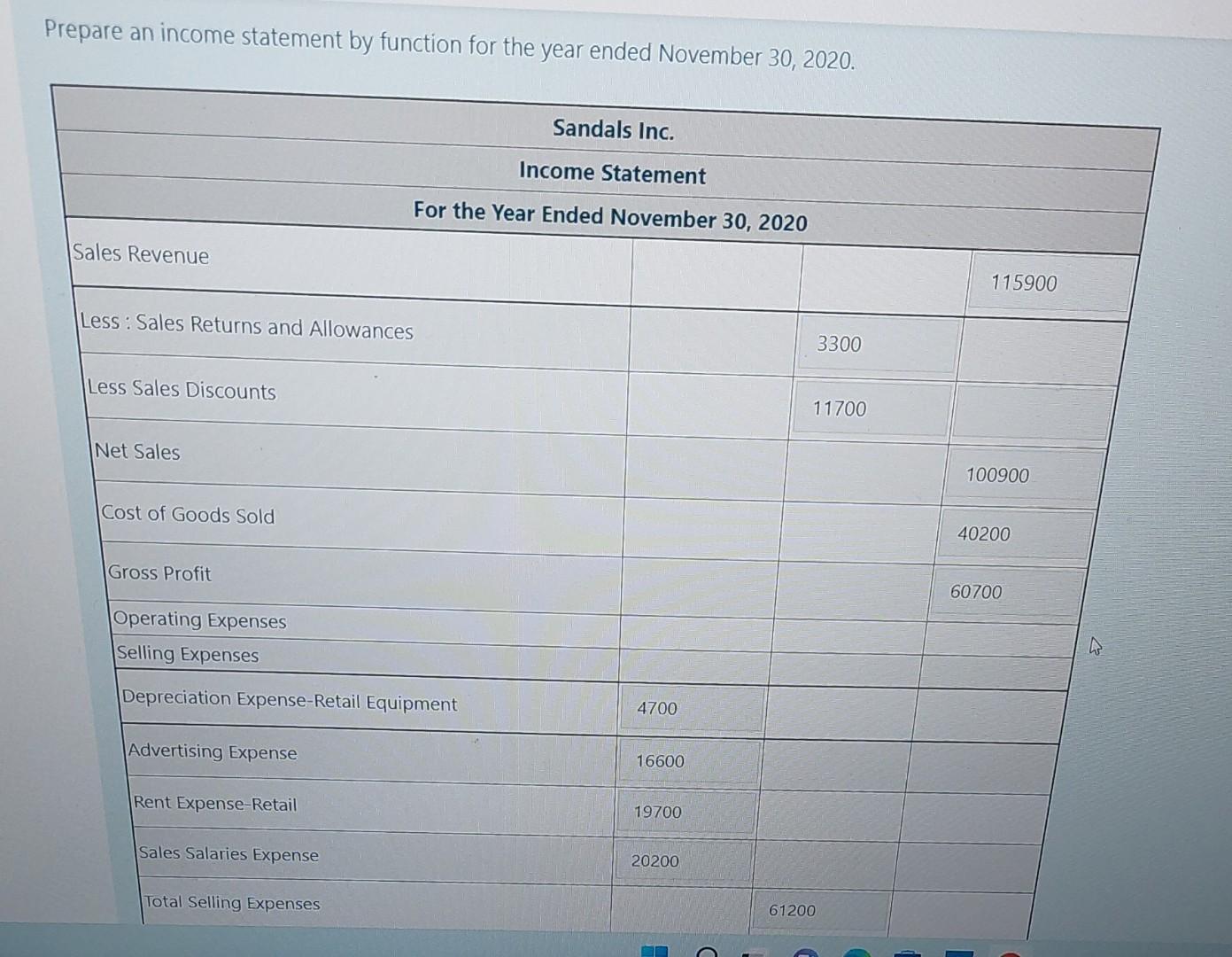

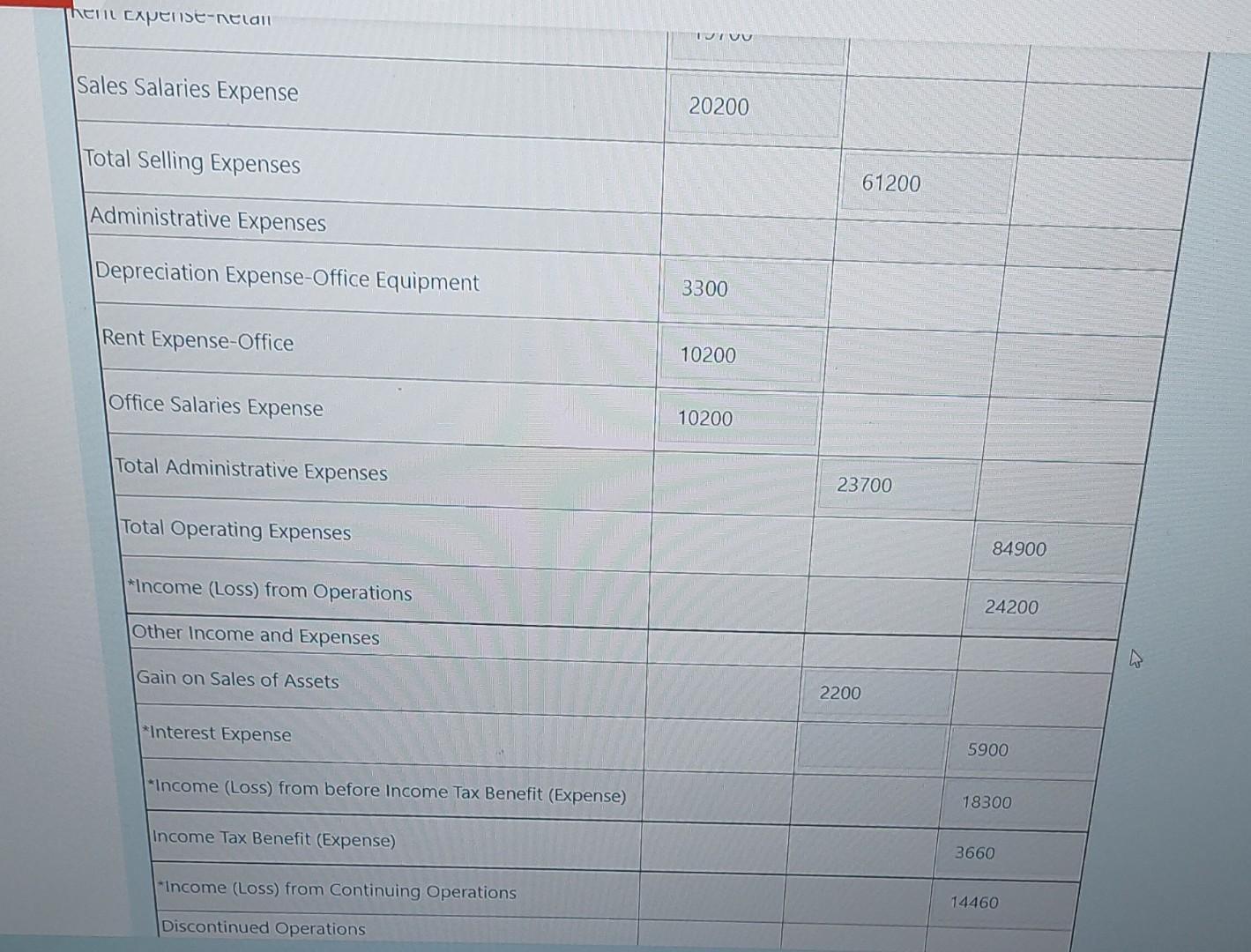

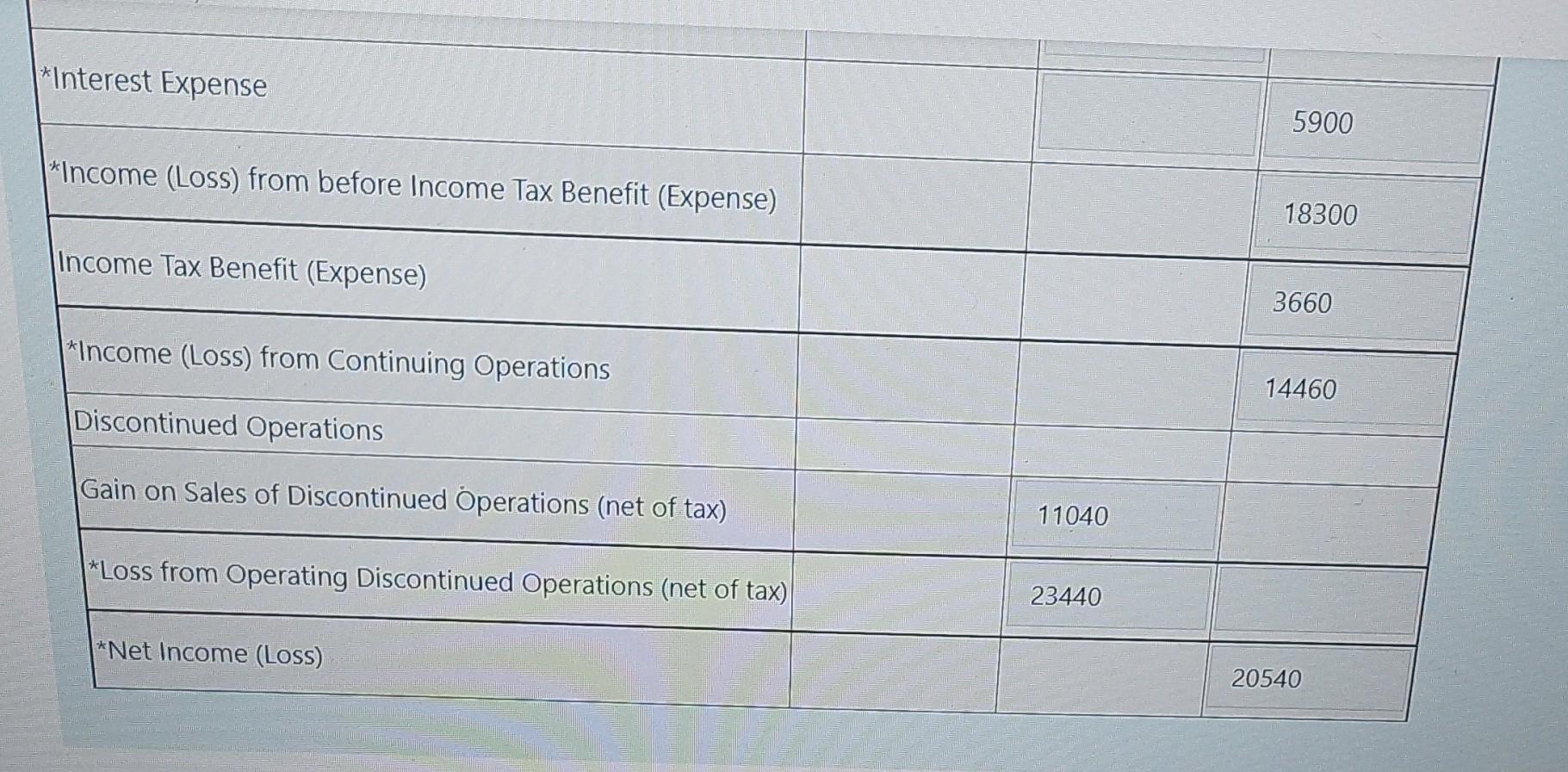

Below is a list of accounts and balances for Sandals Inc. for the year ending November 30, 2020. All balances are in thousands of dollars. Sandals Inc. follows APSE. Assume a tax rate of 20%. Account Title Balance Accounts Payable $20,600 Accounts Receivable $24,000 Accumulated Depreciation $8,600 Advertising Expense $16,600 Cash $19,200 Common Shares $1,700 Cost of Goods Sold $40,200 Depreciation Expense-Office Equipment $3,300 $4,700 Depreciation Expense-Retail Equipment Equipment $50,700 Gain on Sale of Assets $2,200 Gain on Sale of Discontinued Operations $13,800 Income Tax Benefit $8,680 Interest Expense $5,900 Interest Payable $3,900 Loss from Operating Discontinued Operations $29,300 Merchandise Inventory $25,200 Notes Payable $47,000 Office Salaries Expense $10,200 Draforrad Charac $5.800 Income Tax Benefit $8,680 Interest Expense $5,900 Interest Payable $3,900 Loss from Operating Discontinued Operations $29,300 Merchandise Inventory $25,200 Notes Payable $47,000 Office Salaries Expense $10,200 Preferred Shares $5,800 Prepaid Insurance $8,200 Rent Expense-Office $10,200 Rent Expense-Retail $19,700 Retained Earnings $43,020 Salaries Payable $9,300 Sales Discounts $11,700 Sales Salaries Expense $20,200 Sales Returns and Allowances $3,300 Sales Revenue $115,900 Unearned Revenue $22,100 Do not enter dollar signs or commas in the input boxes. Round all answers to the nearest whole number. Use the negative sign for losses and rows marks with *. Prepare an income statement by function for the year ended November 30, 2020. Prepare an income statement by function for the year ended November 30, 2020. Sandals Inc. Income Statement For the Year Ended November 30, 2020 Sales Revenue Less: Sales Returns and Allowances Less Sales Discounts Net Sales Cost of Goods Sold Gross Profit Operating Expenses Selling Expenses Depreciation Expense-Retail Equipment Advertising Expense Rent Expense-Retail Sales Salaries Expense Total Selling Expenses 4700 16600 19700 20200 61200 3300 11700 115900 100900 40200 60700 A hent Expense-nelail Sales Salaries Expense Total Selling Expenses Administrative Expenses Depreciation Expense-Office Equipment Rent Expense-Office Office Salaries Expense Total Administrative Expenses Total Operating Expenses *Income (Loss) from Operations Other Income and Expenses Gain on Sales of Assets *Interest Expense *Income (Loss) from before Income Tax Benefit (Expense) Income Tax Benefit (Expense) *Income (Loss) from Continuing Operations Discontinued Operations TUTVU 20200 3300 10200 10200 61200 23700 2200 84900 24200 5900 18300 3660 14460 *Interest Expense *Income (Loss) from before Income Tax Benefit (Expense) Income Tax Benefit (Expense) *Income (Loss) from Continuing Operations Discontinued Operations Gain on Sales of Discontinued Operations (net of tax) *Loss from Operating Discontinued Operations (net of tax) *Net Income (Loss) 11040 23440 5900 18300 3660 14460 20540

Step by Step Solution

★★★★★

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Sandals Inc Income Statement For the Year ended November 30 2020 Sales Revenue 115900 Less Sales Ret...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started