Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Below is a part of a company's forecasted income statement for the fiscal year of 2023-2024. All figures are in thousands of dollars. The

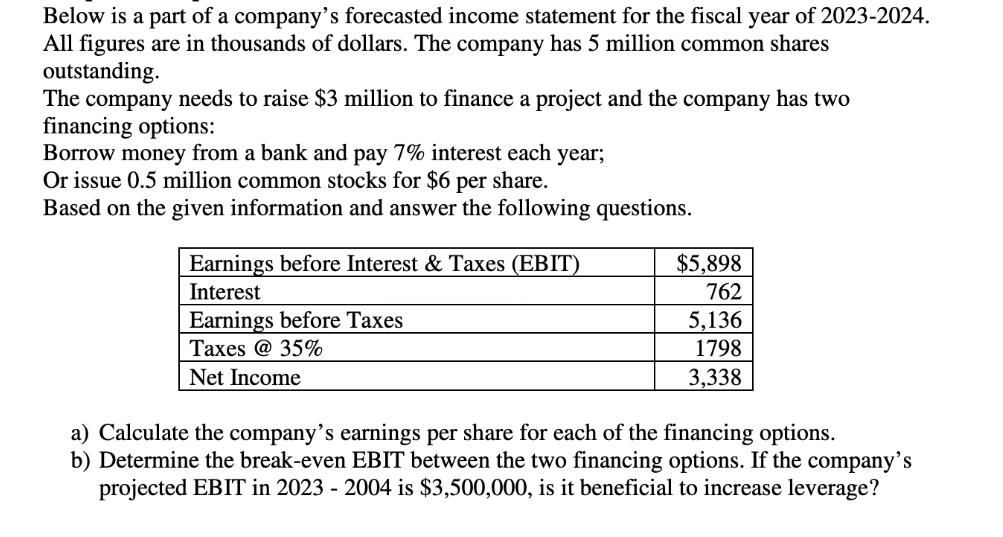

Below is a part of a company's forecasted income statement for the fiscal year of 2023-2024. All figures are in thousands of dollars. The company has 5 million common shares outstanding. The company needs to raise $3 million to finance a project and the company has two financing options: Borrow money from a bank and pay 7% interest each year; Or issue 0.5 million common stocks for $6 per share. Based on the given information and answer the following questions. Earnings before Interest & Taxes (EBIT) Interest Earnings before Taxes Taxes @ 35% Net Income $5,898 762 5,136 1798 3,338 a) Calculate the company's earnings per share for each of the financing options. b) Determine the break-even EBIT between the two financing projected EBIT in 2023 - 2004 is $3,500,000, is it beneficial to increase leverage? ns. If the company's

Step by Step Solution

★★★★★

3.48 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the companys earnings per share EPS for each financing option we need to determine th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started